mxracer317

Well-known member

- Joined

- Nov 20, 2020

- Messages

- 1,250

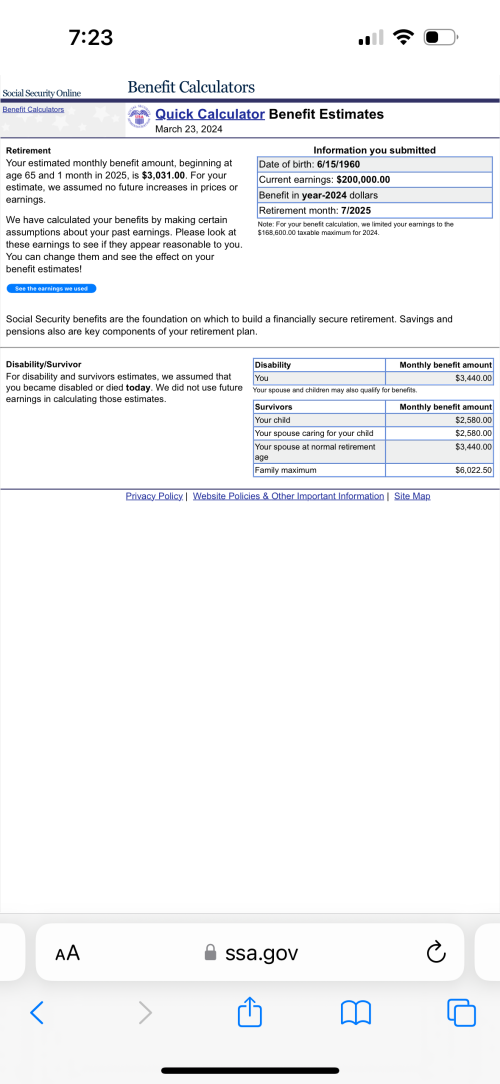

Ida Mae fullerIt's funny you mention that. About 10 years ago, when I was about to retire, I ran through an exercise to see what rate of return I would have needed to receive over the 40+ years I paid into the system to get the payment I was promised. I counted my actual contributions and also my employer contributions over my 40+ work history. I believe I calculated that I would have needed a 13% rate of return over those 40 years to get a payment from 66 to my expected mortality. That's what amazed me. I think my employer & my contributions totaled around $300,000. I remember seeing something how the first woman that collected from social security only contributed $100 but because she lived pretty long had collected thousands of dollars in benefits, even accounting for the time value of money. Do we have any actuaries on here? I think most people are astonished. Benefits far outweigh contributions.

I also ran through a basic calculation to see if it matter whether I retired at 62 or 66.5, my full retirement age. It doesn't, otherwise the system would be incredibly unstable, even more than it is because benefits are so outsized. The actuaries make sure that you are roughly economically indifferent. Benefits for the whole are outsized because it's another handout from Congress. They own us.