SAJ-99

Well-known member

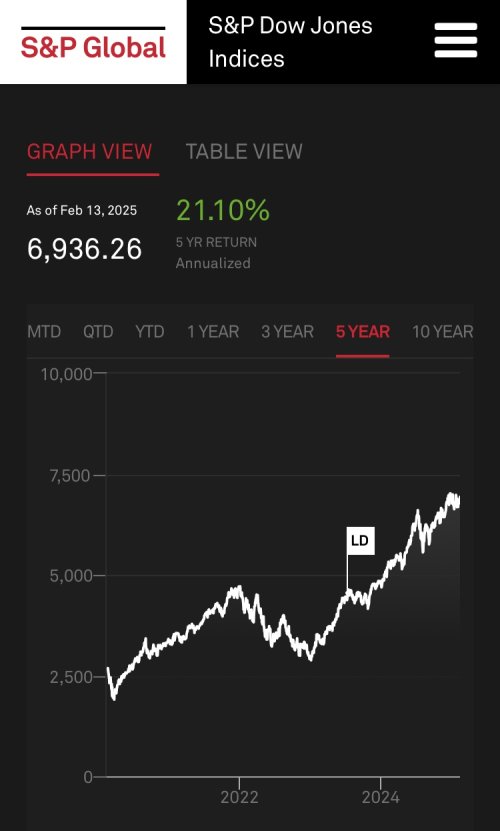

No interested in owning at this valuation. It seemed to get a bump on tariffs, which would hit car manufacturers more than the used cars. You are looking to buy puts, but they are horribly expensive. If I was forced into it, I would probably spread at 260-230. It is pricing in a 7% move. Cost is about $11.Anybody have thoughts on Carvana? I'm considering some put options. Seems like they're riding the highs from covid? I'm assuming they're having some serious headwinds with new car production picking up and used car prices coming down. I recently saw that vroom is planning to end it's used car ecommerce side of the business.

View attachment 359810