I believe ira contributions are limited to earned incomeThis reminds me of my other retirement question... if you do find yourself in that situation in a year where you are not working can you make an IRA contribution to reduce your AGI?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Another retirement question

- Thread starter Lawnboy

- Start date

mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,269

Thanks! Just seeing this now. Totally accurate @schmaltsMedicare premiums are based on AGI (line 11 of 2020 tax return) from two years prior. 2019 AGI is used to determine 2021 Medicare Part B premium. Over $176k AGI for a married couple increases Medicare premiums by $60/month. Converting $1 too much to Roth in a year could cost an extra $720/yr in Medicare premiums.

Costs

What you pay for Medicare will vary based on what coverage and services you get, and what providers you visit.www.medicare.gov

CycleFishHunt

Well-known member

Anyway just curious what you are seeing as retirees as far as how much you need to have saved by the time you call it quits?

It all depends on what you spend.

My in-laws are super frugal. They retired with even more modest savings than you listed above, but it continues to grow since they never even touch it. They live off social security and pensions alone. And live pretty well.

A rough calculation is to assume a 4% annual withdrawal rate and divide that by your annual outlay. E.g. $60k / .04 = $1.5 million.

Again, that’s rough. If you factor in social security and other income that number will drop.

But better to be conservative, IMO, and assume those incomes may always be there.

AlaskaHunter

Well-known member

I retired at 62, my wife at 58..we retired a few years ago.

We had no debt when we retired...no payments for house mortgage, vehicle payments, etc.

But both sides of our family history has lifespans in the upper 90s, so we are looking at ~30-40 years.

I am surprised that as retirees we spend substantially less than when I was working.

Our gross income is less than 89k, so under Obamacare our subsidized BlueCross Gold health insurance is $63.00 per month now.

That helps a lot.

Our retirement investments far outgrow our annual expenses, but inflation may rise substantially and the market may come down for many years, so we are mentally and financially prepared for that.

Retired Life is better than I ever imagined...

We had no debt when we retired...no payments for house mortgage, vehicle payments, etc.

But both sides of our family history has lifespans in the upper 90s, so we are looking at ~30-40 years.

I am surprised that as retirees we spend substantially less than when I was working.

Our gross income is less than 89k, so under Obamacare our subsidized BlueCross Gold health insurance is $63.00 per month now.

That helps a lot.

Our retirement investments far outgrow our annual expenses, but inflation may rise substantially and the market may come down for many years, so we are mentally and financially prepared for that.

Retired Life is better than I ever imagined...

Potsie

Well-known member

Totally agree. My dad came from a family of 9 kids, he was totally on his own after graduating from high school. My wife's dad started working underground when he was 16, worked double shifts every weekend all through college to pay his own way. My wife is a nurse and I'm a construction superintendent. We're not talking Kardashian levels of generational wealth.In our family the rule is to do better for your kids than your parents did for you. There is no reason why that rule should ever stop. While generational wealth may be a product of that rule it is not the intent.

This is not the first time the BCBS Obamacare subsidy has come up. I am stalling retirement til 58 because my company will carry 50% of my, and my wife's, health insurance until medicare eligible. That will be about $700/month I have to pay. If I limit income, then Obamacare might be significantly cheaper. That raises a risk that it might go away at the whim of politicians.

Is there a way to find out the subsidy levels? I spent time on BCBS site and they give some minimal numbers, but nothing concrete.

Is there a way to find out the subsidy levels? I spent time on BCBS site and they give some minimal numbers, but nothing concrete.

RobG

Well-known member

I believe this is what you are looking for: https://www.kff.org/interactive/subsidy-calculator/This is not the first time the BCBS Obamacare subsidy has come up. I am stalling retirement til 58 because my company will carry 50% of my, and my wife's, health insurance until medicare eligible. That will be about $700/month I have to pay. If I limit income, then Obamacare might be significantly cheaper. That raises a risk that it might go away at the whim of politicians.

Is there a way to find out the subsidy levels? I spent time on BCBS site and they give some minimal numbers, but nothing concrete.

However, be careful before making plans using those numbers, Biden's American Rescue Plan Act made some really big changes which might go away at the whim of politicians as you say. You should consult with someone who can explain all this. This article explains a little, but I'm confused as hell on what was done. All I know is that it saved me from going off the subsidy cliff and put more than $10,000 in my pocket.

Updated KFF Calculator Estimates Marketplace Premiums to Reflect Expanded Tax Credits in COVID-19 Relief Legislation | KFF

KFF has updated its 2021 Health Insurance Marketplace Calculator to reflect the expanded premium tax credits available to people who purchase their own coverage through their state’s health insurance exchange as passed by Congress in the American Rescue Plan Act and expected to be signed into...

VikingsGuy

Well-known member

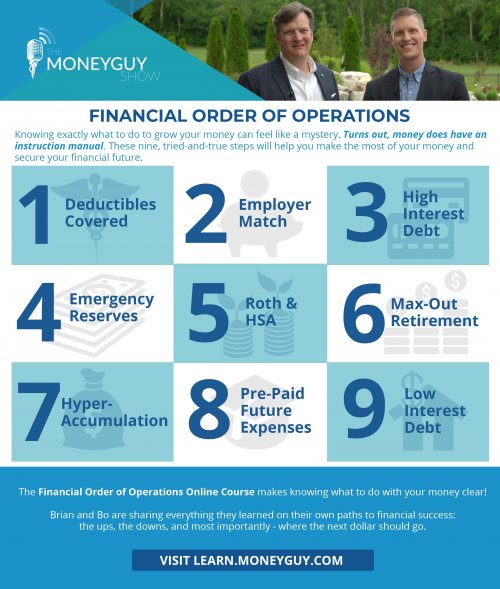

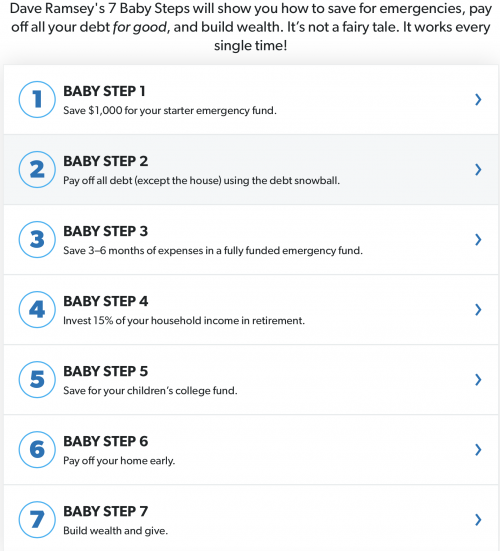

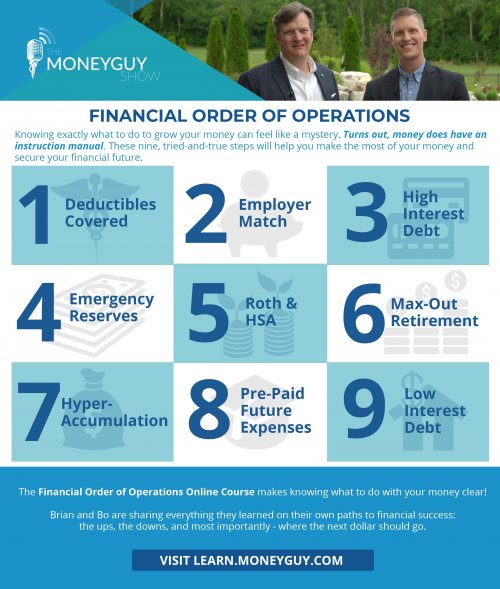

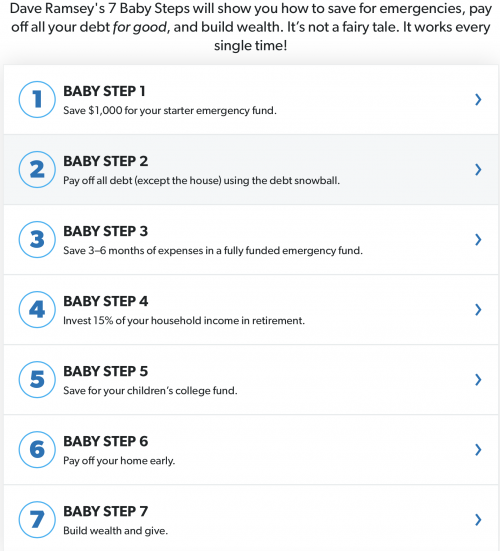

This topic is always hard because of the very broad range of circumstances and knowledge of the topic. I would say if you are just beginning to save or feel some of these discussions were beyond one's depth, I suggest these two "shortcuts" are useful places to start your financial thinking. Neither is magic and there are a dozen others that rehash the same ground - I am also not saying I am a Ramsey or MoneyGuy fan, but to sort through the high volume of info on this topic, if you follow either of these with some discipline in order you will be off to a solid start.

mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,269

Booooo. Our firm is a national firm, fiduciaries AND I’m actually a hunterThis topic is always hard because of the very broad range of circumstances and knowledge of the topic. I would say if you are just beginning to save or feel some of these discussions were beyond one's depth, I suggest these two "shortcuts" are useful places to start your financial thinking. Neither is magic and there are a dozen others that rehash the same ground - I am also not saying I am a Ramsey or MoneyGuy fan, but to sort through the high volume of info on this topic, if you follow either of these with some discipline in order you will be off to a solid start.

View attachment 187035

View attachment 187036

Last edited:

VikingsGuy

Well-known member

First, I am not saying to use these folks for complex financial planning (in fact, I specifically said this in my post), I am saying if you make $40-60k a year, much of finance talk is way overkill. These are simple rules that have been said a hundred ways by a hundred persons. I could have essentially written the same from scratch and I am sure you would give very similar advice in your own words. This type of basic advice for a majority of Americans (and let's be clear the majority have Americans have almost no savings) can be an easy-to-swallow starting point and often is all they will ever need.Booooo. Our firm is a national firm, does a lot better than them AND I’m actually a hunter. Anyone can reach out via PM if they want to visit over the phone or zoom. Complimentary.

Second, I am not a fan of financial advisory firms in general. I believe they have destroyed a lot of value for their customers - 2-3% aggregated load on funds that can be had for 0.03% is bad mojo in my view. Very very few people (I am talking top 1%, and even for them I am not so sure) will ever get more value from an advisory firm than just buying the Bogle book and that book only costs $13.

Last edited:

mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,269

Your certainly entitled to your opinion.First, I am not saying to use these folks for complex financial planning (in fact, I specifically said this in my post), I am saying if you make $40-60k a year, much of finance talk is way overkill. These are simple rules that have been said a hundred ways by a hundred persons. I could have essentially written the same from scratch and I am sure you would give very similar advice in your own words. This type of basic advice for a majority of Americans (and let's be clear the majority have Americans have almost no savings) can be an easy-to-swallow starting point and often is all they will ever need.

Second, I am not a fan of financial advisory firms in general. I believe they have destroyed a lot of value for their customers - 2-3% aggregated load on funds that can be had for 0.03% is bad mojo in my view. Very very few people (I am talking top 1%, and even for them I am not so sure) will ever get more value from an advisory firm than just buying the Bogle book and that book only costs $13.

To me, it’s very clear that you’re a do-it-yourself’er. Not a bad thing by any means.

In fact, we work with many great people, just like you that do a lot of their own investing. It is actually enjoyable working alongside our clients that “get it”.

Nothing you are saying about wall-street is incorrect. They HAVE figured out ways to take advantage of the average investor. We show people how NOT to do what the masses do. Total transparency.

However, to paint the majority of firms in the same brushstroke would be very ignorant to do. There’s a lot of very good firms that care about helping people. If you knew my background and why I got into the industry I think you would might think/have a different perspective.

Obviously, there are many people on this forum that could even build their own house. I don’t even know how to build a house if I wanted to begin. I see value in hiring a professional to do it right. To say all home builders take advantage of people would be unfair.

Or perhaps I might Think that if I get a toothache I can watch a YouTube video and take care of it myself, because dental work is too expensive. I can tell you that I’m not prepared to try and pull one of my own teeth. Just not worth the risk. Neither is trying to do anything that has a significant life impact

You’re very welcome to continue to manage things yourself, but for other people that are looking for guidance… They should definitely seek out the advice of professionals. Fiduciaries, like our firm nonetheless.

Also, for what it’s worth, I can assure you there are many things within the financial world that are important to know, more than what you read on bogleheads.

Having a “plan” is significantly different than having a “portfolio”.

Many of our clients are very financially educated, but their spouses are not. Sounds like you are very much financially savvy.

However if you were to pass away, would your spouse know what to do? This is where relationships come in well before that day.

You only get one retirement, there are no do overs.

Last edited:

grizzly_

Well-known member

- Joined

- Feb 18, 2013

- Messages

- 1,261

I'll send you a PM with my info, I'd like to chat. But no handouts, professionals deserve to get paid for their time.Booooo. Our firm is a national firm, fiduciaries AND I’m actually a hunter. Anyone can reach out via PM if they want to visit over the phone or zoom. Complimentary.

mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,269

We make it a hard rule in our office to never charge for any first appointment, or even talk any kind of financial products. It’s a completely low-key discussion about some of the financial concerns you have.I'll send you a PM with my info, I'd like to chat. But no handouts, professionals deserve to get paid for their time.

If we can help you out, I’ll let you know and if we can’t will still give you that information and point you in the right direction.

VikingsGuy

Well-known member

There are lots of professionals of various types on this forum who don't solicit clients - this seems a little off to me.Booooo. Our firm is a national firm, fiduciaries AND I’m actually a hunter. Anyone can reach out via PM if they want to visit over the phone or zoom. Complimentary.

VikingsGuy

Well-known member

Lots of folks need some basic advice on how to use 401ks, what age to take SS, etc. This can all be gotten through cheap books and a little reading. And the studies have shown again and again that sales loads (often hidden) and other administrative loads on funds and various investment tools and structured insurance destroy huge amounts of value for investors and that over time no stock picker or actively managed funds can beat the many nearly zero load broad index funds. At best advisors get tens of thousands (or hundreds of thousands) of your dollars for a few hundred dollars of basic info. But I suppose cliche's like "You only get one retirement, there are no do overs" do scare some folks into paying through the nose for repackaged common sense and overpriced "investments". To each their own I guess.Your certainly entitled to your opinion.

To me, it’s very clear that you’re a do-it-yourself’er. Not a bad thing by any means.

In fact, we work with many great people, just like you that do a lot of their own investing. It is actually enjoyable working alongside our clients that “get it”.

Nothing you are saying about wall-street is incorrect. They HAVE figured out ways to take advantage of the average investor. We show people how NOT to do what the masses do. Total transparency.

However, to paint the majority of firms in the same brushstroke would be very ignorant to do. There’s a lot of very good firms that care about helping people. If you knew my background and why I got into the industry I think you would might think/have a different perspective.

Obviously, there are many people on this forum that could even build their own house. I don’t even know how to build a house if I wanted to begin. I see value in hiring a professional to do it right. To say all home builders take advantage of people would be unfair.

Or perhaps I might Think that if I get a toothache I can watch a YouTube video and take care of it myself, because dental work is too expensive. I can tell you that I’m not prepared to try and pull one of my own teeth. Just not worth the risk. Neither is trying to do anything that has a significant life impact

You’re very welcome to continue to manage things yourself, but for other people that are looking for guidance… They should definitely seek out the advice of professionals. Fiduciaries, like our firm nonetheless.

Also, for what it’s worth, I can assure you there are many things within the financial world that are important to know, more than what you read on bogleheads.

Having a “plan” is significantly different than having a “portfolio”.

Many of our clients are very financially educated, but their spouses are not. Sounds like you are very much financially savvy.

However if you were to pass away, would your spouse know what to do? This is where relationships come in well before that day.

You only get one retirement, there are no do overs.

AlaskaHunter

Well-known member

Good advise. Our Obamacare monthly payment was $264 per month for Blue Cross Gold policy that went down to $63 per month with the COVID-19 relief bill. Without the subsidy, the policy would cost us $27k per year and would be our largest expense. For us, it has been easy to stay under the maximum gross income of $89k for the subsidy as we have no debt, no major expenses.I believe this is what you are looking for: https://www.kff.org/interactive/subsidy-calculator/

However, be careful before making plans using those numbers, Biden's American Rescue Plan Act made some really big changes which might go away at the whim of politicians as you say. You should consult with someone who can explain all this. This article explains a little, but I'm confused as hell on what was done. All I know is that it saved me from going off the subsidy cliff and put more than $10,000 in my pocket.

Updated KFF Calculator Estimates Marketplace Premiums to Reflect Expanded Tax Credits in COVID-19 Relief Legislation | KFF

KFF has updated its 2021 Health Insurance Marketplace Calculator to reflect the expanded premium tax credits available to people who purchase their own coverage through their state’s health insurance exchange as passed by Congress in the American Rescue Plan Act and expected to be signed into...www.kff.org

mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,269

May i ask what you do for a living?Lots of folks need some basic advice on how to use 401ks, what age to take SS, etc. This can all be gotten through cheap books and a little reading. And the studies have shown again and again that sales loads (often hidden) and other administrative loads on funds and various investment tools and structured insurance destroy huge amounts of value for investors and that over time no stock picker or actively managed funds can beat the many nearly zero load broad index funds. At best advisors get tens of thousands (or hundreds of thousands) of your dollars for a few hundred dollars of basic info. But I suppose cliche's like "You only get one retirement, there are no do overs" do scare some folks into paying through the nose for repackaged common sense and overpriced "investments". To each their own I guess.

SAJ-99

Well-known member

You charge a flat fee, hourly, or asset based? Do you have a benchmark and share performance information? Do you have tax accountants on staff?Your certainly entitled to your opinion.

To me, it’s very clear that you’re a do-it-yourself’er. Not a bad thing by any means.

In fact, we work with many great people, just like you that do a lot of their own investing. It is actually enjoyable working alongside our clients that “get it”.

Nothing you are saying about wall-street is incorrect. They HAVE figured out ways to take advantage of the average investor. We show people how NOT to do what the masses do. Total transparency.

However, to paint the majority of firms in the same brushstroke would be very ignorant to do. There’s a lot of very good firms that care about helping people. If you knew my background and why I got into the industry I think you would might think/have a different perspective.

Obviously, there are many people on this forum that could even build their own house. I don’t even know how to build a house if I wanted to begin. I see value in hiring a professional to do it right. To say all home builders take advantage of people would be unfair.

Or perhaps I might Think that if I get a toothache I can watch a YouTube video and take care of it myself, because dental work is too expensive. I can tell you that I’m not prepared to try and pull one of my own teeth. Just not worth the risk. Neither is trying to do anything that has a significant life impact

You’re very welcome to continue to manage things yourself, but for other people that are looking for guidance… They should definitely seek out the advice of professionals. Fiduciaries, like our firm nonetheless.

Also, for what it’s worth, I can assure you there are many things within the financial world that are important to know, more than what you read on bogleheads.

Having a “plan” is significantly different than having a “portfolio”.

Many of our clients are very financially educated, but their spouses are not. Sounds like you are very much financially savvy.

However if you were to pass away, would your spouse know what to do? This is where relationships come in well before that day.

You only get one retirement, there are no do overs.

99% of financial advisors are used-car salespeople with fancier suits. Becoming registered (I.e a professional) is too easy. It’s like becoming a RE agent. In the time it takes to find one in the 1% a person could learn to do it themselves. Almost Everyone on this forum should realize that they don’t have enough money for customized service and fees add up quick. And all FAs need to eat, so figure out how they are getting paid.

mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,269

All of the above in regards to fee billing. Whatever makes most sense to the client needs.You charge a flat fee, hourly, or asset based? Do you have a benchmark and share performance information? Do you have tax accountants on staff?

99% of financial advisors are used-car salespeople with fancier suits. Becoming registered (I.e a professional) is too easy. It’s like becoming a RE agent. In the time it takes to find one in the 1% a person could learn to do it themselves. Almost Everyone on this forum should realize that they don’t have enough money for customized service and fees add up quick. And all FAs need to eat, so figure out how they are getting paid.

Our focus at our firm is reducing taxes in retirement -hence why I chipped in on Roth conversions.

I appreciate your comments, and agree all around. Not trying to solicit business in anyway, just trying to offer advice to be helpful. As mentioned, anyone is welcome to PM me directly; as giving blanketed financial advice is not always the best thing to follow as individuals should get advice to their specific situations.

Lastly, when a person works with a fiduciary the advisor has to give advice in the clients best interest. Otherwise the fiduciary advisor could be facing either fines, loss of licenses or jail time depending on the severity of providing poor counsel.

This is why I’m emphasizing the importance of seeking advice from a fiduciary.

Very few advisors are fiduciaries. It’s not something a person can claim just because. It takes a lot of legal paperwork, costs, passing certain licenses and they have to be registered with either the state or securities exchange commission (SEC).

In seeking out financial advice, asking if someone is a fiduciary should be one of the very first questions a person should ask.

From there I would ask what their experience level is (how long they’ve been in business).

I would ask to have a list of existing clients that would be willing to talk to you about their own experiences working with the firm.

Don’t be afraid to ask hard or uncomfortable questions. It’s your money that you’ve worked hard for. So trust if you will, but verify.

But seeking out the advice of a true professional that can add value to what your doing, may just be a great thing! At a minimum, going through the process and asking questions can only help out.

Best of luck to all! We want to all do the best we can so we can hunt more.

Last edited:

Similar threads

- Replies

- 181

- Views

- 9K

- Replies

- 102

- Views

- 5K

Latest posts

-

-

-

-

Help Me Legalize Semiauto Rifle Big Game Hunting In Pennsylvania

- Latest: Rack Daniels