ImBillT

Well-known member

- Joined

- Oct 29, 2018

- Messages

- 3,935

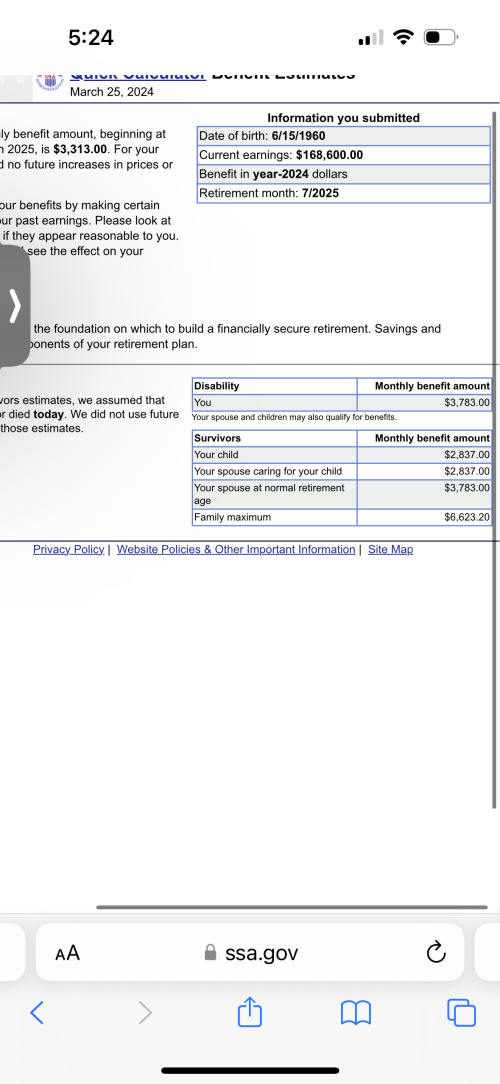

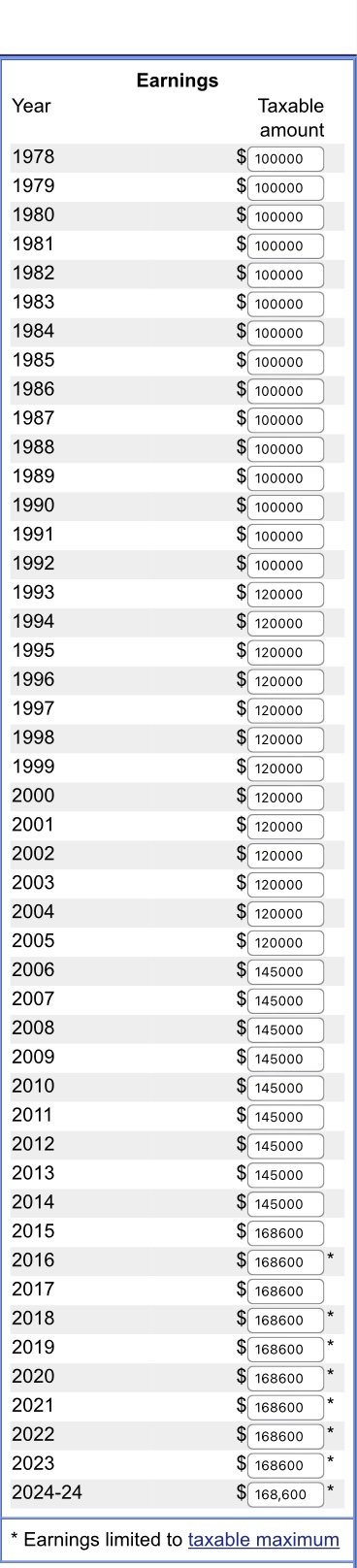

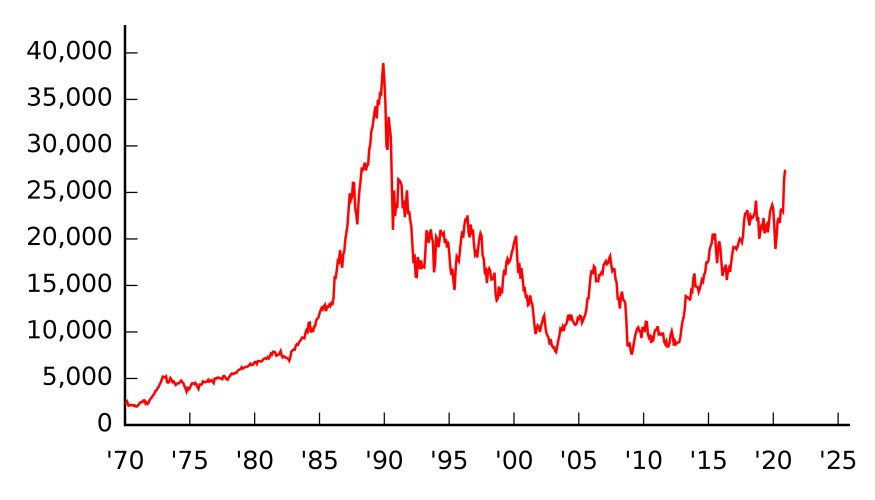

im pointing out that income 40 years ago would be dramatically less than income today. You cannot use a flat income for all forty years. You need to depreciate past year’s income for both inflation and the fact that the employee likely started at something resembling an entry level for their chosen career, be it lawyer, or garbage man. Picking the same starting and finishing salary, with the finishing salary being something sane today, results in a drastically inflated contribution over the 40year period.I just used 100k as an average so that it could plug into a simple compounding interest calculator. You’ll see that my SS calculator a few posts later was also based on a high income, greater than the contribution ceiling, to make it an apples-apples comparison