Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

SAJ-99

Well-known member

SPX is sitting almost exactly at the 200day ma of 3990. 50day is 3911. A breakthrough would be very bullish technically. We will see how much resistance we see at this 200day level. Earnings will start rolling out soon and I can't image the 2023 outlook will be very optimistic. No upside to CEOs to overshoot on estimates. Main problem is around 4000, we are up 4% YTD and stuff starts to look a little expensive even if the current estimates of $225/sh are correct.

SPX is sitting almost exactly at the 200day ma of 3990. 50day is 3911. A breakthrough would be very bullish technically. We will see how much resistance we see at this 200day level. Earnings will start rolling out soon and I can't image the 2023 outlook will be very optimistic. No upside to CEOs to overshoot on estimates. Main problem is around 4000, we are up 4% YTD and stuff starts to look a little expensive even if the current estimates of $225/sh are correct.

TLDR: sell the rip?

SAJ-99

Well-known member

HODL!TLDR: sell the rip?

Seriously, if we can close two days above 200day, it should go higher. Fundamentals don’t justify, but they never really do.

Alabama

Active member

I know the markets are forward looking but what has caused such a strong rally the last few days? I just can't see corporate profits growing when the Fed rate is still sitting at 5% 6 months from now. Bear market rally?

SAJ-99

Well-known member

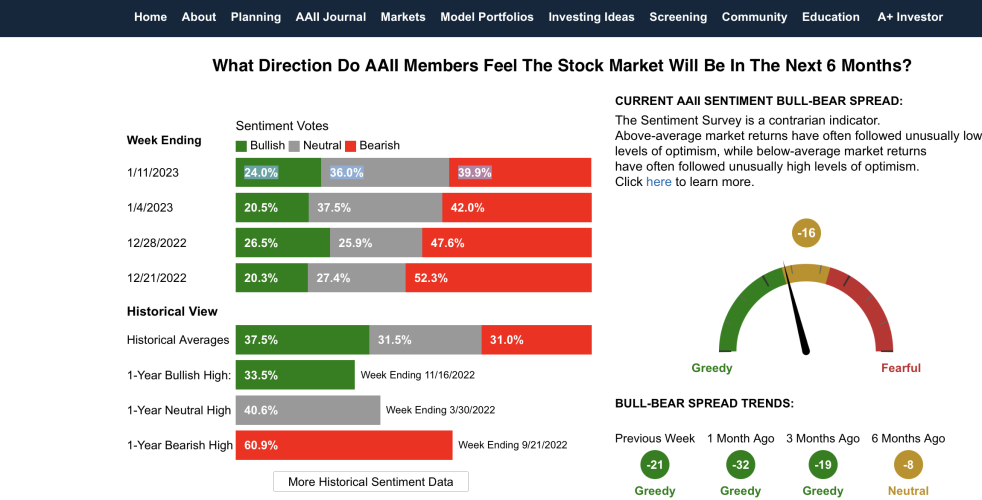

No clue. Maybe it is as simple as the AAII sentiment indicator? It it really hard to be bullish. Seems it's true that the market will do whatever hurts the most.I know the markets are forward looking but what has caused such a strong rally the last few days? I just can't see corporate profits growing when the Fed rate is still sitting at 5% 6 months from now. Bear market rally?

It sounds like the day to day movements are largely driven by algorithmic traders. 60-70% of daily trading is supposedly done by algos.I know the markets are forward looking but what has caused such a strong rally the last few days? I just can't see corporate profits growing when the Fed rate is still sitting at 5% 6 months from now. Bear market rally?

BigHornRam

Well-known member

That isn't an argument for anything. And all charts look like that. Higher debt service will constrain growth. Lower growth limits interest rates. It is a feedback loop. All of economics and markets are a confidence game. I see no cracks in the global confidence in the US ($ or debt), so the game continues.

View attachment 259925

The dollar's worst tumble in 12 years could be just the beginning — and the Fed ending rate hikes will fuel 'ongoing weakness', a UBS strategist says

The dollar's recent slump looks set to continue through 2023, UBS Global Wealth Management's Dominic Schnider said Friday.

SAJ-99

Well-known member

That’s a good thing, not a bad one. It’s working off froth from the sharp rise in US rates. UK, EU and Japan will raise rates until we get back to some semblance of normal. Practically Goldilocks.

The dollar's worst tumble in 12 years could be just the beginning — and the Fed ending rate hikes will fuel 'ongoing weakness', a UBS strategist says

The dollar's recent slump looks set to continue through 2023, UBS Global Wealth Management's Dominic Schnider said Friday.markets.businessinsider.com

BigHornRam

Well-known member

Good if you are an exporter. Bad if you like fancy French wine. Good or bad, it is a crack in the dollar that you didn't see till now.That’s a good thing, not a bad one. It’s working off froth from the sharp rise in US rates. UK, EU and Japan will raise rates until we get back to some semblance of normal. Practically Goldilocks.

View attachment 260671

SAJ-99

Well-known member

The problem was the dollar at 114, not 102 or even 98. Stability would be ideal, but nothing has been stable the last year.Good if you are an exporter. Bad if you like fancy French wine. Good or bad, it is a crack in the dollar that you didn't see till now.

noharleyyet

Well-known member

KB_

Well-known member

crypto has been doing weird stuff the last few days. Some stuff going around on the webs about crypto going to zero. Kinda funny watching people say what the crypto market is going to do. Nobody has a freakin clue lol

SAJ-99

Well-known member

Yeah. Super weird. It has been going up.crypto has been doing weird stuff the last few days.

KB_

Well-known member

I'm not complaining lol. I just find it entertaining that nobody has a clue what crypto is going to do.Yeah. Super weird. It has been going up.

SAJ-99

Well-known member

Crypto survives 2023 and it will be a legit asset. It certainly needs to clean out the dirty laundry.I'm not complaining lol. I just find it entertaining that nobody has a clue what crypto is going to do.

KB_

Well-known member

Agreed, Its worth it to have some in the background if you can afford to spend. I've been increasing my holdings during this "Sale" but money I would otherwise spend on things that dont really matter. I'm wasting that money anyway so its like putting it into a lottery ticket. If it works out, great. If not, oh well.Crypto survives 2023 and it will be a legit asset. It certainly needs to clean out the dirty laundry.

Certainly dont throw money at scam coins but there is at least 10 that have some integration into society in some kind of way that I think are worth having some kind of holding.

SAJ-99

Well-known member

Too many, unless you can prove a separate use case. People can't just be allowed to create a new crypto whenever they want. That is how they got into this mess.at least 10

Similar threads

- Replies

- 29

- Views

- 1K

- Replies

- 43

- Views

- 3K

- Replies

- 13

- Views

- 700

- Replies

- 22

- Views

- 2K

Latest posts

-

-

-

Help Me Legalize Semiauto Rifle Big Game Hunting In Pennsylvania

- Latest: Rack Daniels

-

Turkey DNA initiative started, requesting hunter harvested samples

- Latest: Rack Daniels