wvhunter304

Active member

- Joined

- Oct 23, 2023

- Messages

- 93

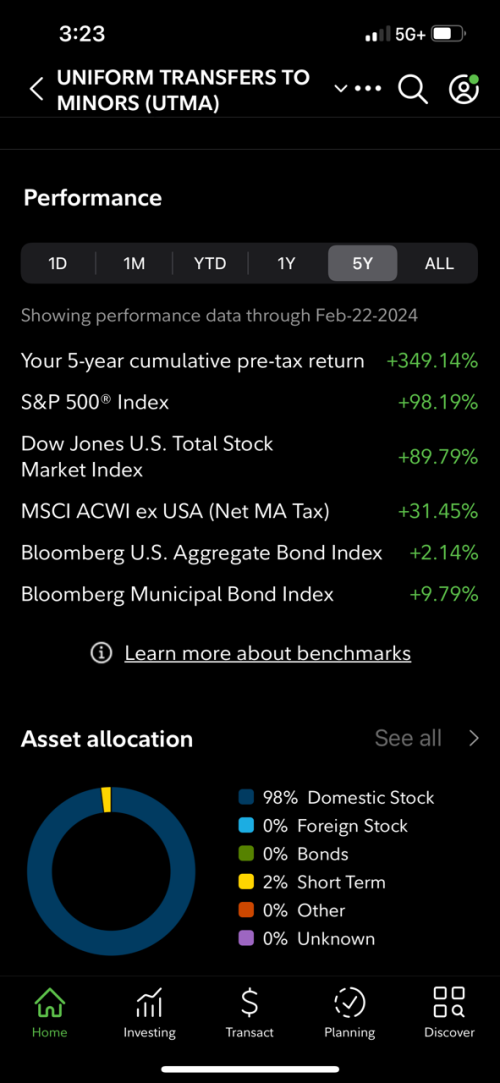

I have $4k a piece for my two children, ages 4 and 11.

I'm thinking about vanguard annuity or just a fractional share in Berkshire Hathaway. What would you suggest?

This isn't a college fund, just hoping to give them some padding in life. Thanks.

I'm thinking about vanguard annuity or just a fractional share in Berkshire Hathaway. What would you suggest?

This isn't a college fund, just hoping to give them some padding in life. Thanks.