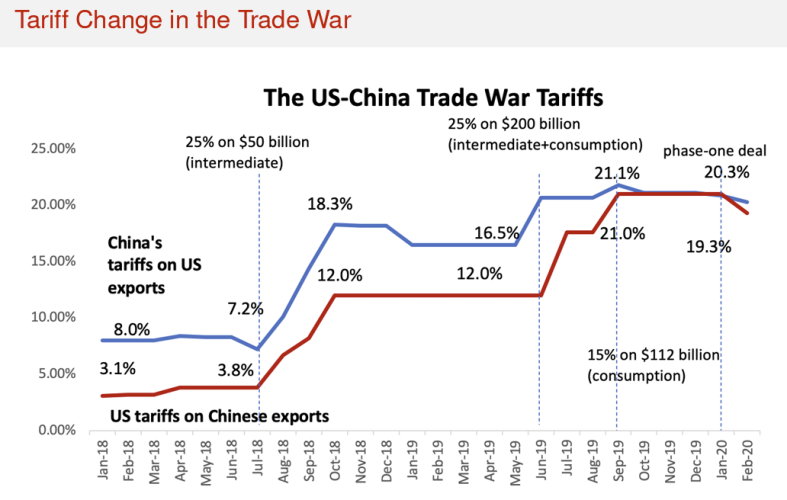

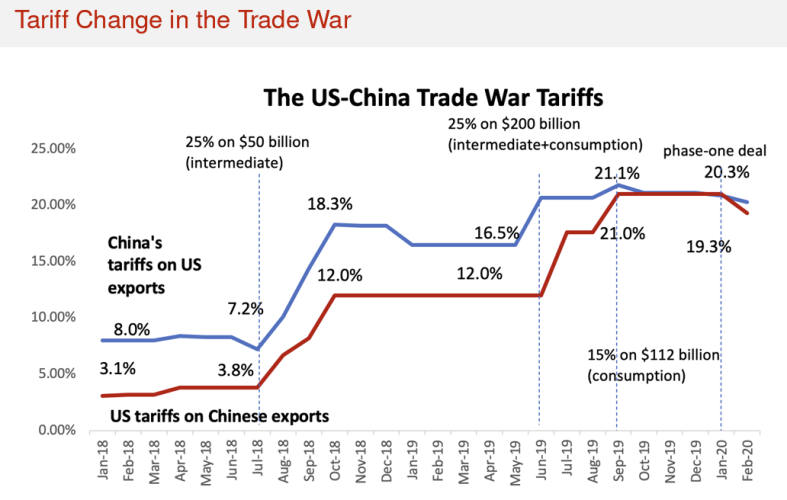

What has been achieved in the last 8 years of tariffs?Okay. However, when Janet Yellin, a former "free trade" advocate reverses gears, wrong, wrong, and wrong are interesting comments w/o alternative opinions shared.

"It is not the critic who counts: not the man who points out how the strong man stumbles or where the doer of deeds could have done better...."

An internet forum poster or those - both Democrat and Republicans (a rarity now days) in agreement for combating China's undercutting of American production.

I agree, prices will rise though those "prices" that rise are due to cheap labor borne goods that directly undercut our American goods. China's interest in their labor market is production many times over the employee. America's interest holds protections for our laborers. It costs more. We've accustomed ourselves to the labor of those in China for the prices we pay for their goods.

I would rather pay more for American goods via inflated values due to tariff to raise the foreign goods price and keep America competing with imports. We continue to let China undermine our American production because we like cheap Chinese products.

Nothing except price inflation for American citizens.