Irrelevant

Well-known member

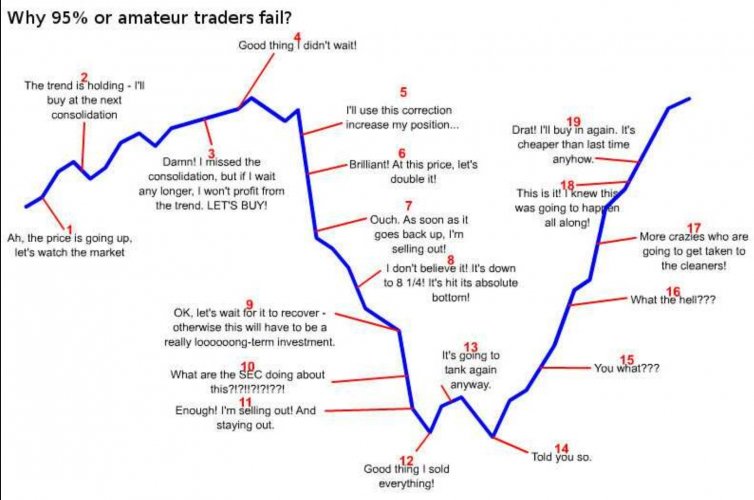

You mean like pharmaceuticals?Maybe. My main issue is that every time the subject of valuation comes up, someone says “what about Amazon”. Yeah it’s still around and still expensive. Do you want me to list 50 other companies that traded at similar valuations are are no longer alive? cherry picking is dangerous.

Funny thing with Amazon, they still sell most of retail stuff at a loss. AWS is what makes the profit. Profit breeds competition and they have a lot of it. Need to find another line of business or start increasing that Prime fee.