I am far far from a savvy investor but if I were at your stage of life, seeing the volatility and the high interest rates, I’d probably do the same you are.I was same when working. Always maxed out workplace plan options. Am retired now so in the drawdown phase, in theory. Worth more now than day retired last spring. Heavy in cash starting as January ended when “tariffs” became focus word of the week. 6% gain over the past 5 weeks by being in 4.2% money market. Will take a while for the growing inflation to work its way out of impacting corporate bottom lines, constricting household budgets and the volatility of the stock market. P/E ratios hate inflation and recession. We may see both. No crystal ball. Timing market pullbacks is rarely a winning strategy. We will see. I may be cash into autumn.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

noharleyyet

Well-known member

Just curious SAJ, do you don an asbestos hat when you're speaking to clients?He is doing a great of job of getting China to stimulate domestic consumption, Germany to start investing in manufacture of weapons, and everyone else to question the reliability of using the dollar as a reserve currency. On the positive side, it appears Elon has shared his Ketamine and other drugs with the rest of the administration as they are imagining everything is going perfectly fine.

406dn

Well-known member

- Joined

- Dec 12, 2019

- Messages

- 2,412

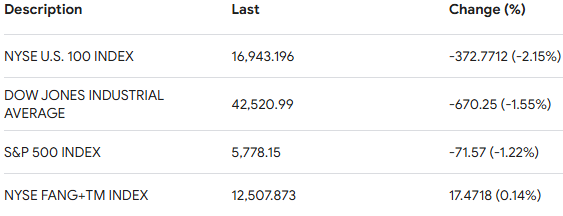

Just think if there was a market to day trade tariff policy. The volatility is wild.

It is impossible to know how this all shakes out. It doesn't seem to me that all of the governmental spasms, makes business leaders feel at ease.

Since retirement, i've been pretty heavily invested in the market. It has been a nice run, these last 12 years. My nest egg has grown significantly, even with the withdrawals to fund our retirement. If the $hit hits the fan hard enough to cause a need to look for work, this old man would be competing with a lot of younger people, I suspect.

It is impossible to know how this all shakes out. It doesn't seem to me that all of the governmental spasms, makes business leaders feel at ease.

Since retirement, i've been pretty heavily invested in the market. It has been a nice run, these last 12 years. My nest egg has grown significantly, even with the withdrawals to fund our retirement. If the $hit hits the fan hard enough to cause a need to look for work, this old man would be competing with a lot of younger people, I suspect.

SAJ-99

Well-known member

Nope. Advice for the last few months has been buy the election, sell the inauguration- starting to look at a change. Maybe trade the volatility for a while. Need to see an acknowledgment they are killing market confidence.Just curious SAJ, do you don an asbestos hat when you're speaking to clients?

All for "reciprocal tariffs".

Not an instant flip. Anyone who believes such - well, cheers to ya! Trade wars always hold a timed economic loss for the greater future. Better than boots on the ground "economic" wars for minerals...

Work the market, collect on the low to build. Market will continue to rise when viewed for the long. For the short duration? Volatility is king! The short-mid term? Those (such as myself), that holds interesting strategy... how to best plan for retirement if intended within the next 3-4 years. IMO, I believe 3-4 years is ideal for economic trade wars to play out and the markets gain. A great time to trickle in the buying power over the drop.

Not an instant flip. Anyone who believes such - well, cheers to ya! Trade wars always hold a timed economic loss for the greater future. Better than boots on the ground "economic" wars for minerals...

Work the market, collect on the low to build. Market will continue to rise when viewed for the long. For the short duration? Volatility is king! The short-mid term? Those (such as myself), that holds interesting strategy... how to best plan for retirement if intended within the next 3-4 years. IMO, I believe 3-4 years is ideal for economic trade wars to play out and the markets gain. A great time to trickle in the buying power over the drop.

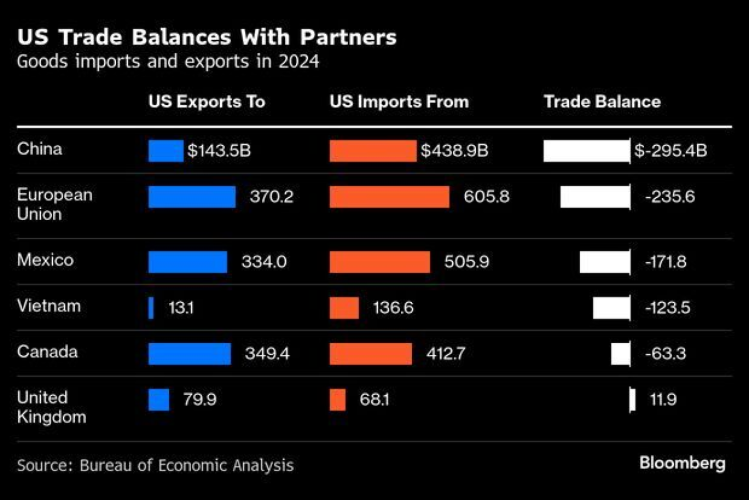

Attachments

stealthy_bowman

Well-known member

Historically trade wars have not been beneficial, quite the contrary actually. The Smoot-Hadley Tariff Act is widely credited for exacerbating the Great Depression. Look it up, the similarities are astounding.All for "reciprocal tariffs".

Not an instant flip. Anyone who believes such - well, cheers to ya! Trade wars always hold a timed economic loss for the greater future. Better than boots on the ground "economic" wars for minerals...

Work the market, collect on the low to build. Market will continue to rise when viewed for the long. For the short duration? Volatility is king! The short-mid term? Those (such as myself), that holds interesting strategy... how to best plan for retirement if intended within the next 3-4 years. IMO, I believe 3-4 years is ideal for economic trade wars to play out and the markets gain. A great time to trickle in the buying power over the drop.

I guess these idiots running the country now don’t read their history books. Btw, it took the stock market 25 years to recover its losses from that epic disaster.

Wildabeest

Well-known member

I guess when Trump crashes the stock market, we spin it as “a buying opportunity”.

LopeHunter

Well-known member

Inflation rate (12 months ending January 2025): 3.0%

Unemployment rate (January 2025): 4.0%

BND price: $73.08

Unemployment rate (January 2025): 4.0%

BND price: $73.08

Similar threads

- Replies

- 9

- Views

- 520