trackerbacker

Well-known member

- Joined

- Jun 30, 2023

- Messages

- 531

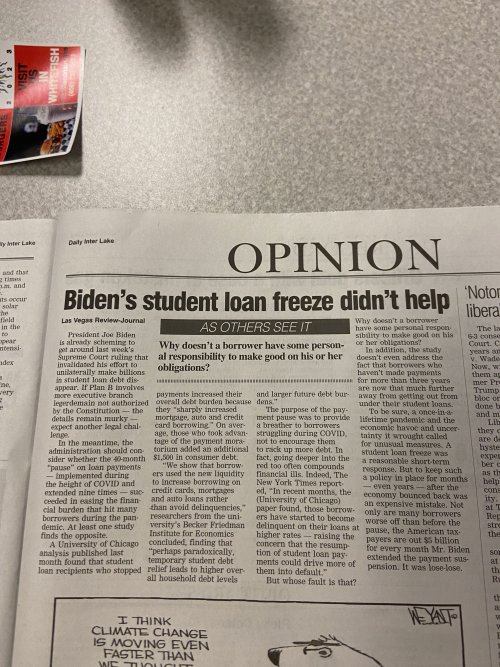

Maybe we all coalesce around the fact politicians, not left or right, but politicians are the problem?Left leaning politicians love increased federal lending, which clearly increases tuition, because it pacifies their base and syphons money to their constituents. The right leaning politicians, especially chamber of commerce repubs, love freshly minted graduates with student loan debt. They have to take jobs they wouldn't otherwise due to their debt. Both sides rely on the student loan bubble.

Also, just wanted to mention crossbows before this sucker gets locked.