ismith

Well-known member

Gun market is super soft right now.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

What do you guys think about this?

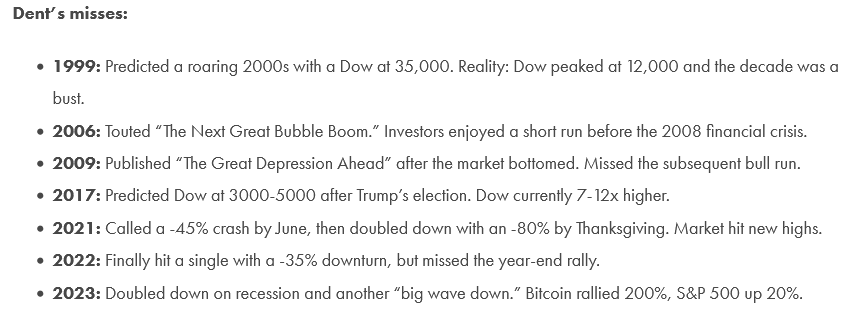

Economist Harry Dent predicts stock market crash worse than 2008 crisis: The ‘bubble of all bubbles’

While now predicting a market bottom in early to mid-2025, U.S. economist and author Harry Dent says it will be a "bigger crash than we got in 2008 to '09."www.foxbusiness.com

Dent is telling Fox viewers what they want to hear. He's aWhat do you guys think about this?

Economist Harry Dent predicts stock market crash worse than 2008 crisis: The ‘bubble of all bubbles’

While now predicting a market bottom in early to mid-2025, U.S. economist and author Harry Dent says it will be a "bigger crash than we got in 2008 to '09."www.foxbusiness.com

Absolutely! This "Nobel laureate" economist is the worst.

It's not hard to find someone exactly the opposite of Krugman. Friedman was one, may he RIP. The whole things is a clown show. Conservative think-tanks are a dime a dozen and will gladly pay an economist to tell them what they believe is correct. Billionaires hiring someone to tell them lower taxes will grow the economy is always popular. I have said they should hire speakers that tell them what they don't want to hear and then hash out the differences and see where they end up. Regardless, economists suck at forecasting anything.Absolutely! This "Nobel laureate" economist is the worst.

Remember, the U.S. doesn't have to pay off all its debt, and there's an easy way to fix it, Nobel laureate Paul Krugman says

The economics of easing U.S. debt concerns are relatively straight forward, so the main obstacle to stabilizing the debt is politics, he wrote.fortune.com

Definitely a game, and the Bernie Sanders/Liz Warren retreads are somewhat popular too, at least on the East coast.It's not hard to find someone exactly the opposite of Krugman. Friedman was one, may he RIP. The whole things is a clown show. Conservative think-tanks are a dime a dozen and will gladly pay an economist to tell them what they believe is correct. Billionaires hiring someone to tell them lower taxes will grow the economy is always popular. I have said they should hire speakers that tell them what they don't want to hear and then hash out the differences and see where they end up. Regardless, economists suck at forecasting anything.

More Baltic. I like the cheap stuff. EM, mostly China and India, and good ole O&G in US. Don't get too excited though, I have some solar stocks too. They are in my basket of things that should pop on first Fed rate cut.So what have you been buying lately with your monopoly money? Boardwalk or Baltic Avenue?

Looking like a Fed rate cut is just a wishful election year prediction by the Ivy League economist class.More Baltic. I like the cheap stuff. EM, mostly China and India, and good ole O&G in US. Don't get too excited though, I have some solar stocks too. They are in my basket of things that should pop on first Fed rate cut.

Moving all my bond and safer less risk money into CD's that I am allowed. Bought one at 5.45% this morning! Money markets are actually hanging in with inflation but CD's are the best buy now IMO.Definitely a game, and the Bernie Sanders/Liz Warren retreads are somewhat popular too, at least on the East coast.

So what have you been buying lately with your monopoly money? Boardwalk or Baltic Avenue?

Firewall protected.Absolutely! This "Nobel laureate" economist is the worst.

Remember, the U.S. doesn't have to pay off all its debt, and there's an easy way to fix it, Nobel laureate Paul Krugman says

The economics of easing U.S. debt concerns are relatively straight forward, so the main obstacle to stabilizing the debt is politics, he wrote.fortune.com

Raise taxes or reduce spending by 2.1% of GDP will fix the problem according to the Center for American Progress.Firewall protected.

I'd guess he suggests that returning to taxation rates we used to have--say in the Reagan days--would be a good first step!

In my experience that sounds good to a lot of people. Even those who are fortunate to make a lot more money than me don't seem to know that means raising their taxes.

Kinda basic checkbook balancing to a point--can't focus on just one side of the ledger to fix a shortfall!

OK thought I would dive in. US GDP in 23 was 27.36 trillion according to the governments Bureau of Economic Analysis.Raise taxes or reduce spending by 2.1% of GDP will fix the problem according to the Center for American Progress.

Meanwhile Trump wants to eliminate taxes on tips,

and Biden wants to wave student loan repayments.

Student loan update: Federal judge hands Joe Biden's plan a legal win

After 11 states filed a lawsuit against Biden's student loan debt forgiveness plan, a judge ruled that only three states can proceed with their case.www.newsweek.com

Both giveaways will lead us closer to insolvency.

Big question is which strategy will buy more votes?

OK thought I would dive in. US GDP in 23 was 27.36 trillion according to the governments Bureau of Economic Analysis.

The congressional budget office said our expenditures in 23 were 6.1 trillion. Of that, 3.8 trillion was spent on things that can't be cut without major action, mostly social security and medicare benefits. 1.7 Trillion was what they called "discretionary" spending that could be more simply cut.

Now back to the Center for American Progress (FAR from a non-partisan group by the way).

2.1 percent of GDP is around 574 billion. Which in turn is about a third of ALL government spending on things other than social security, medicare etc.

That amount of cutting is just not reasonable or even feasible, UNLESS you substantially cut social security and medicare benefits too. Pick most any spending program some might call wastefull/not needed--you could cut most all of them and still not make much of a dent.

On the other hand, the Brookings Insitute--about as centrist as a think tank can get--said if we don't repeal the large 2017 tax cuts we will add another 3,8 trillion to the deficit over the next decade, and take the federal debt--which is at 100 percent of the GDP now--to 211 percent in 30 years.

It's a numbers game. Social Security and Medicare represent such a huge portion of our expenditures that its impossible to cut our way to reversing the debt--but on the other hand, restoring former tax rates would have a much bigger impact.

Are there no socialist think tanks or would you rather not mention them?It's not hard to find someone exactly the opposite of Krugman. Friedman was one, may he RIP. The whole things is a clown show. Conservative think-tanks are a dime a dozen and will gladly pay an economist to tell them what they believe is correct. Billionaires hiring someone to tell them lower taxes will grow the economy is always popular. I have said they should hire speakers that tell them what they don't want to hear and then hash out the differences and see where they end up. Regardless, economists suck at forecasting anything.

Maybe it is best to say that option expirations matter a lot in the proper time frame. The June 21 expiration doesn’t matter if you invest to retire in 10 or 20 year. June 21 expiration matters a lot to where the index will be on June 22. Ironically, the more people buy and hold and target the price in 10yrs, the more the flows from the little things drive the price in the short term.

10yr yield is noise to stocks. Media has current attached themself to it as the narrative because they have nothing else. It’s been boring and yields sounds good and people, even professionals, buy into it. It will need to break above 5 or below 4 to matter, and that will need data that will become the new narrative. See jobs data tomorrow for an example.

Socialists aren’t very good with moneyAre there no socialist think tanks or would you rather not mention them?