Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Housing Appreciation and Inflation: Future Outlook?

- Thread starter Sytes

- Start date

SilentBirdHunter

Well-known member

- Joined

- Feb 5, 2024

- Messages

- 416

Yes the supply is low.Some markets will never return or a semblance of normalcy unless we take institutional investing out of the residential market.

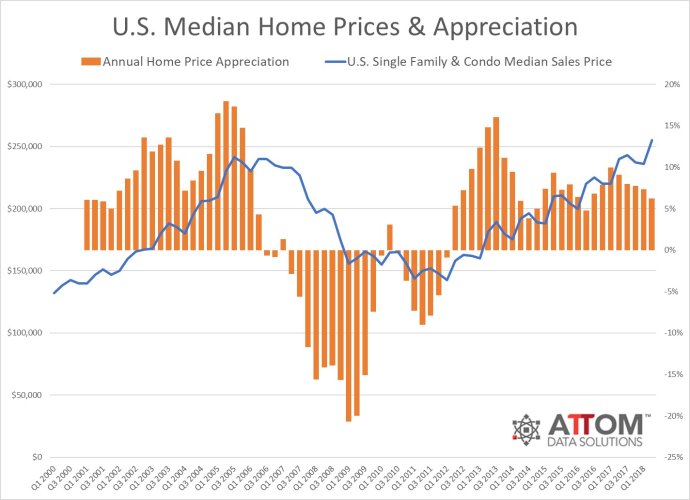

An example is that when mortgage rates rose from 3 to 8 percent, there was no substantial drop in home prices.

Forkyfinder

Well-known member

- Joined

- Dec 13, 2023

- Messages

- 3,735

How much of this is due to the changes in accessibility to turn real estate into a business though?Some markets will never return or a semblance of normalcy unless we take institutional investing out of the residential market.

Just think - airbnb, vrbo, hipcamp, and things like landtrust didnt exist. It was also harder to buy in a place you dont live and manage the cleaning/leasing of the property. The whole chain of capatalism became rabidly efficient and changed traditional home properties into income earning investments even more than they already were.

Many of these LLC corpations are well off people in their 40s, 50s, 60s.

How much of this is due to the changes in accessibility to turn real estate into a business though?

Just think - airbnb, vrbo, hipcamp, and things like landtrust didnt exist. It was also harder to buy in a place you dont live and manage the cleaning/leasing of the property. The whole chain of capatalism became rabidly efficient and changed traditional home properties into income earning investments even more than they already were.

Many of these LLC corpations are well off people in their 40s, 50s, 60s.

Definitely the case in some markets.

However the scale isn’t the same. For example, were I live CT hedge fund money has invested close 600 million in residential properties attached to private ski club, in a two year period.

It virtually impossible to compete on an individual level. This is just a microcosm of the bigger issue.

Last edited:

SAJ-99

Well-known member

Residential properties on a private ski club seems like a pretty extreme example to apply the "microcosm" label. The stats I have seen show Institutional investors own less than 1% of the housing market. 8% of Americans own a second home. Maybe we should there? Although, I sure the CT hedge fund crowd will get more face-time with the appropriate people. Their case sounds like a heart-warming story of struggle and sacrifice.Definitely the case in some markets.

However the scale isn’t the same. For example, were I live CT hedge fund money has invested close 600 million in residential properties attached to private ski club, in a two year period.

It virtually impossible to compete on an individual level. This is just a microcosm of the bigger issue.

ismith

Well-known member

Well, I’m grateful I’m not a renter in the market for a house.

Nick87

Well-known member

Yeah, I'm not sure how the younger generation is gonna pull it off with the price of everything.Well, I’m grateful I’m not a renter in the market for a house.

SAJ-99

Well-known member

Basic formula = Be willing to work hard, set yourself up to have options, and make choices with future you in mind with equal importance to present you.Yeah, I'm not sure how the younger generation is gonna pull it off with the price of everything.

5% down typically incurs PMI $$$ add to that the monthly mortgage on house prices with only 5%.5% down isn’t hard to do but having a stable job history is for some.

I know and am paying that $$$ but hey I bought a house, which is better than rent. O5% down typically incurs PMI $$$ add to that the monthly mortgage on house prices with only 5%.

morley.tyler

Well-known member

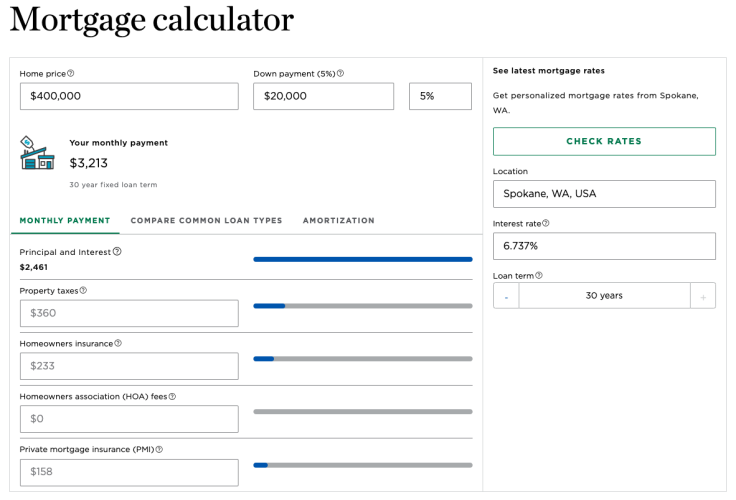

5% down on a $400K house, leaves you a monthly mortgage payment of $3100. That's the minimum payment on a 30-year loan, it's 4 grand if you want a 15-year note... That is not reasonable for a 30-year-old couple in Moscow, ID, Portland, OR, Spokane, Missoula, Casper, Colo Springs, or Knoxville, TN.5% down isn’t hard to do but having a stable job history is for some.

SAJ-99

Well-known member

Im not sure why your hypothetical couple does or what their income is, but it doesn't seem far from being reasonable. Buying a house has never been cheap. There are other options. I see plenty of houses listed in Spokane on North side for $200-400K. You can also rent for $1.2/sq ft and keep saving. I'm not sure what kinds of solutions people want. If we keep complaining politicians will end up giving out freebees that have some serious downside consequences and do nothing to solve the actual problem.5% down on a $400K house, leaves you a monthly mortgage payment of $3100. That's the minimum payment on a 30-year loan, it's 4 grand if you want a 15-year note... That is not reasonable for a 30-year-old couple in Moscow, ID, Portland, OR, Spokane, Missoula, Casper, Colo Springs, or Knoxville, TN.

I never said it’s reasonable, just way more doable than people think. That number seems pretty high to me but maybe with property tax added in and insurance etc.

when I googled it google said 2350 was the payment of a 30 year on 400,000 loan

If I sold my home now and rebought it my wife and I couldn’t afford the payments.

when I googled it google said 2350 was the payment of a 30 year on 400,000 loan

If I sold my home now and rebought it my wife and I couldn’t afford the payments.

ismith

Well-known member

Your “Basic Formula” is divorced from reality.Basic formula = Be willing to work hard, set yourself up to have options, and make choices with future you in mind with equal importance to present you.

morley.tyler

Well-known member

I'm not trying to get into a whole thing here, and I am very blessed that we bought a home (in a shit neighborhood) that we could afford, we fixed it up, it appreciated in value, we sold it, bought a shit home in a great neighborhood, and worked our asses off to improve it and now, it is very valuable. This is not about me...Im not sure why your hypothetical couple does or what their income is, but it doesn't seem far from being reasonable. Buying a house has never been cheap. There are other options. I see plenty of houses listed in Spokane on North side for $200-400K. You can also rent for $1.2/sq ft and keep saving. I'm not sure what kinds of solutions people want. If we keep complaining politicians will end up giving out freebees that have some serious downside consequences and do nothing to solve the actual problem.

In 2022, the median household income in Spokane, was $62,287 in the city, $66,484 in Spokane Valley, and $69,070 in Spokane County.

If you make $70,000 a year living in the state of Washington, USA, you will be taxed $13,831. That means your net pay will be $56,169 per year or $4,681 monthly. Ballpark.

Fiscal responsibility dictates 25-30% of income should be allocated to a mortgage. This is closer to 65%.

Again, I'm gonna be fine, but for younger families coming up, it ain't like it was.

morley.tyler

Well-known member

I never said it’s reasonable, just way more doable than people think. That number seems pretty high to me but maybe with property tax added in and insurance etc.

when I googled it google said 2350 was the payment of a 30 year on 400,000 loan

If I sold my home now and rebought it my wife and I couldn’t afford the payments.

Morley- Tyler you describe my exact situation. I rather be house poor than rent poor.

I still agree with SAJ-99, if you have the right mentality and goal you can do it. You have to work at it though and it might not happen overnight. Took me 15 years to save but it eventually happened. We got lucky on the insanely low interest rates but bought at a highly inflated housing market and could be underwater if there’s a dip- but we love where we live. Plus shooting an elk and a deer every year helps the grocery bill

I still agree with SAJ-99, if you have the right mentality and goal you can do it. You have to work at it though and it might not happen overnight. Took me 15 years to save but it eventually happened. We got lucky on the insanely low interest rates but bought at a highly inflated housing market and could be underwater if there’s a dip- but we love where we live. Plus shooting an elk and a deer every year helps the grocery bill

Latest posts

-

-

-

As if I wasn't ready to leave CO already.........the hits just keep on coming.

- Latest: Stcknstringer22

-

-