VikingsGuy

Well-known member

Back to beer surveys and gun pics for me. Maybe BenLamb and BrentD will teach me more about cool old guns.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I don't recall calling anyone names. I never said your posts did, and I have no need to convince anyone of anything. I think any productivity this discussion had has probably expired.I suggest the pot stop calling names. My posts have nothing to do with oil companies over paying and refunding those payments to oil companies and you know it.

For the love of god someone start a music thread

China can't purchase these lands due to CFIUS rules.

DEPARTMENT OF THE TREASURY

Office of Investment Security

31 CFR Part 802

RIN 1505–AC63

Provisions Pertaining to Certain

Transactions by Foreign Persons

Involving Real Estate in the United

Part-2 Utah Test and Training Range, West Desert Test Center

Part 3- 90th Missile Wing, Francis E. Warren Air Force Base

Missile Field (Colorado, Nebraska, and Wyoming).

I’m not saying there isn’t, I’m saying it’s a non-starter for this deal. Likely 90% of the value is precluded areas.They certainly could buy a large chunk of it. While its true there are proximity laws where the US government does not allow foreign ownership next to national security assets there is plenty of land that exists outside of this range. Foreign countries own over 26 million acres in the United States, they are finding it somewhere.

I am sure that a lot of that is on Federal land, so send me my check.

The problem I have with your argument is that you will never be able to acquire more public land (unless it is given to the state - which happens occasionally). And if there is no rainy-day fund, any time there is a budget shortfall the odds of selling a piece of public land go up. I think we agree that Governments should be more fiscally responsible, but that would have to involve an increase in taxes or less payments to retirees. Side Note - The Illinois Supreme Court said the state was legally obligated to pay the promised retirement benefits, setting a precedent for other states to worry about. It is certainly a hot mess.

But before I go, . . .

This thread was disappointing all around. Lots of good points from different perspectives from folks I usually learn from (agree or disagree). Not sure how this went toxic, but to the extent I was part of the escalation I apologize. State land management in its own right is not a simple topic and we managed to raise 15 other reasonable but tangential issues and it all fell apart from there.

Take care, and I hope you can enjoy some public lands and a beer this weekend - since I am in urban MN this weekend I will just have to settle for 2 beers.

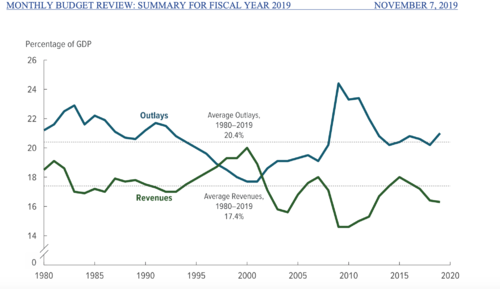

I will agree that it isn't a perfect comparison, but that is because there is no good comparison. You can't compare the amount of taxes not collected to the change in GDP. We are running a $25T dollar economy and GDP trends up. You have to look at revenues and outlays. All you need to see below is total revenues continue to trend down, and that is despite tariff collections, and outlays trend up (Social Security/Medicare and Def are the drivers there). Trust me, there is a plethora of research on the topic of tax cuts and growth. Economists largely agree that the two are unrelated.That’s not how you evaluate the economic impact of the tax cut. You compare the taxes cut to the increase in GDP. The tax cut did not cause debt.

But before I go, . . .

This thread was disappointing all around. Lots of good points from different perspectives from folks I usually learn from (agree or disagree). Not sure how this went toxic, but to the extent I was part of the escalation I apologize. State land management in its own right is not a simple topic and we managed to raise 15 other reasonable but tangential issues and it all fell apart from there.

Take care, and I hope you can enjoy some public lands and a beer this weekend - since I am in urban MN this weekend I will just have to settle for 2 beers.

For the love of god someone start a music thread

I've been expecting to see some well timed memes of a dead horse getting beat or a lady yelling at a cat.... but I'm a page or so behind.

You all probably have more in common than not but you've latched on to your argument and won't let go.

I will agree that it isn't a perfect comparison, but that is because there is no good comparison. You can't compare the amount of taxes not collected to the change in GDP. We are running a $25T dollar economy and GDP trends up. You have to look at revenues and outlays. All you need to see below is total revenues continue to trend down, and that is despite tariff collections, and outlays trend up (Social Security/Medicare and Def are the drivers there). Trust me, there is a plethora of research on the topic of tax cuts and growth. Economists largely agree that the two are unrelated.

View attachment 128791

Read post #272, yeah you're that guy...I don’t have anything personally against anyone in the thread and hope they don’t feel that way.

You missed a few who are common thread killers/spinners and frequent vistors to BigFin's naughty list -- a few you seem to 'like' pretty frequently, so I guess you give a pass to the contributors you agree with -- which is fine, boring but fine.Read post #272, yeah you're that guy...

Read post #272, yeah you're that guy...

I will agree that it isn't a perfect comparison, but that is because there is no good comparison. You can't compare the amount of taxes not collected to the change in GDP. We are running a $25T dollar economy and GDP trends up. You have to look at revenues and outlays. All you need to see below is total revenues continue to trend down, and that is despite tariff collections, and outlays trend up (Social Security/Medicare and Def are the drivers there). Trust me, there is a plethora of research on the topic of tax cuts and growth. Economists largely agree that the two are unrelated.

View attachment 128791

Far from the worst graph ever, but you notice the difficulty in measuring the impact of a change in the economy. GDP is simply a constant by which you are measuring the two variables. Revenues did increase last year by like 4% (about equal to nominal GDP growth) but you expect that in a growing economy. You don’t care so much about GDP or its growth, what you care about is you financial situation (revs vs expenses). As you pointed out, moving in opposite directions is bad. As the saying goes, when you find yourself in a hole, first stop digging. Unfortunately every candidate regardless of party brings another shovel and promises to dig their way out. It’s insane.I've stayed out of it but this is one of the worst graphs in the history of graphs.

If you cut the tax rate then taxes are going to be a smaller percentage of GDP. It's a fact. How you could have it work otherwise I have no idea.

What that graph doesn't tell you at all is that GDP grew enough that revenues actually were up slightly overall.

What that graph actually does tell you is that government spending is completely out of hand and has actually gotten worse under Trump instead of better.