Ukraine v Russia thread wandered a bit. Tossed this over here to find, fresh tracks.

World of the relations between Death and Taxes.

That is far down the list.

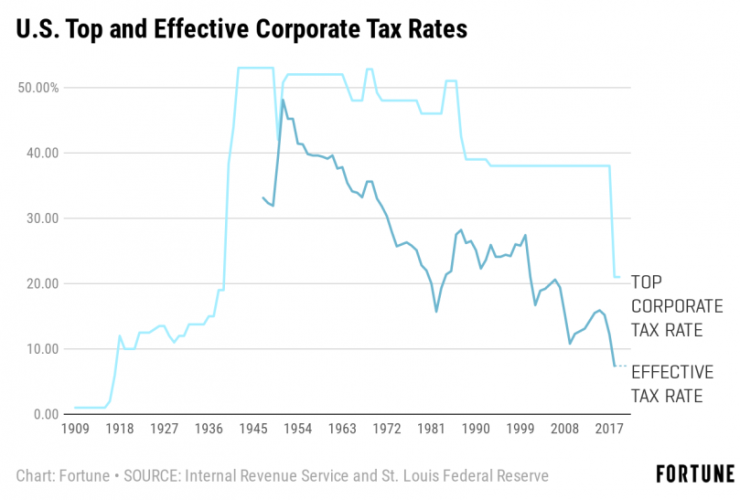

The primary reason for corporate tax cuts are to increase a more sustained GDP.

GDP, (Gross Domestic Product) is defined as:

"A comprehensive measure of U.S. economic activity. GDP measures the value of the final goods and services produced in the United States (without double counting the intermediate goods and services used up to produce them). Changes in GDP are the most popular indicator of the nation's overall economic health."

www.bea.gov

www.bea.gov

So, in a sense, it does increase the sales to the consumer as supply becomes more in line with demand. When this occurs, demand value decreases and it becomes a semblance of cost saving to the consumer.

Basically, a country's economic standard is not a simple yes / no response. If you follow the tax cut principles, one of the end results is more domestic products available which reduces the increase value of demand

Politics twist spoons, beyond Matrix level. Outside politics, below adds to the topic.

A quick find to support my opinion:

www.investopedia.com

www.investopedia.com

"The National Bureau of Economic Research studies the persistent effects of temporary changes in U.S. federal corporate and personal income tax rates. According to their recent 2022 working paper, a corporate income tax cut leads to a sustained increase in GDP and productivity. In contrast, personal income tax cuts trigger a short-lived boost to GDP, productivity, and hours worked but have no long-term effects."

World of the relations between Death and Taxes.

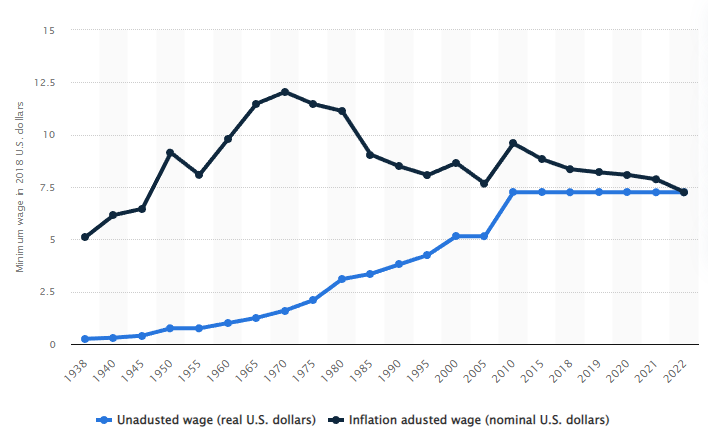

Corporate tax cuts are an interesting subject. Most people believe if there are corporate tax cuts, the purpose is for the consumer.Has it gone down ever for the working family? Serious question as I'm (somewhat) young...

That is far down the list.

The primary reason for corporate tax cuts are to increase a more sustained GDP.

GDP, (Gross Domestic Product) is defined as:

"A comprehensive measure of U.S. economic activity. GDP measures the value of the final goods and services produced in the United States (without double counting the intermediate goods and services used up to produce them). Changes in GDP are the most popular indicator of the nation's overall economic health."

Gross Domestic Product | U.S. Bureau of Economic Analysis (BEA)

So, in a sense, it does increase the sales to the consumer as supply becomes more in line with demand. When this occurs, demand value decreases and it becomes a semblance of cost saving to the consumer.

Basically, a country's economic standard is not a simple yes / no response. If you follow the tax cut principles, one of the end results is more domestic products available which reduces the increase value of demand

Not sure that theory holds up. Mostly because you can’t isolate the tax cut (or rise) front the other dozens of variables that affect an economy.

Taxes are applied to income. It’s a division of the final pie. Taxes go to a government entity who spends the money - also a component of GDP. Simply put, the theory politicians like to use is based on how a pie is divided will actually make the pie bigger or smaller. Hogwash. There is an optimal tax rate where it doesn’t affect behavior, but no one knows what that is. Regardless, we are spending more than we collect so something has to change eventually. Either revenue or expenses.

Politics twist spoons, beyond Matrix level. Outside politics, below adds to the topic.

A quick find to support my opinion:

How Tax Cuts Affect the Economy

An increase or decrease in taxes affects the economy and spending decisions of individuals in higher and lower income brackets.

"The National Bureau of Economic Research studies the persistent effects of temporary changes in U.S. federal corporate and personal income tax rates. According to their recent 2022 working paper, a corporate income tax cut leads to a sustained increase in GDP and productivity. In contrast, personal income tax cuts trigger a short-lived boost to GDP, productivity, and hours worked but have no long-term effects."