D

Deleted member 28227

Guest

@neffa3 speaking of rentals...

My parents built there house in 1997 back then it was illegal to build a lock-off and/or to rent out part of your house.

Fast forward 2022 the county is loaning folks money at crazy low interest rates to build lock-offs to increase housing.

"The term of the Loan shall be fifteen years (“Term”). During the first three years of the Term (the “initial period”), the Loan shall not carry any interest and no Loan payments shall be due. After the expiration of the initial period, the Loan shall carry a maximum simple interest rate of 2% annually for the remainder of the Term or until the Loan is paid in full, whichever occurs first. Loan payments of principal and interest may be made on an annual basis."

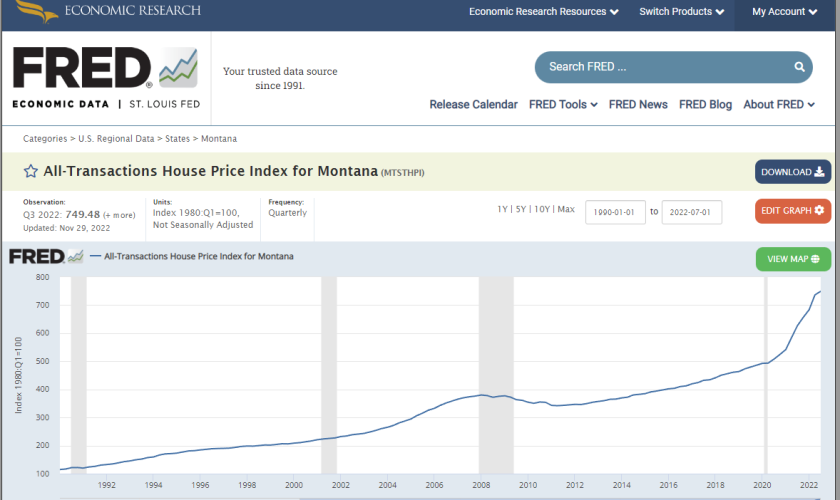

You know the market has completely priced out middle to upper middle class families when...

My parents built there house in 1997 back then it was illegal to build a lock-off and/or to rent out part of your house.

Fast forward 2022 the county is loaning folks money at crazy low interest rates to build lock-offs to increase housing.

"The term of the Loan shall be fifteen years (“Term”). During the first three years of the Term (the “initial period”), the Loan shall not carry any interest and no Loan payments shall be due. After the expiration of the initial period, the Loan shall carry a maximum simple interest rate of 2% annually for the remainder of the Term or until the Loan is paid in full, whichever occurs first. Loan payments of principal and interest may be made on an annual basis."

You know the market has completely priced out middle to upper middle class families when...