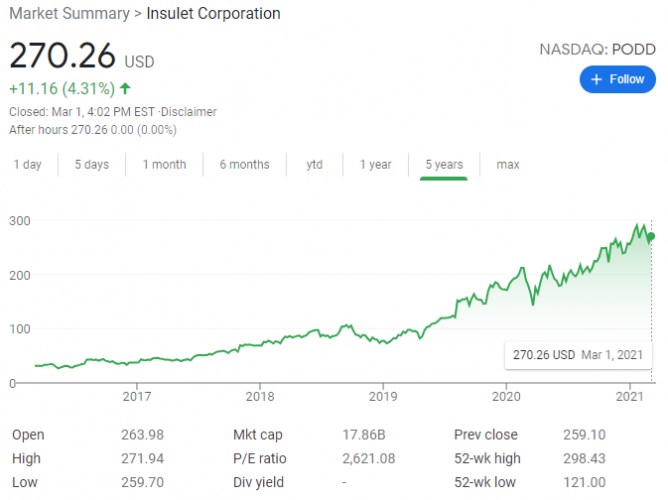

PODD ($270) (Omnipod - mentioned w/in @SAJ-99 's post (see start to current below)) is another monster success story that began around 2016 and will continue to evolve as DXCM, ABT, and SENS proceed. I don't believe PODD really competes against any of the three. Each has the ability to work with PODD. They're separate components. DXCM, SENS, ABT monitors, PODD is one version of the various insulin pump companies. Could be a game changer for one if a merger/buyout occurs...

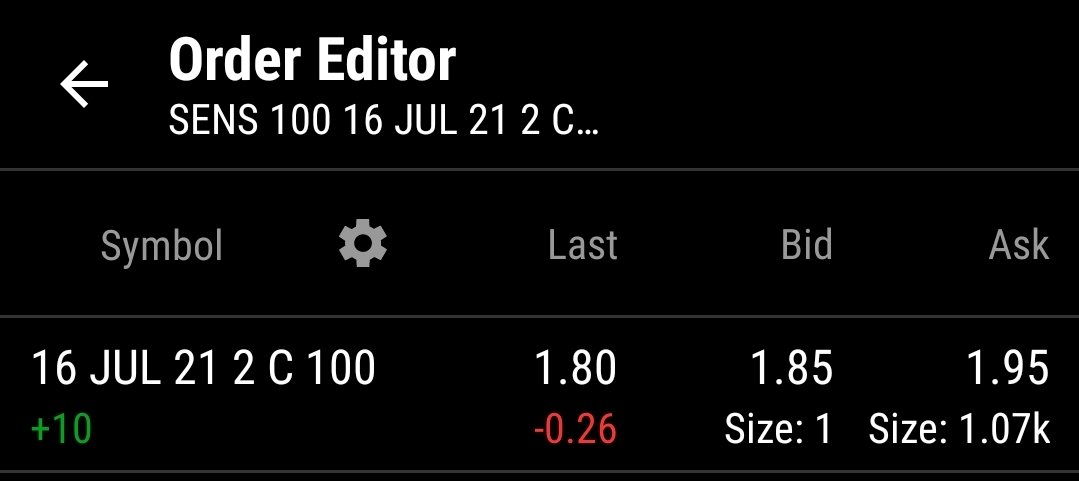

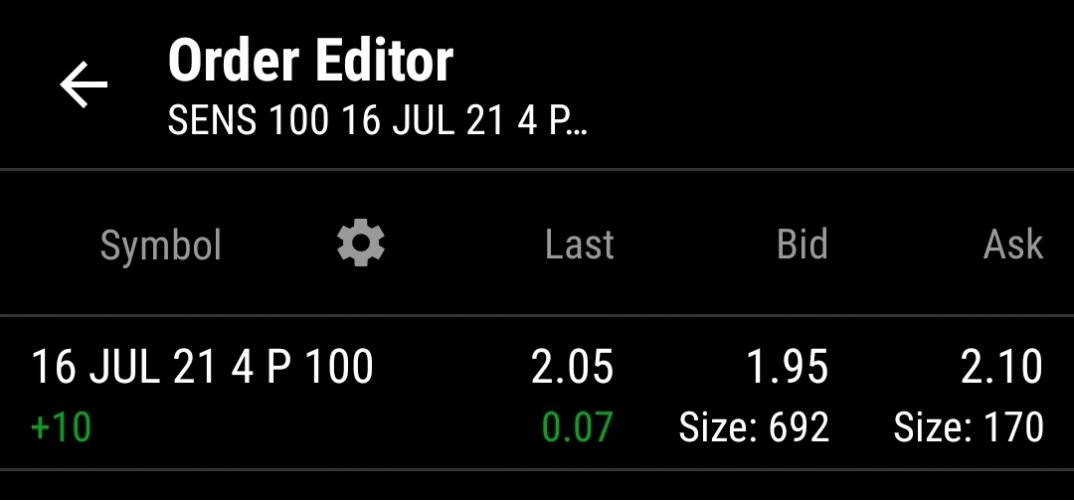

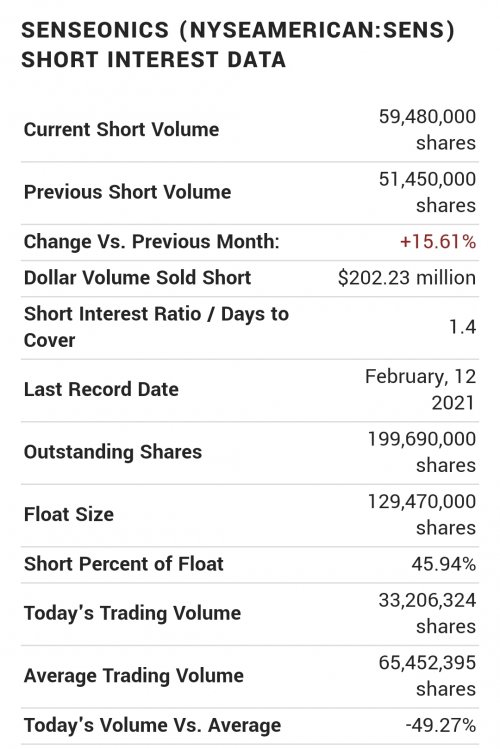

One aspect I like - SENS holds Patents over a large swath of the implantable cgm/fgm devices. Buyout opportunists by DXCM or ABT if SENS FDA approval succeeds for the 180 day implants, from U.S. current 90 day. Note: EU has already green lighted SENS 180. Supposed FDA reject/accept stamp is projected for first half of this year. 2024 is their investor (new car smell) projection ofr a 365 day implant.

I believe SENS largest hurdle is convincing Insurance to carry their product. The FDA pending approval of the 180 day implant is supposedly that mark for expense compared to required patient replacement each 9 days of DXCM prescriptions. 18 CGM and transmitters vs one outpatient CGM implant / transmitter.

You and my wife know the leaps DXCM (Dexcom) / ABT (Libre) have taken diabetic research... the continuous glucose monitoring at the patient and professional level has to be a leading breakthrough for diabetes research.

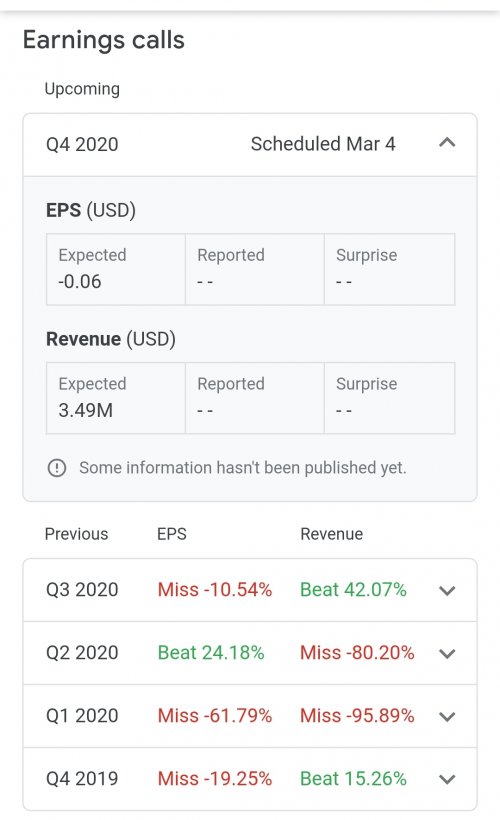

PODD:

BTW @neffa3 did you hear... Elon is postulating IPO of SpaceX/Starlink. Probably not any time soon and likely chest tight for those available to participate... Though Elon is unmasking his next muahaha! public opportunity.

Probably not any time soon and likely chest tight for those available to participate... Though Elon is unmasking his next muahaha! public opportunity.

www.fool.com

www.fool.com

One aspect I like - SENS holds Patents over a large swath of the implantable cgm/fgm devices. Buyout opportunists by DXCM or ABT if SENS FDA approval succeeds for the 180 day implants, from U.S. current 90 day. Note: EU has already green lighted SENS 180. Supposed FDA reject/accept stamp is projected for first half of this year. 2024 is their investor (new car smell) projection ofr a 365 day implant.

I believe SENS largest hurdle is convincing Insurance to carry their product. The FDA pending approval of the 180 day implant is supposedly that mark for expense compared to required patient replacement each 9 days of DXCM prescriptions. 18 CGM and transmitters vs one outpatient CGM implant / transmitter.

You and my wife know the leaps DXCM (Dexcom) / ABT (Libre) have taken diabetic research... the continuous glucose monitoring at the patient and professional level has to be a leading breakthrough for diabetes research.

PODD:

BTW @neffa3 did you hear... Elon is postulating IPO of SpaceX/Starlink.

Elon Musk Doubles Down on Promise to IPO Starlink | The Motley Fool

The Starlink IPO will arrive sooner than you think -- and cost more than you can imagine.