TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,317

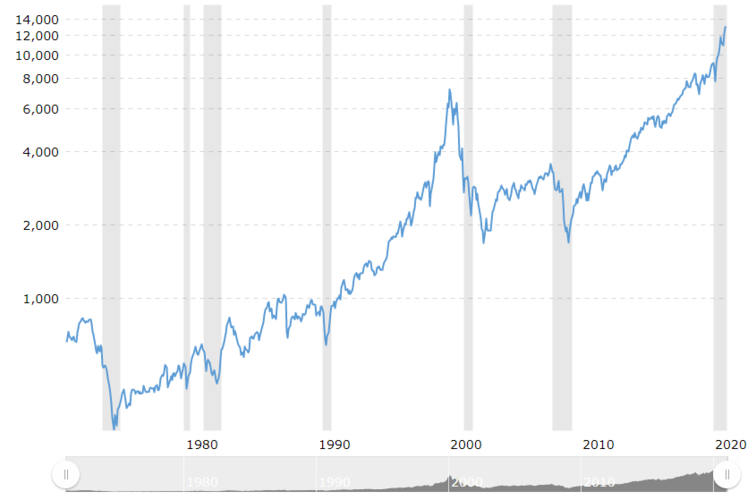

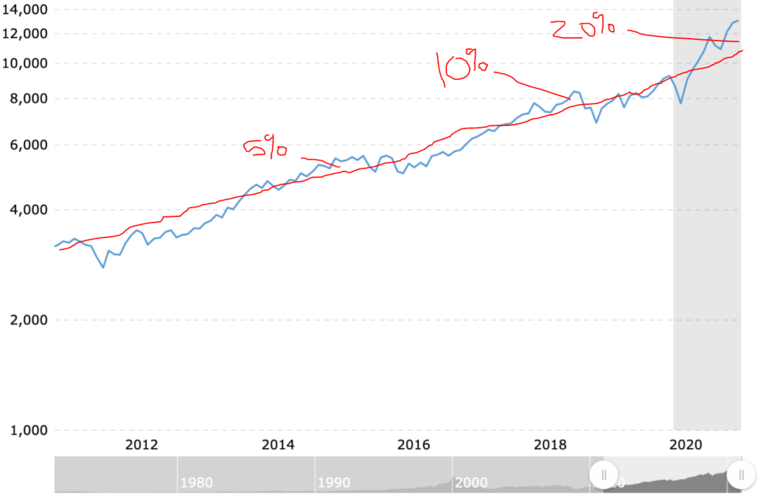

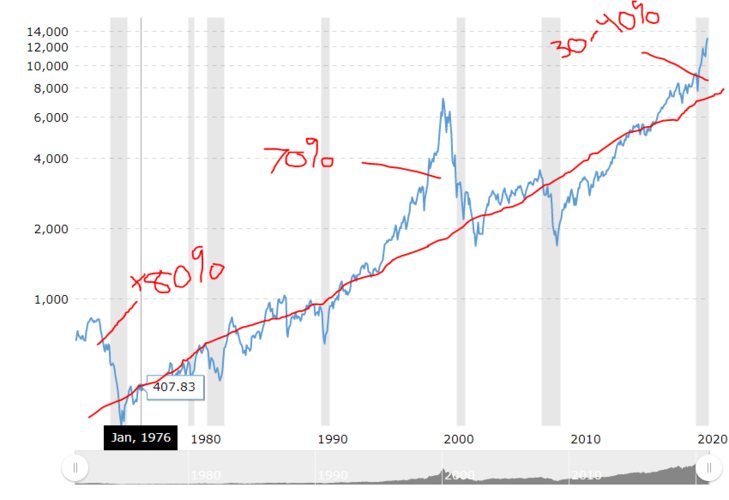

I think a lot of people waiting for another housing crash as going to be bummed too. By the time it happens, if it does, it will dump to prices within the last couple years, not 2009 levels (IMO).Not to take this off topic too much farther (although this does relate directly to the market)...

Imagine what the 2020 unemployment and payroll figures would look like had the US government not spent over $1 Trillion on the PPP program (paying companies not to lay people off or cut pay). Would not be a pretty picture.

At some point, I would expect for business fundamentals once again become relevant to a company’s stock price. I’ve been waiting for that to happen for a while now and it hasn’t happened though, maybe time has just passed me by...

A good friend of mine, upon moving to Florida around 2005, was house shopping and the broker advised him that he could get approved for $1MM if he wanted it. My friend knew he couldn't afford that kind of money and realized the market was unsustainable so held off. He was justified when the market crashed a few years later. However, when seeing the relatively rapid recovery, he became entrenched in the idea that the market would crash again soon and still held off. He finally bought a place within the last two years and paid (easily) over twice as much as he would have had he bought in 2009 like I did. Despite having to borrow money from a friend just for the $1,000 down-payment, it's been the best financial decision I've made to date.

The point I'm trying to make, is that you can a long time waiting for the "best price" and miss out on years worth of equity and growth. And heck, if the market does crash, just keep making your payments if your able. You'll be right side up again before you know it.