SAJ-99

Well-known member

Thanks. The numbers are hard to reconcile, but completely possible and scary.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Thanks. The numbers are hard to reconcile, but completely possible and scary.

Dude, stocks only go up! Look at everything going on currently in the US, it is a freaking crazy house with the patients running the asylum. The market totally ignores any bad news and rallies like crazy in the slightest hint of something positive. Short of a meteor impacting the earth or the fed turning off the money printer, I’d say skies the limit. Don’t worry about the disconnect between Well Street and Main Street. As long as the money printer go Brrrrrrrrrrr, Stonks go up.Mirrors my thoughts.

Huge Market Crash Coming? Warren Buffett and Other Experts Sound the Alarm

Warren Buffett and other billionaires are anticipating a repeat of the dot.com bubble burst. Instead of gambling and speculating, investors should park their money in defensive dividend-payers like the Fortis stock.The post Huge Market Crash Coming? Warren Buffett and Other Experts Sound the...ca.finance.yahoo.com

Reality has a way of biting people in the ass at the worst possible time. Not a matter of if but when.Dude, stocks only go up! Look at everything going on currently in the US, it is a freaking crazy house with the patients running the asylum. The market totally ignores any bad news and rallies like crazy in the slightest hint of something positive. Short of a meteor impacting the earth or the fed turning off the money printer, I’d say skies the limit. Don’t worry about the disconnect between Well Street and Main Street. As long as the money printer go Brrrrrrrrrrr, Stonks go up.

Just in case you don’t pick it up this post is half sarcasm , half reality.

You should kick that dude right in the junk.Seriously self, get your sh!t together and starting listening to me! WTF if wrong with you?!

View attachment 146725

Look at the loan loss provision. It is a good indication of a bank's view of the general economy and they have a direct view of it through loan payments. Q1 was $8.3B and estimate for Q2 is $8.1. JPM tends to be conservative (provision more than necessary), but if that number is higher, every bank is going to sell off. Given the increasing mortgage forbearance and non-payment of rent talked about earlier, I think the estimate is low, but just a guess. Whether I'm right or wrong, your question is probably where does the stock go. No clue. My dog's guess is as good as mine. That said, JPM under $90 is a buy.JPM thoughts for earnings?

Agree.That said, JPM under $90 is a buy.

Lower.Agree.

Meat and potato(e) though... let's not derail the objective. (Humor) What side of the Oreo does JPM land considering the market is not reflective of the real world. This is the known, Big bankers quarterly session for earnings. I have a feeling, if anything hits a bit more realistically for market relative to actual - this series of bank earnings reports will expose the weakness or the ideal steps out of this quagmire.

..still up nef...way upI finally saw some green out of Wells Fargo and jumped on it...

I hope the Tesla crash is epic, F those guys LOL

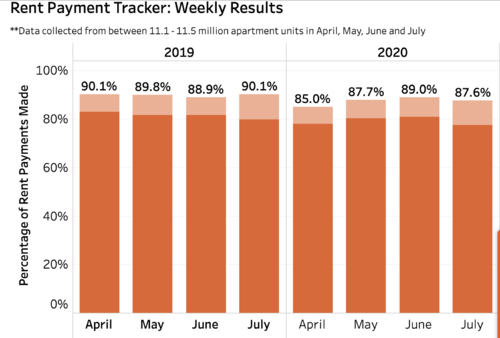

Another website tracking renter payments. Not as bad as the CNBC cited data- so why I am always skeptical. Data is all over the place in the RE market, earn - commercial, residential and multifamily.I still trying to wrap my head around the seriousness of the economy and these prices. For example, I heard today, for the 2nd straight month, about 33% didn't fully pay mortgage or rent last month. At some point something has to give. The S&P at all time high when many people thought it was over bought 12 months ago when the economy was at full speed.