BigHornRam

Well-known member

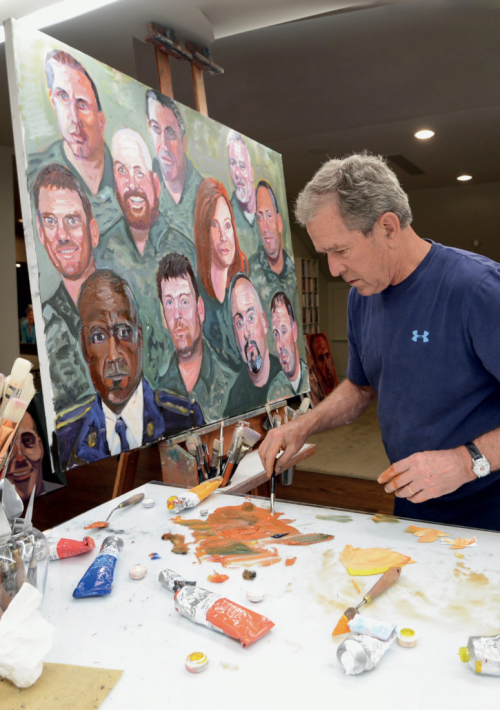

Absolutely! Art's where the real money is.Cons gonna con.

Hunter Biden’s art now sells for up to $225,000 to anonymous buyers despite ethics concerns - Washington Examiner

The artwork of Hunter Biden is now selling for up to $225,000 to anonymous buyers at a new exhibition in Manhattan despite concerns over ethics and the prospect of multiple investigations into President Joe Biden's son. SoHo gallery owner George Berges, who is the art dealer for Hunter Biden...