SAJ-99

Well-known member

There is your news https://www.senseonics.com/investor-relations/news-releases/2021/06-03-2021-210515226

What do you do now?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

There is your news https://www.senseonics.com/investor-relations/news-releases/2021/06-03-2021-210515226

Short it, it’s working out real well for AMC shorts this weekThere is your news https://www.senseonics.com/investor-relations/news-releases/2021/06-03-2021-210515226

What do you do now?

/#inittowinit!There is your news https://www.senseonics.com/investor-relations/news-releases/2021/06-03-2021-210515226

What do you do now?

Short it, it’s working out real well for AMC shorts this week

Yeah the hedgies are hurting bad the last 6 months and especially this week/#inittowinit!

/#Holdthehotpotato!

/#RidetheBullandrunthebear!

Yes, I saw the news... Heh, typical businesswire blabber. Usually movement of this sort for pharma catches people wondering wtf they missed and hop on the train... then - maybe we last through Friday - maybe not. If it does roll further, Monday premarket, players reap the gains... and it settles back down though, IMO, markedly higher than current value.

My bowling ball sez, "$2.5 will be the new standard" until... FDA supports SENS current statement. Timing wise, this could be the ride of green if FDA followed up a week or so from now. This primed the stock.

Meh, beats $1.80

If only the common folk had the platforms ability to fund shorts under $5 and since GME hedgers had their nuts squeezed, reservation for platforms has really placed their sack in ice water. Haha!

Puts are out of the question for the value, least IMO.

Hire a financial advisor. I know you commented "diy" though anyone willing to share advise for how to best spend your $ for your future is playing monopoly with another family's real $.We’re thinking of putting some money into something reliable for the long term,

Thanks. We’re considering it. I mostly would just like a starting place to learn the lingo and how markets work. Like a book or website. Appreciate the help.Hire a financial advisor. I know you commented "diy" though anyone willing to share advise for how to best spend your $ for your future is playing monopoly with another family's real $.

Here is a cheat. Pick the approximate year of your retirement (65ish)- let’s say 2050 (no clue but it doesn’t matter for my example). Go find a 2050 Target Date Fund (Blackrock, American Funds, Vanguard, or the like). Look up the fact sheet and find the % breakdowns of what it is invested in. By cheap etfs with the same exposure. If you want to cheat more, just use vanguard target date funds and buy the five funds they invest in. Those funds invest in vanguard etfs which are always low cost. Rinse and repeat every year to make sure you are close to the target %’s. that is all the financial advisor is going to do, just with fancier software, and for a fee of course.Thanks. We’re considering it. I mostly would just like a starting place to learn the lingo and how markets work. Like a book or website. Appreciate the help.

Thank you.Here is a cheat. Pick the approximate year of your retirement (65ish)- let’s say 2050 (no clue but it doesn’t matter for my example). Go find a 2050 Target Date Fund (Blackrock, American Funds, Vanguard, or the like). Look up the fact sheet and find the % breakdowns of what it is invested in. By cheap etfs with the same exposure. If you want to cheat more, just use vanguard target date funds and buy the five funds they invest in. Those funds invest in vanguard etfs which are always low cost. Rinse and repeat every year to make sure you are close to the target %’s. that is all the financial advisor is going to do, just with fancier software, and for a fee of course.

You could by the target date if you don’t care at all, but if you want to learn you need to spend a little time on it.

https://investor.vanguard.com/mutual-funds/profile/overview/vfifx

Thanks. We’re considering it. I mostly would just like a starting place to learn the lingo and how markets work. Like a book or website. Appreciate the help.

I know crypto seems stupid...and it mostly is...but I hold bitcoin and continue to. Still...a bit concerned about recent developments...

Yup. I don’t want to be one of those folks working well after 60. My wife and I have decided to hire a fiduciary. We’re shopping around for one now. Thanks @Sytes@rtraverdavis decent quick overview regarding age, planning, retirement, etc.

Jaw-Dropping Stats About the State of Retirement in America

Many Americans spend their lives working hard and dreaming of the day they can finally retire. But planning for retirement requires more than dreaming — it means being strategic and focused on...finance.yahoo.com

No big bang theory to retirement though interesting read for general overview.

SENS option Open interest jumped this week on call buying. The late day jumps are market maker delta hedging. I suspect someone (probably HEdgies) are scanning WSB and buying calls in names that have high activity in posts on the hopes of a meme run.See if this coming week results in SENS profit takers or a continued /Wallstreetbets meme push based on some good news though not FDA 180... yet.

It's given SENS a couple good pushes.

I'll take it. helps keep a nice squeeze for those shorts for their buy to cover.

Why Senseonics Holdings Popped by Nearly 11% Today | The Motley Fool

WallStreetBets strikes again!www.fool.com

Looks like the squeeze is attributing to covers. - Nice...

Senseonics Shorts Get Squeezed Again And Options Traders Bet Big - Senseonics Holdings (AMEX:SENS)

Senseonics Holdings (NYSE: SENS), a Maryland-based medical device startup, has been earmarked by Reddit traders and institutions alike for the large amount of short interest on its stock.www.benzinga.com

We'll see. It's fun to see green...not so with red.

No touch SENS still climbing:

View attachment 185614

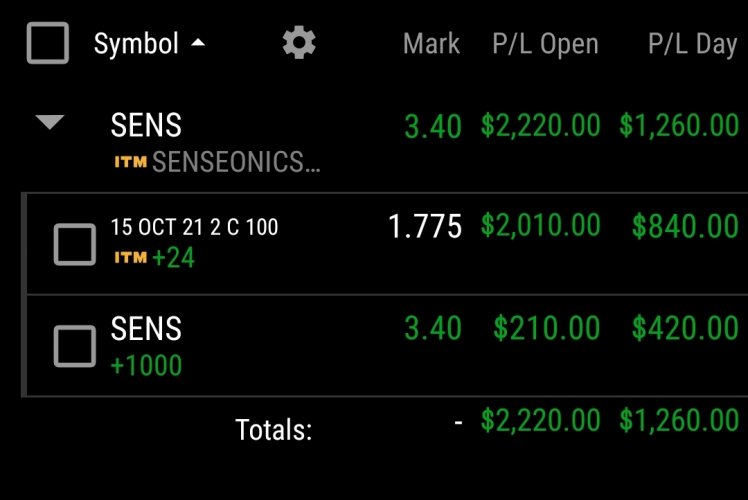

My hobby SENS shares:

View attachment 185615

Hobby options:

View attachment 185616

This company is a heck of a lot better than the B&M GME. I care not who wants to adopt gorillas... I want green.

However, had some info ride by my ears... AHT. Someone knows someone that knows someone who may or may not own the company they're Covid days are long over and $$$ is filling back in beyond expectations. Mega earnings to report. Looking back at its history... sure looks like a RIPE opportunity.