Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

antelopedundee

Well-known member

How does a stock like AuroZone AZO market cap 44 billion get to 2500 while something like Apple market cap 2.6 trillion sort of languishes between 140 and 170? I own and have owned AAPL over the years. Seems to me that they are lacking a blockbuster product in the pipeline unless some sort of EV is expected to be that product.

SAJ-99

Well-known member

But this time is it in bold font.OilPrices.com also claimed $200 oil last year... and the year before... grain of salt buddy.

SAJ-99

Well-known member

Stock split.How does a stock like AuroZone AZO market cap 44 billion get to 2500 while something like Apple market cap 2.6 trillion sort of languishes between 140 and 170? I own and have owned AAPL over the years. Seems to me that they are lacking a blockbuster product in the pipeline unless some sort of EV is expected to be that product.

Chance of a blockbuster product is pretty slim, for Apple or any company. Apple is practically a utility now. It is a cash printing machine. I think it makes more money that all the other Russell 2000 small cap stocks combined. It’s going to trade on macro view of global growth and consumer sentiment.

Last edited:

BigHornRam

Well-known member

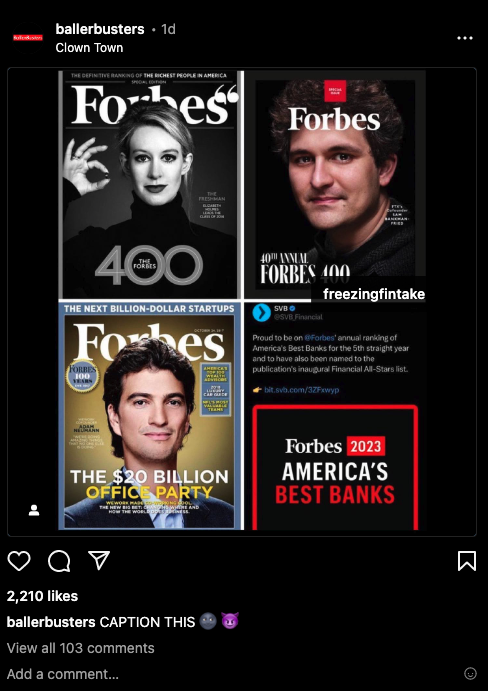

The BigHornRam investment news letter stock tip of the day.

Investment strategies dependent on the spending whims of van life hippy chicks is risky at best.

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Made over 100% in 2 years in Energy !OilPrices.com also claimed $200 oil last year... and the year before... grain of salt buddy.

I am happy !

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

They are different typesThe 52 week range has been 124-180. I'd rather buy at 160 and sell at 175 for a $15 profit then to have bought at $180. People trade it every day so some are buying well and some maybe not so well. I thought that the first rule of investing is that you can't go wrong by taking a profit.

Day traders or weekly traders

Then their is Investors that horizon is much longer 1 year to 20 years .

I most often fall into the second .

I tend to add to my portfolio in times of weakness. I cannot say when I will exit the market the market will tell me when.

I watch the political scene and their policies.

Like most over the years the SP 500 in SPY has been my choice. But not today.

With this administration in place Energy in XLE and VDE has been my choice for 2 Years.

Jamen

Well-known member

Saw a tik tok video last Friday claiming Pelosi put almost everything she had into PYXS. No actual proof of that from what i found. Video gained a lot of hype. Others made videos like that. And now today its almost 3x what it was Friday. Just shows the power of social media has out their on people. I believe its a pump and dump and these people try to gain the hype and get people to believe their story.

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Yes be careful what you here on Media !Saw a tik tok video last Friday claiming Pelosi put almost everything she had into PYXS. No actual proof of that from what i found. Video gained a lot of hype. Others made videos like that. And now today its almost 3x what it was Friday. Just shows the power of social media has out their on people. I believe its a pump and dump and these people try to gain the hype and get people to believe their story.

Those politicians have insights and connections in corporations contracts that we only learn about much later. Insider trading .

Jamen

Well-known member

I agree, there was no actual proof she had bought any of it. But the video gained a lot of hype and people bought into that and now its almost 3x in 3 days.Yes be careful what you here on Media !

Those politicians have insights and connections in corporations contracts that we only learn about much later. Insider trading .

SAJ-99

Well-known member

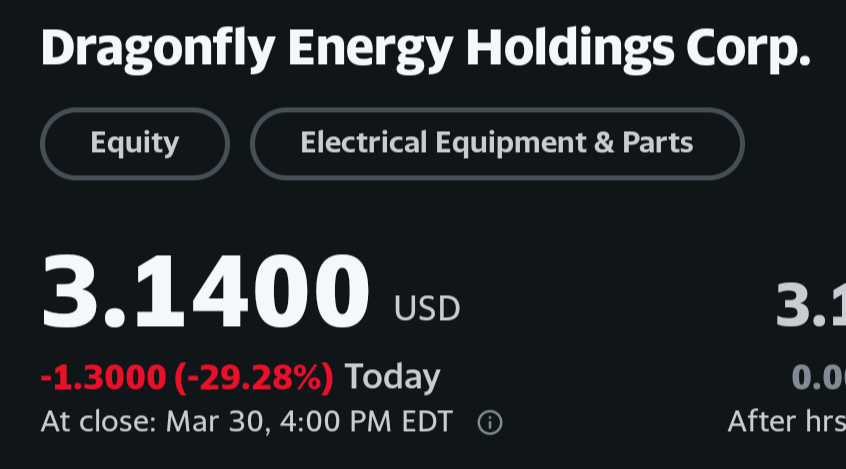

At this point, it's a bet on them signing a deal with utilities/municipalities/telecom that want large amounts of grid storage. Too much of the business is still OEM, and that market is going to get (getting) crushed at these interest rates. DTC isn't going to cut it.The BigHornRam investment news letter stock tip of the day.

Investment strategies dependent on the spending whims of van life hippy chicks is risky at best.

They heard you... Haha!DFLI earnings day,

General summary = Not great

- Net Sales of $86.3 million were 10.6% higher compared to $78.0 million in 2021

- Gross Profit of $24.0 million was lower compared to $29.6 million in 2021

- Operating expenses of $(37.5) million, increased compared to $(23.2) million in 2021

- EBITDA for the full year 2022 was a negative $(12.6) million, compared to $7.1 million in 2021

- Adjusted EBITDA for the full year 2022 was a negative $(7.9) million, compared to $8.5 million in 2021

- Cash was $17.8 million, and debt was $76.2 million on December 31, 2022

SAJ-99

Well-known member

Unfortunately, I listened to the conference call and that was 40 minutes of my life I will never get back.

It's my SENS.

Red-Team 98

Active member

- Joined

- Dec 18, 2022

- Messages

- 306

Added to XLE today …….

noharleyyet

Well-known member

When & if I get back to snorkel depth I’m going low and slow cash…and I mean it this time.

BigHornRam

Well-known member

Any knowledge of this vineyard @jryoung ?

www.benzinga.com

www.benzinga.com

AcreTrader: Templeton Preserve Vineyard

Real estate investment platform AcreTrader launched an offering for a wine grape vineyard in Templeton, California.

jryoung

Well-known member

Not really, most of the wines I've had/collect are west of town in Adelaida and Willow Creek districts.

Paso has changed so much year to year even, when Justin Smith/Saxum scored Wine of the Year from Wine Spectator AND a perfect score from Parker with his 2007 James Berry Vineyard blend (which I was able to flip for a 350% gain overnight....wish I could pick stocks like that).

I've not looked too much into acre trader, but like anything in CA, especially central valley-ish type agriculture water would be a concern rate limiting step. The statement below would give me pause making sure they can build it, and will have water rights/budget to fill it.

"The redevelopment plan includes the construction of a reservoir with the capacity to store over 2 million gallons of water."

Paso has changed so much year to year even, when Justin Smith/Saxum scored Wine of the Year from Wine Spectator AND a perfect score from Parker with his 2007 James Berry Vineyard blend (which I was able to flip for a 350% gain overnight....wish I could pick stocks like that).

I've not looked too much into acre trader, but like anything in CA, especially central valley-ish type agriculture water would be a concern rate limiting step. The statement below would give me pause making sure they can build it, and will have water rights/budget to fill it.

"The redevelopment plan includes the construction of a reservoir with the capacity to store over 2 million gallons of water."

Last edited:

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 13

- Views

- 712

- Replies

- 22

- Views

- 2K

Latest posts

-

-

Help Me Legalize Semiauto Rifle Big Game Hunting In Pennsylvania

- Latest: Pucky Freak

-

-

-