Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

SAJ-99

Well-known member

BHR, I think you would try to ruin a teenage wet dream.Just so you know 6-kw system won't do much for you.

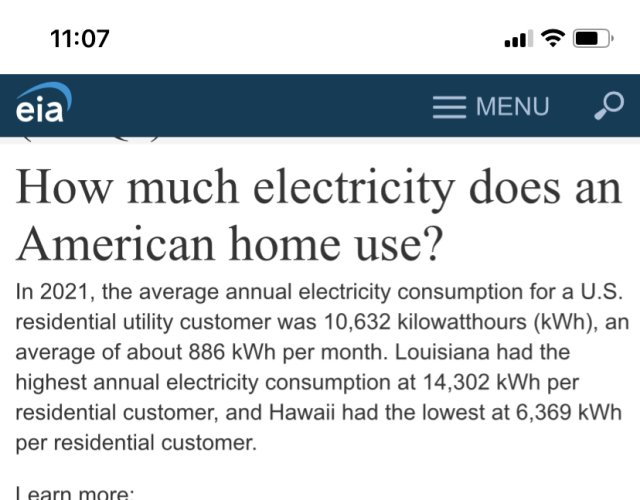

Everything depends on what you pay for electricity now. Reasonable installation cost of solar is $0.08 to 0.10/kWh. So it makes sense that CA and HI are big into solar. It is going to be tough for me in WA. Our rates are some of the lowest. MT is very low too, but closing Colstrip plant means your rates are going up. You could have other changes too, like more efficient solar panels (Current only 23%).

Be optimistic in 2023. And don’t let perfect be the enemy of good.

Scientists just set a new solar-cell efficiency world record

Researchers in Berlin have developed a tandem solar cell that converts 32.5% of incident solar radiation into electrical energy.

electrek.co

electrek.co

SAJ-99

Well-known member

Feel like I missed LUV, but it could be back at $40 in early 2023.Someone mentioned Southwest Airlines... I wouldn't bite just yet though given the setting, pre earnings looks like their next outlook might shine a rosier future. Looks like a good options play.

Southwest Airlines Cancels Thousands Of Flights (NYSE:LUV)

Southwest Airlines canceled thousands of flights over the Christmas holiday. Click here to find out why LUV stock is still a buy.seekingalpha.com

I did miss TSLA, at least this bounce. Will keep watching for another chance. Just looking for tradable rallies in this high vol name.

My resolution for 2023 is to wait for fat pitches and use trailing stops more often so I don’t get out too soon. Had a good 2022, but gave up a lot on stupid trades that were only 50/50 that kept it from being great.

BigHornRam

Well-known member

I think you are the teenager and solar is your wet dream. Study up on it if you are considering using it. This outfit has good easy to understand informational videos on solar.BHR, I think you would try to ruin a teenage wet dream.

Everything depends on what you pay for electricity now. Reasonable installation cost of solar is $0.08 to 0.10/kWh. So it makes sense that CA and HI are big into solar. It is going to be tough for me in WA. Our rates are some of the lowest. MT is very low too, but closing Colstrip plant means your rates are going up. You could have other changes too, like more efficient solar panels (Current only 23%).

Be optimistic in 2023. And don’t let perfect be the enemy of good.

Scientists just set a new solar-cell efficiency world record

Researchers in Berlin have developed a tandem solar cell that converts 32.5% of incident solar radiation into electrical energy.electrek.co

BigHornRam

Well-known member

BTW years ago I made two lucrative trades with CSIQ. Buy low, sell high!

jryoung

Well-known member

Currently in Hawaii and noticing everything is running on batteries. All lawn garden equipment, push mowers, riding movers, golf cart type vehicles and gator type vehicles for maintenance, hotel housekeeping carts.

The riding mowers for the golf courses was the biggest surprise, now to figure out what battery play is the best.

The riding mowers for the golf courses was the biggest surprise, now to figure out what battery play is the best.

BigHornRam

Well-known member

Research this one. I'm keeping an eye on them.Currently in Hawaii and noticing everything is running on batteries. All lawn garden equipment, push mowers, riding movers, golf cart type vehicles and gator type vehicles for maintenance, hotel housekeeping carts.

The riding mowers for the golf courses was the biggest surprise, now to figure out what battery play is the best.

Battle Born Batteries | Reliable Lithium-Ion Batteries

At Battle Born Batteries, we specialize in top of the line LiFePO4 lithium-ion batteries. Get out there, stay out there!

jryoung

Well-known member

Been on my list for both investing and buying for my trailers. So much opportunity in this space from an investment perspective.Research this one. I'm keeping an eye on them.

Battle Born Batteries | Reliable Lithium-Ion Batteries

At Battle Born Batteries, we specialize in top of the line LiFePO4 lithium-ion batteries. Get out there, stay out there!battlebornbatteries.com

BigHornRam

Well-known member

I bought 2- 100amp battle born batteries last year . Company was easy to work with. Product has been great so far. DFLI stock is volatile. New small company stocks can be that way however.Been on my list for both investing and buying for my trailers. So much opportunity in this space from an investment perspective.

Irrelevant

Well-known member

You should try QS, that'll make two of us investing in it, I mean it can't go lower... right?!Currently in Hawaii and noticing everything is running on batteries. All lawn garden equipment, push mowers, riding movers, golf cart type vehicles and gator type vehicles for maintenance, hotel housekeeping carts.

The riding mowers for the golf courses was the biggest surprise, now to figure out what battery play is the best.

LOL

BigHornRam

Well-known member

D

Deleted member 28227

Guest

MBA-ish | Work Satire & Mentorship on Instagram: "It’s a bit more nuanced than that but not much more. Necessarily evil often times. Hopefully a good pivot to a better life for those who are laid off. True story: Some of my friends were very pro-empl

MBA-ish | Work Satire & Mentorship shared a post on Instagram: "It’s a bit more nuanced than that but not much more. Necessarily evil often times. Hopefully a good pivot to a better life for those who are laid off. True story: Some of my friends were very pro-employee and anti-layoffs and then...

www.instagram.com

www.instagram.com

noharleyyet

Well-known member

Side note for REITs.

One perspective.

www.businessinsider.com

www.businessinsider.com

One perspective.

A married couple with a 47-unit real estate portfolio worth $19 million explain why the housing market is setting investors up for 'significant opportunities' in 2023 — and the top regions to buy in

A couple that own a 47-unit portfolio worth $19 million share where they're putting their money in 2023 — and how to find the top markets to buy in.

SAJ-99

Well-known member

Looks like new year same as old year. It seems Fed is clearly focused on job market, despite all inflation indicators pointing lower. I'm still very defensive as 65% equity and 35%cash/bonds. Bought some KWEB last week and made 12% in a few days, so took it off. Today's gap on 1yr chart is pretty obvious so I will look to get back in at lower levels if the opportunity presents.

Watching oil and XLE closely, but mostly just confused.

Watching oil and XLE closely, but mostly just confused.

Devilscrown

Well-known member

Agreed, new year same mentality as last year at this point. In 2022, I was disappointed with the holiday closure of the markets, in 2023 it may have brought relief  hopefully we are poised for some spring rally’s, I am optimistic that the tide will turn at some point this year and want to be in the game when it does. Sold some SMMT recently after a nice run and looking at adding AMD in the near future.

hopefully we are poised for some spring rally’s, I am optimistic that the tide will turn at some point this year and want to be in the game when it does. Sold some SMMT recently after a nice run and looking at adding AMD in the near future.

BigHornRam

Well-known member

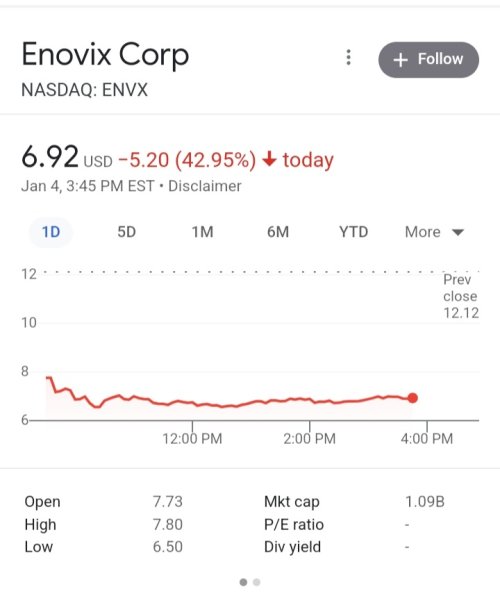

This one got a lot cheaper today.Marc Cohodes mentioned he like this one in the SBF beat down podcast. Been watching. Not sold on it yet.

View attachment 258401

Is it destined for the dumpster or is it possible upswing? Flip a coin? weighted one side or the other - or neutral?This one got a lot cheaper today.

View attachment 259153

BigHornRam

Well-known member

It's new battery technology. Could go either way. I'm thinking it will get cheaper yet.Is it destined for the dumpster or is it possible upswing? Flip a coin? weighted one side or the other - or neutral?

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 12

- Views

- 616

- Replies

- 22

- Views

- 2K