ismith

Well-known member

Only 45 and a half more months to go!It will be amazing if anyone can recover the losses of the last 2 days and the upcoming losses until this clown show is over.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Only 45 and a half more months to go!It will be amazing if anyone can recover the losses of the last 2 days and the upcoming losses until this clown show is over.

We must be reading different threads then.Nope that’s not what I’m reading on here

Hire that man. He is full of inshiet on the market. Keep buying shorts and selling and rebuying. You will have a fortune at the end.Only 45 and a half more months to go!

I prefer gambling at a casino rather than options. I know what my potential maximum loss is at a casino. With puts, potential maximum loss is astronomical unless doing straddles. Can you outperform the S&P 500 over a decade with your system, net of fees? At what risk?So why not make money off that clown?

PM me for any specific questions and I’ll be happy to answer.I would love to say I follow the Oracle of Omaha's perspective of the market though I fail (hopefully to succeed) in one area. I time the market... I know, for many it is bad ju-ju. I am 100% for Buffett's buy during fear and sell during greed. Use dips, such as this to buy quality merchandise when it is marked down.

IMO/E, I was sucessful with COVID and made roughly 30% more than those who rode out the Covid market. I am doing the same here. It could bite me in the arse though, again, IMO/E by very little. Why? Here's my view and @mxracer317 feel free to critique my "play" for the potential loss I may incur over others who ride out a market.

I am a gov employee and TSP is our version of the 401.

A month prior when the threats started building, I moved my main chunk of coin to the G (cash), F (bonds), and I (Int'l stocks) funds. I could have split the I into the G and F though...

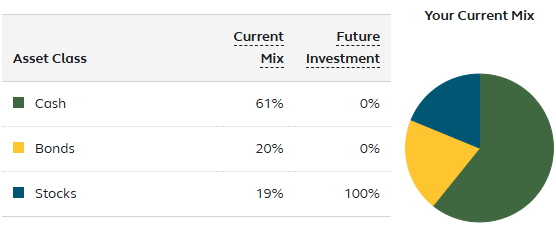

(Erased the $ value in the graphic below)

View attachment 367024

It's set with the I (MSCI) fund @ 20%.

Since moving my main coin, I've kept my TSP payroll (26 annual) deductions (26%) and gov 5% in the C (mainly S&P500 - largest companies) and S (mainly Dow small/medium companies) that are taking a beating currently though, to me, I am buying stocks as they drop to lower prices and as they rise out of the dip, again, buying at lower prices.

If I let my main coin ride into the dip, I have no gain / loss as it rides through the duration. However, as I placed the main coin into safe(r) harbors for the time being, I will buy back into the market with a sizeable amount of $ and make a large purchase of the C and S at "marked down" values.

Basically, everyone aching about their 401/TSP down 17%-20%, I'm only down 3% for the year. If I bought back in even at this point, I would have 14%-17% more buying power for the "marked down" values over those riding out the storm... again, at this point. As it continues downard into the dip, I'll gain additional buying power until it starts to rise out of the dip when that will begin to reduce - even still though depnding how deep the dip, I'll still have a far greater % of money buying discounted company stock over those riding it out.

I agree for those not involved in the market, it is best to let it roll through the storm. I have been a hobby day/swing trader for - heck I've posted in HT back in 2011 my stock and option plays, etc. I am more comfortable using my ToS charts, etc. That said, no matter where I buy in, I have a much higher % of money over those who are riding it out.

Highly doubt he'll last that longOnly 45 and a half more months to go!

Had someone like you suggest that right before covid blew up. Had I taken that advice ...which is making an assumption the bottom is here or close..we would have lost so much our retirement we would be put off for years. And by the way...several accountants told me Hell no on the aggressive conversion.I’m not giving legal tax advice on a public forum here, so consult with your tax professional…

HOWEVER, where many of you might be able to make money at this point is doing Roth conversions from a tax-deferred account such as TSP, 401k, IRA, etc. into Roth 401k and/or Roth IRA.

If you subscribe to the theory that future tax rates are going to be higher, now is also an opportunity to take advantage of converting your investments at a lower price into Roth.

Once the money goes into the Roth IRA, assuming you follow the five-year rule, the principal, the interest and all of the distributions will be tax-free forever. Even the beneficiaries that might inherit your accounts one day in the future will have zero tax on it.

Downside, you got to pay the taxes. But, you’re gonna have to pay taxes no matter what on this money. So you might as well get it into Roth as cheaply as possible.

While you can’t control right of return in the market, you can control future tax rates by paying them now while taxes are low and on sale. That, in my opinion, is another way to put money back into your pocket in times like this.

At the height of the loss in March 2020, the S&P 500 was -34%. Assuming, you knew where the bottom was which nobody would, but let’s just for fun entertain the idea that you converted when it was -34%, that is significantly less in taxes a person has to pay on tax deferred money.Had someone like you suggest that right before covid blew up. Had I taken that advice ...which is making an assumption the bottom is here or close..we would have lost so much our retirement we would be put off for years. And by the way...several accountants told me Hell no on the aggressive conversion.

Be careful with advice like that guys.

LOL, long term accountants don't understand tax planning, huh?At the height of the loss in March 2020, the S&P 500 was -34%. Assuming, you knew where the bottom was which nobody would, but let’s just for fun entertain the idea that you converted when it was -34%, that is significantly less in taxes a person has to pay on tax deferred money.

Now, understand that by the end of 2020 the S&P 500 finished +16%. That’s a major tax-free win.

No one said anything about “aggressive conversion”. You could do whatever amount you want to stay in whatever marginal tax rate.

All of those gains would be 100% tax-free. It seems like you and whomever you visited with did not understand tax-planning.

Wishing you and your portfolio the best of luck.

Go back and re-read the first sentence of post #5286.LOL, long term accountants don't understand tax planning, huh?

Surprised you are advising that if you do this for a living. Lots of factors needed in that decision, perhaps you are making assumptions on individual situations you shouldn't be.

Best think is to drink a shot and hit the buy button and hope American ingenuity can navigate this mess.

What’s funny is MASSIVE or TREMENDOUS government spending and a world war fixed thatWhat amazes me more than anything is that despite the insanely stupid economic policies of this administration, that have the real possibility of destroying US dominance and ushering in an economic downturn the likes of which no one alive has experienced, some people are still blindly drinking the Trump Kool Aid…

People forget that the market crash of 1929 didn’t recover until 1954 and that what’s happening today has stark similarities to that period.