Scott85

Well-known member

- Joined

- Nov 22, 2018

- Messages

- 3,175

Diesel in eastern Va $5.09.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

$3.21 yesterday upper county outside DCYou'd think.there gonna want that money back at some point.

I’m not an educated, career politician but……….

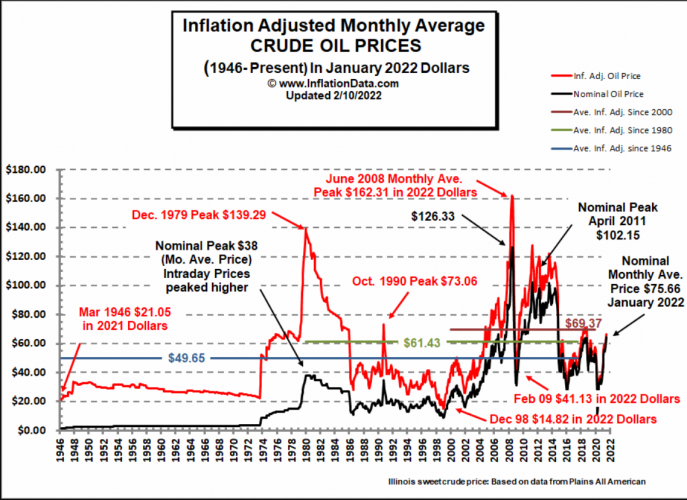

When we already have inflation wouldn’t handing out “free” money make it worse and increase the length of high prices?View attachment 216443

Probably close to the same. If he hadn't banned Russian oil, $90 and -.60 on whatever price your paying now.wllm1313 you are probably the most informed person I know regarding the oil business. If Biden had not messed with any energy policies at all (drilling, pipelines, leases etc.) when after he took office, what do you think we would be paying for gas at the pump right now ?

So all this $200 barrel summer talk I see pop up is bs? I know know can predict the future, but your .02?Probably close to the same. If he hadn't banned Russian oil, $90 and -.60 on whatever price your paying now.

-------------------------------------------------------------

Why is gasoline/oil expensive now

1. Pandemic, dramatic drop in demand

2. Russia/Saudi price war

3. ESG initiatives/Pull back of capital

4. Potentially stimulus and consumers ability to increase demand quickly

5. Supply chain shortages

All of these lead to a dramatic decline is US production

What could have actually mitigated prices

1. Filling SPR under trump in March of 2020

What can be done now by a president

1. Foreign oil i.e. Iran & Venezuela

2. Maybe if we go to war with Russia the Defense Production Act, though I think that would be on the demand side think rationing.

------------------------------------------------------------

During the last months of Trumps presidency oil prices were already starting to rise, they rose by 32% as demand bounced back. Biden inherited a trend, the Keystone XL pipeline would not have been operational had Biden not cancelled it, ANWR would have taken 10 years to produce a drop of Oil, Biden did shut down a lot of federal activity (building pad sites, roads, etc) in early 2021, but that was mostly back by the end of the year. That was mostly in NM and WY, but those basins have a considerable amount of drilling on private land so it's also hard to speculate how much production it curtailed, IMHO not a significant amount give then lack of rigs that were running, WY had 5 in 2021, versus 15 today. Actions that Biden has taken will effect US production/supply in the long term but not the near term.

If Trump had been reelected, I honestly think we would be in the same place, even if he didn't choose to ban Russian oil prices would still be in the $85-$100. It's entirely an economics equation of demand rushing back and supply slow to catch up.

In terms of politics, presidents are limited in what they can do to effect prices. I've said this before do you blame the president under who's watch things happened or do you blame the opposition during their presidency, at this point that's a very valid question both sides spend seemingly most of there time trying to throw egg on the others face and very little accomplishing anything. To that end Trump didn't fill the SPR, he didn't stabilize oil prices, and there was a lot of stimulus and therefore a lot of capacity for post pandemic increase in demand.

Folks like to blame Biden for ESG, but ESG was popular during the Trump administration. Engine 1 started in 2020, Tesla released the roadster 10 years ago, Carter made his Moral Equivalent of War in 1977. Point being, ESG is not a new idea that Biden birthed it's been around for my entire life, Biden was elected by constituents who want to move away from fossil fuels. What we are dealing with in this moment is that desire to move away, has caused wall street to pull back their money from the industry, big banks and PE investors aren't throwing gobs of money around now, that's new. The take away from ESG is that it's not popular anymore to invest in Oil/Gas that's not a Biden thing that's a popular culture thing.

Currently there are a number very large private oil companies looking to sell, I'm kinda looking at them as bellwethers of investment in the industry, if they sell to public companies and those companies are rewarded in share price increases I think that could signal to folks that expanding production is the right move. Either way though at $100 oil people are getting hit hard in their check books and if we stay here too long demand will retract and prices will drop, $100 is just way above market equilibrium so something will change and prices will drop.

$200 implies an average gasoline prices above $5.80... at leastSo all this $200 barrel summer talk I see pop up is bs? I know know can predict the future, but your .02?

Great points. And see below, as much as people complain about gas prices, they haven’t yet begun to change plans that would reduce demand.Probably close to the same. If he hadn't banned Russian oil, $90 and -.60 on whatever price your paying now.

-------------------------------------------------------------

Why is gasoline/oil expensive now

1. Pandemic, dramatic drop in demand

2. Russia/Saudi price war

3. ESG initiatives/Pull back of capital

4. Potentially stimulus and consumers ability to increase demand quickly

5. Supply chain shortages

All of these lead to a dramatic decline is US production

What could have actually mitigated prices

1. Filling SPR under trump in March of 2020

What can be done now by a president

1. Foreign oil i.e. Iran & Venezuela

2. Maybe if we go to war with Russia the Defense Production Act, though I think that would be on the demand side think rationing.

------------------------------------------------------------

During the last months of Trumps presidency oil prices were already starting to rise, they rose by 32% as demand bounced back. Biden inherited a trend, the Keystone XL pipeline would not have been operational had Biden not cancelled it, ANWR would have taken 10 years to produce a drop of Oil, Biden did shut down a lot of federal activity (building pad sites, roads, etc) in early 2021, but that was mostly back by the end of the year. That was mostly in NM and WY, but those basins have a considerable amount of drilling on private land so it's also hard to speculate how much production it curtailed, IMHO not a significant amount give then lack of rigs that were running, WY had 5 in 2021, versus 15 today. Actions that Biden has taken will effect US production/supply in the long term but not the near term.

If Trump had been reelected, I honestly think we would be in the same place, even if he didn't choose to ban Russian oil prices would still be in the $85-$100. It's entirely an economics equation of demand rushing back and supply slow to catch up.

In terms of politics, presidents are limited in what they can do to effect prices. I've said this before do you blame the president under who's watch things happened or do you blame the opposition during their presidency, at this point that's a very valid question both sides spend seemingly most of there time trying to throw egg on the others face and doing very little to accomplishing anything. To that end Trump didn't fill the SPR, he didn't stabilize oil prices, and there was a lot of stimulus and therefore a lot of capacity for post pandemic increase in demand.

Folks like to blame Biden for ESG, but ESG was popular during the Trump administration. Engine 1 started in 2020, Tesla released the roadster 10 years ago, Carter made his Moral Equivalent of War in 1977. Point being, ESG is not a new idea that Biden birthed it's been around for my entire life, Biden was elected by constituents who want to move away from fossil fuels. What we are dealing with in this moment is that desire to move away, has caused wall street to pull back their money from the industry, big banks and PE investors aren't throwing gobs of money around now, that's new. The take away from ESG is that it's not popular anymore to invest in Oil/Gas that's not a Biden thing that's a popular culture thing.

Currently there are a number very large private oil companies looking to sell, I'm kinda looking at them as bellwethers of investment in the industry, if they sell to public companies and those companies are rewarded in share price increases I think that could signal to folks that expanding production is the right move. Either way though at $100 oil people are getting hit hard in their check books and if we stay here too long demand will retract and prices will drop, $100 is just way above market equilibrium so something will change and prices will drop.

Wouldn't covid play a pretty big factor from the same time period last year?Great points. And see below, as much as people complain about gas prices, they haven’t yet begun to change plans that would reduce demand.

From the March 18 report

Total products supplied over the last four-week period averaged 21.0 million barrels a day, up by 11.7% from the same period last year. Over the past four weeks, motor gasoline product supplied averaged 8.8 million barrels a day, up by 4.0% from the same period last year. Distillate fuel product supplied averaged 4.3 million barrels a day over the past four weeks, up by 8.6% from the same period last year. Jet fuel product supplied was up 43.7% compared with the same four- week period last year.

Sure. But more for Jet fuel obviously. Here is the chart. Looks like there was some demand destruction in Jan-Feb, but it looks like people said “meh” and started purchasing again. We will see what happens over the next few weeks. Do we think people start changing spring break or summer vacation plans? There is a price point it happens. Not sure what that is.Wouldn't covid play a pretty big factor from the same time period last year?

I think it'll take longer to make that much of a difference. People as a whole aren't all that great with not spending money, vacations are more important.Sure. But more for Jet fuel obviously. Here is the chart. Looks like there was some demand destruction in Jan-Feb, but it looks like people said “meh” and started purchasing again. We will see what happens over the next few weeks. Do we think people start changing spring break or summer vacation plans? There is a price point it happens. Not sure what that is.