Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Im bowing out

- Thread starter Bigjay73

- Start date

I think you will be better to just sit tight where your at. I think we are going to see another bust cycle fairly soon. I bought my house at the top of the boom cycle in 07.

Banks are loaning out equity lines of credit like crazy. I think they know when the market slows or crashes people won't be able to pay off all their debt on their 300-500k home loans and they will just foreclose on them.

Remember banks don't have the money to loan you. They can loan out 10k to every 100 dollars. So their giving you a line of credit and making money off the interest. If it goes south they keep your interest payments and the home. If people make a run on the bank and pull their money out then the banks are bust and the peanut butter really hits the fan.

This should have happened in 08. But the government bailed out the to big to fail and just compounded the problem. Hold on its gonna get bumpy with winners and losers.

I might be wrong but history says different.

Banks are loaning out equity lines of credit like crazy. I think they know when the market slows or crashes people won't be able to pay off all their debt on their 300-500k home loans and they will just foreclose on them.

Remember banks don't have the money to loan you. They can loan out 10k to every 100 dollars. So their giving you a line of credit and making money off the interest. If it goes south they keep your interest payments and the home. If people make a run on the bank and pull their money out then the banks are bust and the peanut butter really hits the fan.

This should have happened in 08. But the government bailed out the to big to fail and just compounded the problem. Hold on its gonna get bumpy with winners and losers.

I might be wrong but history says different.

In eastern Iowa the market is nuts. We bought in 2016, 3br 1 3/4 bath, bought right and did what little work it needed our self. Just sold last week, double what we had in it. Absolutely insane.

Only sold due to getting into a property deal from family that was too good to pass up.

Only sold due to getting into a property deal from family that was too good to pass up.

SAJ-99

Well-known member

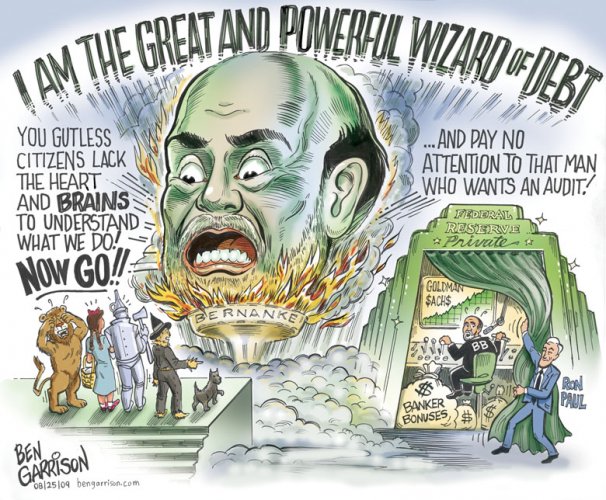

Ron Paul has entered the chat…I think you will be better to just sit tight where your at. I think we are going to see another bust cycle fairly soon. I bought my house at the top of the boom cycle in 07.

Banks are loaning out equity lines of credit like crazy. I think they know when the market slows or crashes people won't be able to pay off all their debt on their 300-500k home loans and they will just foreclose on them.

Remember banks don't have the money to loan you. They can loan out 10k to every 100 dollars. So their giving you a line of credit and making money off the interest. If it goes south they keep your interest payments and the home. If people make a run on the bank and pull their money out then the banks are bust and the peanut butter really hits the fan.

This should have happened in 08. But the government bailed out the to big to fail and just compounded the problem. Hold on its gonna get bumpy with winners and losers.

I might be wrong but history says different.

D

Deleted member 28227

Guest

#millennial has entered the chat#But we can't always live our lives assuming the worst case at every turn.

Whoa GenX don’t you have some nirvana to listen to…

Cheesehead

Well-known member

- Joined

- Dec 6, 2017

- Messages

- 1,046

Never live your life in fear. But life is a lot harder to live when you don't pay attention to what has happened and what is happing.

Feds to raise interest rates 4 times this year.

Guess what happens when loans cost more?

Just look back to Jimmy Carter years in the 70's

Feds to raise interest rates 4 times this year.

Guess what happens when loans cost more?

Just look back to Jimmy Carter years in the 70's

Gellar

Well-known member

When we had our new construction house appraised the first question the appraiser asked was “how much do you need it be?”Banking regulations require banks to have no affiliation or contact with appraisers before an appraisal is complete. If they bank were caught instructing appraisers to do this, that would be very bad news for that bank.

SwaggyD

Well-known member

- Joined

- Jan 26, 2022

- Messages

- 1,933

Oh I’m not arguing that. I’ve had them ask me during refinances. But my point is appraisers shouldn’t control market price. Anything you own is worth whatever somebody is willing to pay for it. As a compliance officer for a bank, I understand what is allowed on the banking side. We have no control over your conversations, and if there’s supporting comps for ‘what you need’, so be it. Most real estate loans are held at community banks for a short period of time before the servicing transfers to someone else. Most RE lenders also get paid on commission, so they would want to close loans, not tell appraisers to under value a house.When we had our new construction house appraised the first question the appraiser asked was “how much do you need it be?”

SAJ-99

Well-known member

I believe that’s the point. Money isn’t free, or at least shouldn’t be free, under capitalism. Good ideas should have to compete to get funds. You clearly have become accustomed to 0% rates. Therein lies the problem. We have a whole generation of people that think a 3% mortgage and 12% equity returns are a god-given right.Never live your life in fear. But life is a lot harder to live when you don't pay attention to what has happened and what is happing.

Feds to raise interest rates 4 times this year.

Guess what happens when loans cost more?

Just look back to Jimmy Carter years in the 70's

Cheesehead

Well-known member

- Joined

- Dec 6, 2017

- Messages

- 1,046

ShootsManyBullets

Well-known member

What is raising rates really going to do? Diddly squat.

Are there more people wanting housing than houses available? Yup. It'll take ages for housing supply to catch up to demand. No real drop in prices until there's inventory, inventory doesn't sell, then sellers drop prices to sell. We're still in the no inventory stage so there's no immediate price decline coming.

The real inflation issue is lack of supply, which causes shortages of everything, which leads to higher prices.

Printing money and paying people to do nothing means more money chasing the same amount of goods and services. In our current case it means more money chasing less goods and services --->inflation.

The people listening to Dave Ramsey might as well be computing with an Apple IIc. Who wouldn't borrow today's dollars and pay them off with money worth less over time? The way our dollar is depreciating it's a no brainer at this point. Long term fixed financing repaid with toilet paper is a win for normal folks. The gov't is doing it to us with their bonds, paying no real interest and returning money worth less than what they borrowed. We should be doing the same scam. Then there's some tax breaks for owning real estate. . .

Are there more people wanting housing than houses available? Yup. It'll take ages for housing supply to catch up to demand. No real drop in prices until there's inventory, inventory doesn't sell, then sellers drop prices to sell. We're still in the no inventory stage so there's no immediate price decline coming.

The real inflation issue is lack of supply, which causes shortages of everything, which leads to higher prices.

Printing money and paying people to do nothing means more money chasing the same amount of goods and services. In our current case it means more money chasing less goods and services --->inflation.

The people listening to Dave Ramsey might as well be computing with an Apple IIc. Who wouldn't borrow today's dollars and pay them off with money worth less over time? The way our dollar is depreciating it's a no brainer at this point. Long term fixed financing repaid with toilet paper is a win for normal folks. The gov't is doing it to us with their bonds, paying no real interest and returning money worth less than what they borrowed. We should be doing the same scam. Then there's some tax breaks for owning real estate. . .

ShootsManyBullets

Well-known member

We're not in capitalism anymore. We want to be and some of us think we are, but we're not.I believe that’s the point. Money isn’t free, or at least shouldn’t be free, under capitalism. Good ideas should have to compete to get funds. You clearly have become accustomed to 0% rates. Therein lies the problem. We have a whole generation of people that think a 3% mortgage and 12% equity returns are a god-given right.

Um actually I don't think their a god given right and I think you missed my whole point.I believe that’s the point. Money isn’t free, or at least shouldn’t be free, under capitalism. Good ideas should have to compete to get funds. You clearly have become accustomed to 0% rates. Therein lies the problem. We have a whole generation of people that think a 3% mortgage and 12% equity returns are a god-given right.

Money is being printed with nothing to back it up. So yeah it is kinda free just not for me and you. My grandparents we're from Germany same with my father. Germany did the same thing with their money after ww1.

They tried to print their way out of debt. You can look that up and see how that turned out. Zimbabwe did the same thing. What's the exchange rate on their currency ?

BigHornRam

Well-known member

The appraisal process is a worthless pile, but just part of the game if you want to borrow money for real estate. Ouija board science is what I call it.Oh I’m not arguing that. I’ve had them ask me during refinances. But my point is appraisers shouldn’t control market price. Anything you own is worth whatever somebody is willing to pay for it. As a compliance officer for a bank, I understand what is allowed on the banking side. We have no control over your conversations, and if there’s supporting comps for ‘what you need’, so be it. Most real estate loans are held at community banks for a short period of time before the servicing transfers to someone else. Most RE lenders also get paid on commission, so they would want to close loans, not tell appraisers to under value a house.

Higher interest rates slows the economy down. Business don't borrow money to expand. Some business go out of business.What is raising rates really going to do? Diddly squat.

Are there more people wanting housing than houses available? Yup. It'll take ages for housing supply to catch up to demand. No real drop in prices until there's inventory, inventory doesn't sell, then sellers drop prices to sell. We're still in the no inventory stage so there's no immediate price decline coming.

The real inflation issue is lack of supply, which causes shortages of everything, which leads to higher prices.

Printing money and paying people to do nothing means more money chasing the same amount of goods and services. In our current case it means more money chasing less goods and services --->inflation.

The people listening to Dave Ramsey might as well be computing with an Apple IIc. Who wouldn't borrow today's dollars and pay them off with money worth less over time? The way our dollar is depreciating it's a no brainer at this point. Long term fixed financing repaid with toilet paper is a win for normal folks. The gov't is doing it to us with their bonds, paying no real interest and returning money worth less than what they borrowed. We should be doing the same scam. Then there's some tax breaks for owning real estate. .

People lose jobs they can't pay for their homes they go up for short sales. I'll I'm saying is their is opportunities in a down turn in the economy if you haven't put your self into huge debt. If you have money saved up you are in a good position to take advantages. Don't get so complex about stuff.

Midwestwhitetail

Active member

- Joined

- Dec 1, 2019

- Messages

- 107

I am curious as to the career fields that the people are in that have these $500k plus mortgages and 2 car payments and student loan debt? I make good money but don't see myself signing any papers with a promise to pay back that kind of money anytime soon.Just a quick glance within about 45 minutes of me in East Tn. 26 listings between $500K and $550K, 3,000 or less SF, 1 acre or less lot size.

This is nothing compared to bigger cities or some other states. $500K is not crazy house money anymore by any stretch.

View attachment 211773

VikingsGuy

Well-known member

Big difference between 10,000% inflation and 7.5%. Also big difference between Zimbabwe and the global reserve currency.Um actually I don't think their a god given right and I think you missed my whole point.

Money is being printed with nothing to back it up. So yeah it is kinda free just not for me and you. My grandparents we're from Germany same with my father. Germany did the same thing with their money after ww1.

They tried to print their way out of debt. You can look that up and see how that turned out. Zimbabwe did the same thing. What's the exchange rate on their currency ?

VikingsGuy

Well-known member

No doubt smart debt usage and big city growth and jobs will win every time.0 debt and money in the bank.... and don't live in the twin cites. Bad situation for sure.

Just Remember currency with nothing backing it is what starts wars when the deck of cards stats to get shaking. And it's shakingBig difference between 10,000% inflation and 7.5%. Also big difference between Zimbabwe and the global reserve currency.

Similar threads

- Replies

- 10

- Views

- 2K

- Replies

- 17

- Views

- 2K

Latest posts

-

-

Colorado draft big game license recommendations

- Latest: BrokenChicken

-

-

-