D

Deleted member 28227

Guest

In our section/ a lot of Boston it's the opposite, which has been a head scratcher for me.And even still, in many markets, it is STILL cheaper to pay that mortgage monthly than it is to rent. That's more true the more bedrooms you need. I have family back in south Florida struggling to find a 2-3 bedroom rental townhome for less than $3K/month.

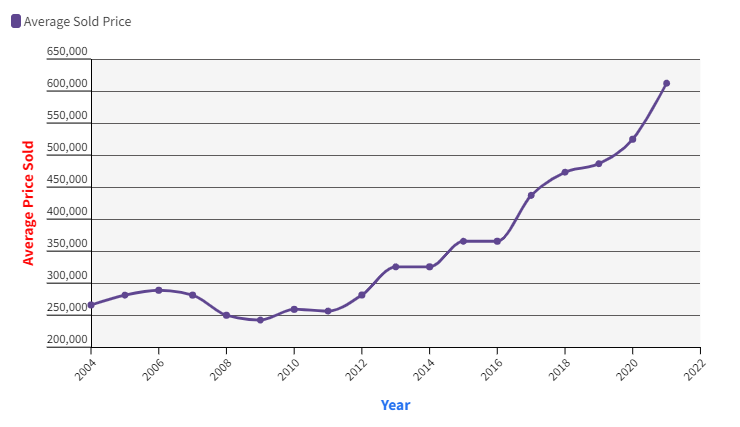

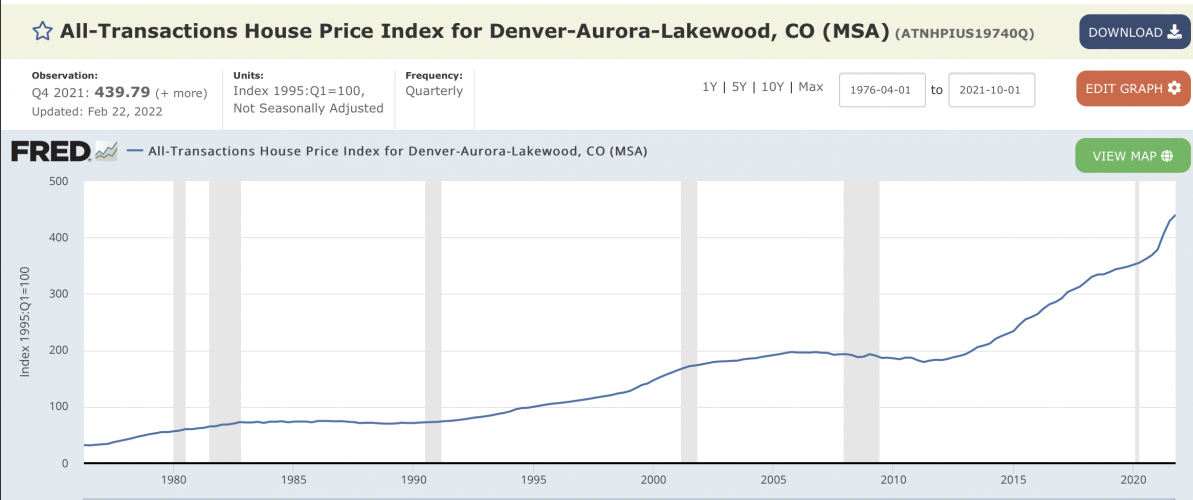

In Denver, even with very little down say 5%, your mortgage payment on a 30 was around 1/2 to 2/3 of rent for the same size place in the exact same neighborhood.

I ran the math last week and our mortgage with 20% down in our neighborhood would be 1.6X our rent. My college roommate lives in beacon hill and over there it's 2X+