SAJ-99

Well-known member

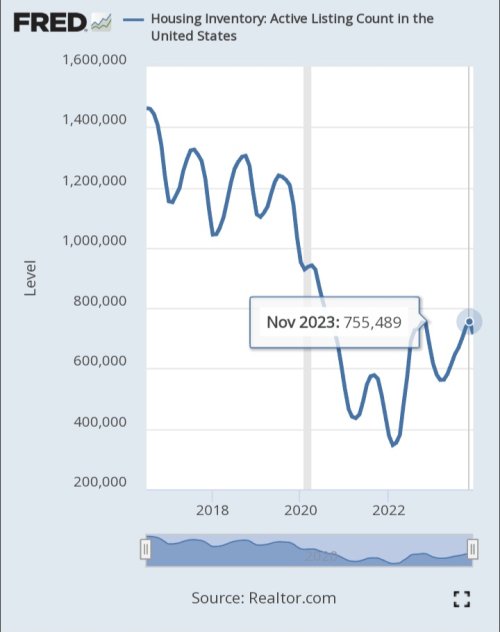

And hence why our housing market is a train wreck. Low mortgage-rate holders are locked in. Great for them, bad for new buyers. Owners are not upsizing, boomers with a paid-off house are as firmly rooted in that house the trees in the front yard.Which makes things different for people getting a 7% mortgage today. For them it might make most sense to get that mortgage paid off ASAP.

I have done both too, so I get the mental aspect of it. But the math is the math. That "extra cash flow" is not valuable if you are following Ramsey. Extra cash flow saved is the same as the net value (value - mtg) of your house increasing by the principal amount each month as you reduce the mortgage. It also prevents you from spending it, ie. forced savings. In the end, in the world today, not having debt is practically impossible. The way to get "comfortable" (hate the words rich or wealthy) is to borrow cheaply and invest wisely.Having the cash flow from not paying on a mortgage is even better.

Ramsey will be adding a "financial dick-measuring" program to his website soon. He sells everything else.It's still dick measuring since everyone's piece of mind has a different price tag.