I think there was a computer glitch because one of my student loans actually had a -.1% interest rate. Yeah, they were paying me each month to have the loan. I didn’t pay that one off early. It still felt good making that last payment, though.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Debt Elimination Question

- Thread starter David58

- Start date

IsThisHeaven?

Active member

- Joined

- Jan 16, 2013

- Messages

- 133

I respect that each person can chart their own path, so the following is not directed to you @ElkFerver2, but for others that are still in the learning process I will respond.

This is fundamentally flawed financial logic. As with most things, extreme approaches on both sides of a topic are rarely the right answer for most situations.

To under-use of “smart debt” is to over pay for big good assets a such as homes (as their prices rise faster than the value of the cash you are saving to buy). You also can lose monumental gains while paying someone else’s mortgage via rent payments.

An underuse of smart debt can minimize growth of your overall net worth and thereby make you more dependent on your employer, your government SS, and your pension - three things I trust a lot less than index funds or 2.85% mortgages.

It’s like saying because too many Americans abuse opioids that I won’t take take any meds and throw insulin in the trash. There are good meds, bad meds and good meds used badly. Debt is the same.

You and Wilm are smart people. Both much smarter than I, and I am not being patronizing. If I was a smart as either of you, I would probably do things differently. Probably whatever you are talking about quoted above makes total sense, and my financial philosophy is absurd.

I am 39. I bought a house for much less than I can afford with a really low interest rate (2.65%). I hate debt and paying interest. I paid off my student loans as quickly as possible. The numbers floated here are astounding. I had $28K in student loans and my $17k, and I was uncomfortable with those payments. We had those paid off years ago. We pay for our vehicles with trade-ins plus cash.

We have about 18 months in living expenses in savings and about $300k in retirement savings.

Again, I know nothing about finances or investing, or any of that stuff. I don’t have your knowledge base or background. I do know sleep much better at night knowing I owe one bank. You can’t put a price on a good night’s sleep.

Last edited:

VikingsGuy

Well-known member

Sounds like you did it right. You used modest debt at good rates to buy appreciating assets (home and education) and then in a disciplined manner paid those debts off/down. You avoided debt on depreciating assets like cars, have healthy emergency reserve and a solid start on retirement for your age class. You sir are a finance natural as they say.You and Wilm are smart people. Both much smarter than I, and I am not being patronizing. If I was a smart as either of you, I would probably do things differently. Probably whatever you are talking about quoted above makes total sense, and my financial philosophy is absurd.

I am 39. I bought a house for much less than I can afford with a really low interest rate (2.65%). I hate debt and paying interest. I paid off my student loans as quickly as possible. The numbers floated here are astounding. I had $28K in student loans and my $17k, and I was uncomfortable with those payments. We had those paid off years ago. We pay for our vehicles with trade-ins plus cash.

We have about 18 months in living expenses in savings and about $300k in retirement savings.

Again, I know nothing about finances or investing, or any of that stuff. I don’t have your knowledge base or background. I do know sleep much better at night knowing I owe one bank. You can’t put a price on a good night’s sleep.

IsThisHeaven?

Active member

- Joined

- Jan 16, 2013

- Messages

- 133

Sounds like you did it right. You used modest debt at good rates to buy appreciating assets (home and education) and then in a disciplined manner paid those debts off/down. You avoided debt on depreciating assets like cars, have healthy emergency reserve and a solid start on retirement for your age class. You sir are a finance natural as they say.

I always knew my mom was wrong….

I would pay down the debt monthly pre-retirement if possible. I would (did) pay the student loan off as soon as possible first. Then move onto the trailer loan. Pay as much as possible toward the student loan. If I was pushing it, and the debt was running toward my retirement date, I would pay the rest off in cash to avoid paying into retirement.

I would not sell the trailer considering how much you use it, how much you enjoy it, and how much it means to you. I would treat it as an extension of my house and look at it a little differently.

But I would want all the debt gone before retirement or if I lost stable income. And under no circumstances short of an emergency would I assume additional debt/interest.

D

Deleted member 28227

Guest

Is the U.S. Student Loan Program Facing a $500 Billion Hole? One Banker Thinks So.

Government sees it as a moneymaker. A former JPMorgan executive sees a giant loss looming due to rosy repayment hopes. Biden officials reject his diagnosis.

TLDR either you forgive the loans/reduce interest rates or the borrowers mostly likely to repay refinance with private loans, these borrowers have the means aka credit scores thus weighting the entire portfolio with borrowers most likely to default either way sinking ship.

VikingsGuy

Well-known member

Is the U.S. Student Loan Program Facing a $500 Billion Hole? One Banker Thinks So.

Government sees it as a moneymaker. A former JPMorgan executive sees a giant loss looming due to rosy repayment hopes. Biden officials reject his diagnosis.www.wsj.com

@VikingsGuy

TLDR either you forgive the loans/reduce interest rates or the borrowers mostly likely to repay refinance with private loans, these borrowers have the means aka credit scores thus weighting the entire portfolio with borrowers most likely to default either way sinking ship.

Every modern financial mess has been/is a government/private partnership- chrony capitalism and an ever expanding interventionist govt is a recipe for disaster. But now that we can just print money, I suppose it doesn’t matter.

Wildabeest

Well-known member

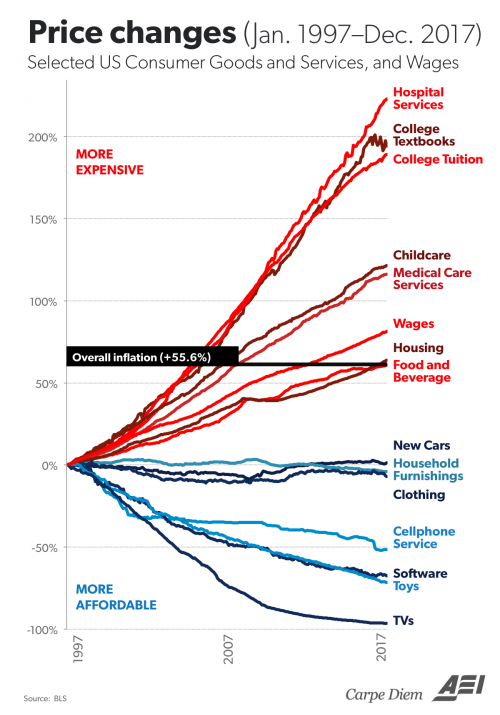

Mine was similar dates but $700 (in state) for me vs. $50k (out of state) for my son. Fortunately, he had scholarships and worked to offset the crazy costs. But still, I don’t think many things have inflated as much over the past 30 years as college costs!In the fall of 1984 my first quarter of university tuition was $274. In the fall of 2021 my payment for my son's first quarter of university tuition (not incl. room/boarding/books/etc) will be $21,500. Now that's what I call inflation.

VikingsGuy

Well-known member

Some will see this as justification to why the government needs to intervene in the top half of the graph.

other’s will see that intervention as the cause of the top half of the graph.

interesting how that works.

VikingsGuy

Well-known member

Very true - It is a political Rorschach test. I originally had typed my take on that point but decided to post remark-free as to not completely derail this thread.Some will see this as justification to why the government needs to intervene in the top half of the graph.

other’s will see that intervention as the cause of the top half of the graph.

interesting how that works.

Straight Arrow

Well-known member

It's hard to believe new cars' prices have remained so flat. Likely the new trucks graph would rise much more steeply.

Bluffgruff

Well-known member

Anybody know a good backpack dall sheep outfitter?Yeah I try not to do that math… you know a dall sheep hunt every year lol

VikingsGuy

Well-known member

I don't know which specific data sets were used for this chart, but often prices in these studies are adjusted for increased quality/longevity and/or decreased lifecycle costs. So if I could make a new version of my truck that lasted 1 year longer on average and was 10% more fuel-efficient, in some inflation data I could raise sales price by 5-10% on the sticker price and economists would report this as 0% inflation in the cost of my truck - as they look at value received over the expected life of the product, not just sticker price upfront. Not sure that is the case here, but this methodology is definitely used in the federal CPI calculation.It's hard to believe new cars' prices have remained so flat. Likely the new trucks graph would rise much more steeply.

D

Deleted member 28227

Guest

@VikingsGuy… so… we’re making a run at writing our own text book?

Also can someone please explain to me why a TI-83 graphing calculator 1. Still exists 2. Is the same price it was in 2001.

Also can someone please explain to me why a TI-83 graphing calculator 1. Still exists 2. Is the same price it was in 2001.

VikingsGuy

Well-known member

Just like to share a little common sense I learned from my foolish years. Plus, my kids have stopped listening to me so now I direct all this wisdom on you folks@VikingsGuy… so… we’re making a run at writing our own text book?

Wildabeest

Well-known member

VikingsGuy

Well-known member

I need to adjust my balance - currently know too much and drink too little - had more fun when I was young and that was flipped 180

Last edited:

David58

Well-known member

The data used are important, and usually selected simply to confirm the author's hypothesis. College costs, both school and text, have risen simply because of a) demand, and b) easy money. The demand is manufactured in largest part by parents and guidance counselors, wanting kids to have that college "experience". Easy money takes the initial sting out.I don't know which specific data sets were used for this chart, but often prices in these studies are adjusted for increased quality/longevity and/or decreased lifecycle costs. So if I could make a new version of my truck that lasted 1 year longer on average and was 10% more fuel-efficient, in some inflation data I could raise sales price by 5-10% on the sticker price and economists would report this as 0% inflation in the cost of my truck - as they look at value received over the expected life of the product, not just sticker price upfront. Not sure that is the case here, but this methodology is definitely used in the federal CPI calculation.

Medical costs have risen because of the ability to game the system. Local hospital here will knock the top 20% off your bill just by asking. That's after the "negotiation" with the insurance company. Both the 20% and the insurance "adjustment" go on the loss side of the books, helping to maintain the non-profit status of the hospital. And that remaining 80%, less the negotiated discount for insurance, is overpriced. As consumers, we have no ability to price shop - how many hospitals or docs post their prices? Still, I'd rather get my medical treatment here in the US than in revered Canada, or anywhere else.

tzone

Well-known member

Retirement approacheth. We have two significant non-mortgage debts, a student loan that we are paying for the parent's privilege on our son's education, and a trailer. Student loan is about $48K, the trailer about $25K. We have $48K available to pay down one or the other, or some part of each.

The student loan is with us to the grave, cannot bankrupt out of it, etc.

The trailer has some value as collateral, we could sell it if in a bind and not have that debt.

Seems to me that marking off the student loan on September 29 is the best approach, since no payment has to be made until then and the cash stack can still grow until we pay off. But I am not a finance and planning expert, so I thought I would appeal to other nonfinancial experts here on a hunting forum. Just kind of turning this over in my hands, trying to decide which is best (and the student loan payment is about 2X of the trailer).

Thanks for weighing in!

Pay off the smallest debt first, the pay the rest on the higher debt. Unless, for some reason the student loan interest rate is much higher than the trailer.

Similar threads

- Replies

- 278

- Views

- 16K

D