Why can’t I ask you questions? Are you a King?You realize it's okay for you to say no right? It's impolite to answer a question with another question.

I don't know many who feel "well represented".

Answer my question before you ask me any questions please. Makes the conversation easier to have for both parties.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Future of 401ks

- Thread starter SAJ-99

- Start date

rjthehunter

Well-known member

If you can't answer that easy of a question, I'm not interested in further discussion.Why can’t I ask you questions? Are you a King?

GoodIf you can't answer that easy of a question, I'm not interested in further discussion.

I think the financial industry will be against this. The entire system has been set up to give workers low cost exposure to markets. Costs have been reduced dramatically over the last 50yrs. The stock market could still be primarily for the wealthy without the creation of the mutual fund and the tax changes implemented in 1978.

Joe American better start caring.

From the ICI

401(k) plans hold $6.9 trillion in assets as of September 30, 2023, in more than 710,000 plans, on behalf of about 70 million active participants and millions of former employees and retirees. Savings rolled over from 401(k)s and other employer-sponsored retirement plans also account for about half of the $12.6 trillion held in individual retirement account (IRA) assets as of September 30, 2023.

They maybe against it however once they see that this will come to fruition they will lobby to gain an angle that ensure they have a foot in the door and profits to come with it.

Wildabeest

Well-known member

Not saying it doesn’t happen, but that’s illegal. I’ve made a career out of helping govt agencies find these people and cut them off (and also recover payments and put some in jail).Well another issue is the people that know how to work the system and go out on disability. They then work cash jobs. I have also meet a few government workers that went out on disability and then get jobs in the private sector doing the same job. Not saying some to most don’t deserve it, but I am tired of seeing my taxes increasing to pay for scammers that no one seems to care about.

This is one blatant example: https://amp.theolympian.com/news/local/article25284742.html

It’s crazy the shit people will put online of themselves committing crimes. Facebook was a godsend for investigations of this stuff - people using their real names and posting their physical accomplishments while collecting disability. Game the system at your own risk.

shannerdrake

Well-known member

In before the lock!

Considering “lost” revenue from pretax retirement plans is costing the government about 1% of our country’s annual operating budget and .15% of our current national debt, one has to assume that no one would really rally around ending pretax plans in the name of improving/balancing (chuckle) the budget. Right????

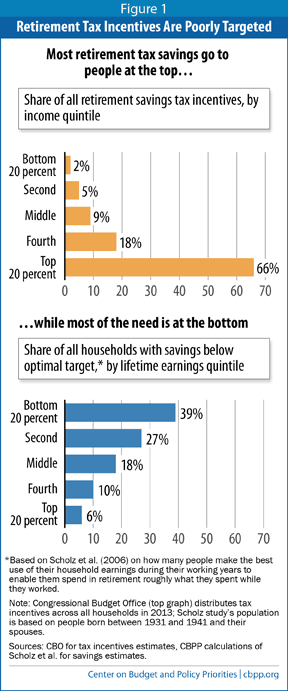

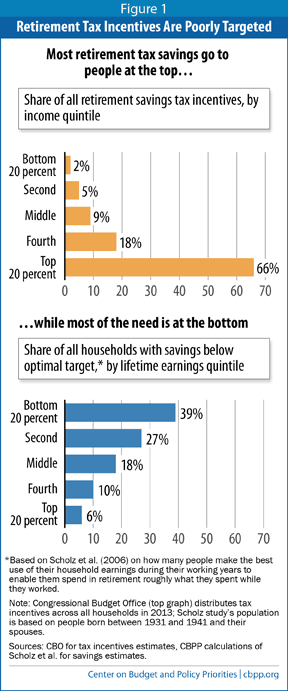

That being said, the “eat the rich” narrative seems to play strangely well to both sides and graphs like this prove that the evil top 20% benefit the most from pretax plans. So who knows? There are people in congress who ran on platforms vowing to reduce our country’s annual cow farts so stranger things have happened.

Considering “lost” revenue from pretax retirement plans is costing the government about 1% of our country’s annual operating budget and .15% of our current national debt, one has to assume that no one would really rally around ending pretax plans in the name of improving/balancing (chuckle) the budget. Right????

That being said, the “eat the rich” narrative seems to play strangely well to both sides and graphs like this prove that the evil top 20% benefit the most from pretax plans. So who knows? There are people in congress who ran on platforms vowing to reduce our country’s annual cow farts so stranger things have happened.

D

Deleted member 48080

Guest

Not saying it doesn’t happen, but that’s illegal. I’ve made a career out of helping govt agencies find these people and cut them off (and also recover payments and put some in jail).

This is one blatant example: https://amp.theolympian.com/news/local/article25284742.html

It’s crazy the shit people will put online of themselves committing crimes. Facebook was a godsend for investigations of this stuff - people using their real names and posting their physical accomplishments while collecting disability. Game the system at your own risk.

It seems so crazy to me to read about situations like these and @LIK2HNT mention, after seeing how hard it is for legitimately sick people to get on it.

Is it crooked doctors fabricating the paperwork?

LIK2HNT

Well-known member

Another government bs issue. How come an agency can invest their pension plan in the stock market, and then raise sales tax to cover their loss? And leave that tax in place long after they recouped their losses. My losses in ‘08 were my burden alone, and mine to figure out how to reinvest. No one bailed me out! Actually now I get the privilege to pay more for everything.

D

Deleted member 48080

Guest

Another 401k question- does anyone have input or opinions on a company directing bonus money to 401k accounts, rather than giving it directly to the employees?

LIK2HNT

Well-known member

Keep up the good work. Glad to see someone doing it.Not saying it doesn’t happen, but that’s illegal. I’ve made a career out of helping govt agencies find these people and cut them off (and also recover payments and put some in jail).

This is one blatant example: https://amp.theolympian.com/news/local/article25284742.html

It’s crazy the shit people will put online of themselves committing crimes. Facebook was a godsend for investigations of this stuff - people using their real names and posting their physical accomplishments while collecting disability. Game the system at your own risk.

longbow51

Well-known member

- Joined

- Feb 17, 2023

- Messages

- 1,255

I've got a great idea; how about we get the same retirement plan Congress gets, or they get the same one we get?

Wildabeest

Well-known member

Sometimes. Some docs are more “prone” than others to sign disability orders, and that’s something we look for in the data to establish suspicion. We do the same thing to identify docs overprescribing opioids (aka “pill mills”). Then the investigators take over to audit everything and sometimes even do surveillance to build a case. Those “post-it note and string” things you see on TV crime dramas - we do on computers.It seems so crazy to me to read about situations like these and @LIK2HNT mention, after seeing how hard it is for legitimately sick people to get on it.

Is it crooked doctors fabricating the paperwork?

SAJ-99

Well-known member

A company paying annual profit sharing as a 401K match is pretty normal. I have never heard of a company paying a cash (salary) bonus in one year and then switching it to a 401k contribution the next. That said, if I were to guess, it is perfectly legal unless there is a contract stating otherwise.Another 401k question- does anyone have input or opinions on a company directing bonus money to 401k accounts, rather than giving it directly to the employees?

Wildabeest

Well-known member

A lot of bonuses are earned in one year, but paid in the next - especially for companies on a calendar year fiscal. They don’t know bonus payouts until the books close after Jan 1. So long as you aren’t over your annual max 401k contribution, you can legally allocate as much of your bonus as you want to your 401k. Subject to your employer’s 401k policies of course.A company paying annual profit sharing as a 401K match is pretty normal. I have never heard of a company paying a cash (salary) bonus in one year and then switching it to a 401k contribution the next. That said, if I were to guess, it is perfectly legal unless there is a contract stating otherwise.

D

Deleted member 48080

Guest

A company paying annual profit sharing as a 401K match is pretty normal. I have never heard of a company paying a cash (salary) bonus in one year and then switching it to a 401k contribution the next. That said, if I were to guess, it is perfectly legal unless there is a contract stating otherwise.

Sorry- yes, profit sharing. Not bonuses.

I wasn't questioning the legality or anything, moreso just wondering what the benefit/risk is of doing it that way. I'm such a damn pessimist on stuff like that, that I have no faith that I'll ever see that money.

D

Deleted member 28227

Guest

For 2023 employee contribution is $22,500 and Employer is $66,000.Sorry- yes, profit sharing. Not bonuses.

I wasn't questioning the legality or anything, moreso just wondering what the benefit/risk is of doing it that way. I'm such a damn pessimist on stuff like that, that I have no faith that I'll ever see that money.

I’ve heard of 100% matches so $22,500 from an employer, but I’ve never heard of anyone getting the full $66,000.

Seems like a lot left on the table… I always wondered if you could negotiate for a ~300% match, but most employers seem like they don’t have a lot of flexibility in that regard

SAJ-99

Well-known member

It should just get put in your account. It's yours if you have immediate vesting, which is how it typically works in a 401K.I'm such a damn pessimist on stuff like that, that I have no faith that I'll ever see that money.

D

Deleted member 48080

Guest

It should just get put in your account. It's yours if you have immediate vesting, which is how it typically works in a 401K.

What's the penalty to take it out now? I need to go chase a white sheep.

westbranch

Well-known member

For 2023 employee contribution is $22,500 and Employer is $66,000.

I’ve heard of 100% matches so $22,500 from an employer, but I’ve never heard of anyone getting the full $66,000.

Seems like a lot left on the table… I always wondered if you could negotiate for a ~300% match, but most employers seem like they don’t have a lot of flexibility in that regard

Adding additional profit sharing/401k contributions allows company owners to go up to the $66k max on their personal accounts. They can't just max out there own account without giving extra to their covered employees. A lot of extra calculations go into a cross-tested 401k plans that allow that. It can work well for a small (<20 employee), high-income employers. Just doesn't work well for most businesses, they go with a safe-harbor plan to prevent issues with highly compensated employees getting more of a benefit.

SAJ-99

Well-known member

Gets classified as income and they tack on a 10% penalty, unless you are 59.5. Although a sheep hunt might qualify as a hardship withdrawal, LOL.What's the penalty to take it out now? I need to go chase a white sheep.

Similar threads

- Replies

- 42

- Views

- 5K

- Replies

- 4

- Views

- 657

- Replies

- 136

- Views

- 6K