more_cowbell

Well-known member

- Joined

- Feb 26, 2023

- Messages

- 957

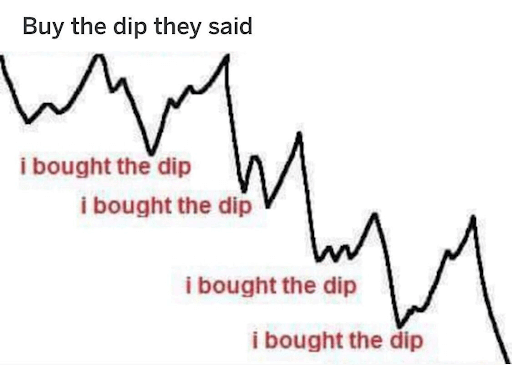

Good question I think that's what Fed is trying to figure out. Not in an enviable position at this point. Other than employment, however, home prices many places are coming back down, as are car prices, and thought I read that orders or purchasers of other durable goods is declining (because over the past 3 years everyone bought all new stuff at Home Depot). Household CC debt is rising, and interesting to see more "newer" used vehicles on car lots. Not sure if that means people are turning the keys back over to the bank on their 2021 4Runner TRD Pro or not.So is there a scenario where unemployment stays super low near current levels and inflation comes down? That’s probably what the best case scenario would be but is that even possible?