npaden

Well-known member

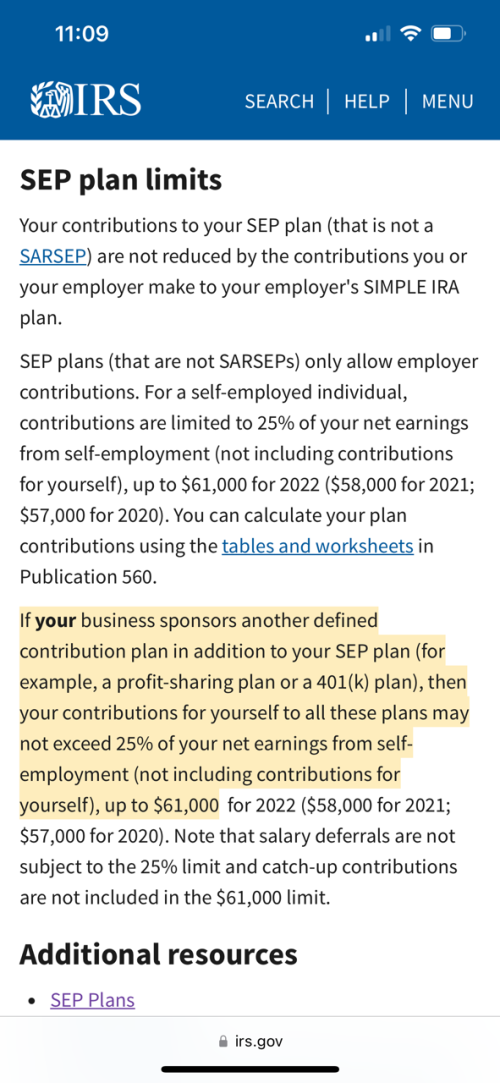

I’m not sure on that. I don’t do much with SEP plans. It doesn’t sound like it though.@npaden correct me if I'm wrong, it is my understanding you can max out both the 401k and SEP as long as you don't have ownership in the company that you get the W2 from. 69k for each in 2024.