Bonasababy

Well-known member

- Joined

- May 16, 2024

- Messages

- 915

I finally looked today--before the bump from today down nearly 50KI’m still down 6 figures even with the bump…

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I finally looked today--before the bump from today down nearly 50KI’m still down 6 figures even with the bump…

I came home broke and with a new wife.This thread reminds me of when people go to Vegas. Everyone always wins…

But--a good ten years or more away from normal retirement age right?i'm never sure if people in here are primarily discussing things through the lense of their retirement funds or personal brokerage accounts.

my retirement funds are 100% on autopilot. i log into that like once a quarter at the most just to see what things look like and pat myself on the back for stocking away.

as far as this thread goes, i'm usually talking about what we invest above and beyond our savings and emergency funds. a very small slice of which goes into a more gambling type jar.

i deployed about as much cash as i told myself i was allowed to in the last few days. and i'm not upset i did. but i'm not gonna say i'm "winning" or anything.

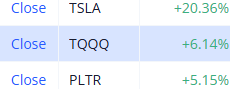

I haven't quite sold that one and celebrated yet but I bought in too on that one Monday I think it was!This is my @seeth07 level win for the day. Don't ask me about everything else lol.

View attachment 367406

To each his/her own how we operate our funds.my retirement funds are 100% on autopilot. i log into that like once a quarter at the most just to see what things look like and pat myself on the back for stocking away.

as far as this thread goes, i'm usually talking about what we invest above and beyond our savings and emergency funds. a very small slice of which goes into a more gambling type jar.

Tbh I was waiting for a better deal.for those of you that were worried about your 401k late last week and the last two days....it was all for nothing. We back. @npaden didn't you call the rebound to happen? Just off by a few days?

View attachment 367425

I think we all have learned gains/losses can be reversed quickly so far this year.for those of you that were worried about your 401k late last week and the last two days....it was all for nothing. We back. @npaden didn't you call the rebound to happen? Just off by a few days?

View attachment 367425

I put some more cash in, but not as much as I was hoping to before this was all over. Something tells me we're going to get another chance.Tbh I was waiting for a better deal.

More than likely I'm sure.Something tells me we're going to get another chance.

We went back part of the way in the market because Trump blinked for 90 days. His blink doesn’t change the underlying issues with the tariffs nor trade war that might damage the U.S. economy.for those of you that were worried about your 401k late last week and the last two days....it was all for nothing. We back. @npaden didn't you call the rebound to happen? Just off by a few days?

View attachment 367425

Playing the market works great for those knowing when to place portions into the market.

You didn't ask, but I'm expecting a rise in the morning followed by a sell off leaving us in the red.

I predict a flat day. I'm remaining neutral tonight and not touching anything. In other words I'm taking my money and running while watching the show

You didn't ask

If the dip tomorrow and then next day doesn’t bust the floor then I’ll believe the chart voodoo, sell my gains and throw it in Qqq’s and those corresponding individual stocks.I know my market -12% entry point with 50% of my move from cash and bonds made me 60k over those who are riding through the market.

As for the market tomorrow, I'll sit back and watch. My 50% S&P large company entry with continued payroll and matching continue to buy, I'll watch.

My next move would be an anticipated drop again. Hopefully I can get in another drop with my other 50% of cash and bonds around -10 or better %.

If the market suddenly stabilizes... which i don't think it will, I'll trickle in at 25% increments over the next couple weeks.

Hoping for China 124% broomstick to play havoc and collect a bit more than those riding the market out.

How about you?