D

Deleted member 28227

Guest

Well, most most of those "investors" are losing their ass with bitcoin right now, so you can't count on them to step up anyway.

But seriously though.... WTF

70% of US energy comes from OG, there is nothing eminent that changes that...

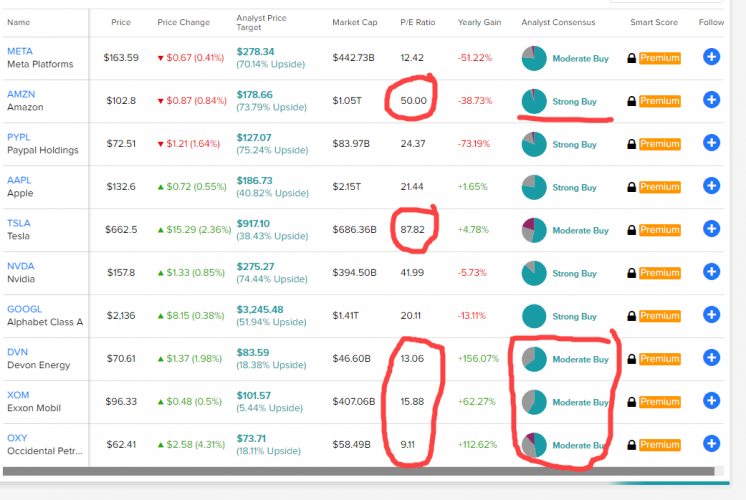

Oil and Natural Gas prices are at record highs, the rest of the market sucks.

Yet folks are real anemic about it... I dk...

certainly prices could crash OG is fickle... but still some of the low valuations I've seen are kinda nuts at least in the near term.