BigHornRam

Well-known member

I can already see it's going to be a rough 2 years for you @wllm .Off to a stupid start... I do declare I'm shocked, shocked

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I can already see it's going to be a rough 2 years for you @wllm .Off to a stupid start... I do declare I'm shocked, shocked

Hey folks can polish turds, I'm just saying it's a turd.I can already see it's going to be a rough 2 years for you @wllm .

When Joe vetoes the bill and you get audited next year........don't cry to me about it.Hey folks can polish turds, I'm just saying it's a turd.

I’m with Schwab. I note that Schwab and TD Ameritrade are merging, so will be the same. You said you were buying Foreign stocks? Can you elaborate? It may change my answer. Foreign ADRs can be bought in all the mentioned platforms, but foreign stocks in other non-usd currencies, you will need to go up a notch in service level.I'm gonna derail the conversation for a bit... I am ready to begin buying individual stocks (particularly foreign stocks), but I am not sure which trading platforms are best. My Dad uses Ameritrade, my brother uses Robinhood. Thoughts and comments from the Hunttalk Community? These trading platforms seem to be very similar to each other, to me.

I take one for the team in exchange for reasonable enforcement, my game is tight wouldn't be a problem.When Joe vetoes the bill and you get audited next year........don't cry to me about it.

But maybe it helps out with that debt problems you said you were going to worry about all year?When Joe vetoes the bill and you get audited next year........don't cry to me about it.

We don't want taxes, but also we want to spend a bunch of moneyBut maybe it helps out with that debt problems you said you were going to worry about all year?

Cognitive dissonance on full display.

By spending 70 billion dollars to shake down you and wllm? I'm thinking that will fail miserably.But maybe it helps out with that debt problems you said you were going to worry about all year?

Cognitive dissonance on full display.

I'm an advocate for adulting.But no one is advocating for adulting.

"I'm with Schwab." Boy, did that statement catch me by surprise!I’m with Schwab. I note that Schwab and TD Ameritrade are merging, so will be the same. You said you were buying Foreign stocks? Can you elaborate? It may change my answer. Foreign ADRs can be bought in all the mentioned platforms, but foreign stocks in other non-usd currencies, you will need to go up a notch in service level.

Reality is if you take the the standard deduction, don't file a schedule C, don't have foreign bank accounts, don't take massive losses you have nothing to worry about this covers 90% of Americans. Less than 1% of folks get audited and IMHO those that do typically should be audited.By spending 70 billion dollars to shake down you and wllm? I'm thinking that will fail miserably.

I had a concrete sub-contractor that did a lot of work for me way back. He wasn't great at numbers and made a few mistakes on his taxes. One Friday he took a check from me for the latest job to the bank to deposit it. It was also payday for his crew. He came back a little later saying the IRS siezed his bank accounts. The teller told him to make sure his crew came in immediately to cash their checks before his account was locked. Nice of her to tell him that....probably could have got her fired.Reality is if you take the the standard deduction, don't file a schedule C, don't have foreign bank accounts, don't take massive losses you have nothing to worry about.

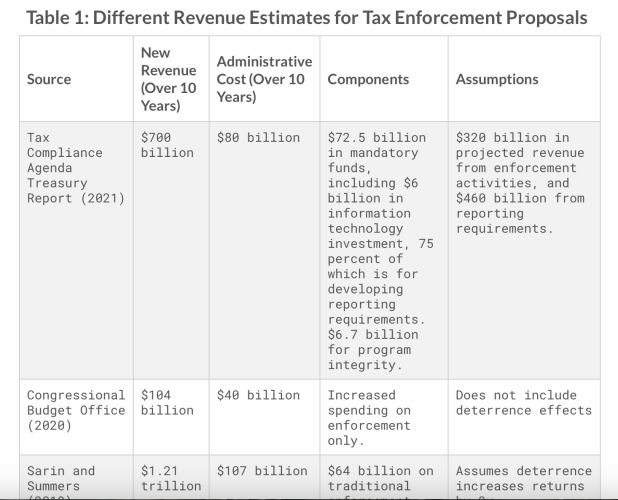

@BigHornRam did you read this? I will reiterate @noharleyyet suggestion. It is always better to be informed.Worthwhile speedread if your are interested...

Simplifying the Tax Code and Reducing the Tax Gap: What Can Be Achieved?

Reducing the tax gap is, on the margin, a good way to raise revenue, but is not without costs. Policymakers should consider compliance costs for law-abiding taxpayers as well as administrative costs for the IRS when evaluating measures to reduce the tax gap.taxfoundation.org

Yeah. Obviously.He wasn't great at numbers and made a few mistakes on his taxes.

Do your homework. Sounds way too risky of investments for me. Agree with your thinking about the US markets but what you are suggesting sounds like falling out of the frying pan and into the fire to me. Good luck!"I'm with Schwab." Boy, did that statement catch me by surprise!I have never invested in individual stocks before, but I've been studying to begin investing (I am an intelligence analyst by trade). I know that I'm only a "rookie", but I have still noticed some trends in the market that indicate that US stocks have further to slide, before they begin to recover. Every time that the FED has "pivoted" on the FED rates since the late 1960s, the stock market has actually declined for several more months- so, I know that whether the FED raises rates or pivots, we are likely to see US stocks slide some more. This, along with mass layoffs, historic yield curve inversions, recent congressional actions, ect... have all combined to convince me to hold off buying US stocks for the time being, so I am looking at getting started in foreign stocks first- the BRICS countries and some African countries that are suppliers for 1st world countries are particularly interesting to me. Does this answer your question?

Kinda reminds we of the guy who says “I got arrested by the game warden for not having a blaze hat on”…I had a concrete sub-contractor that did a lot of work for me way back. He wasn't great at numbers and made a few mistakes on his taxes. One Friday he took a check from me for the latest job to the bank to deposit it. It was also payday for his crew. He came back a little later saying the IRS siezed his bank accounts. The teller told him to make sure his crew came in immediately to cash their checks before his account was locked. Nice of her to tell him that....probably could have got her fired.

$5,000 tax mistake was blown up to $100,000 with fines and penalties. It ended getting resolved for a lot less, but the IRS doesn't screw around when they go after you.

I've hired good accountants over the business years and have been fortunate to have never been audited.....yet.

"I'm with Schwab." Boy, did that statement catch me by surprise!I have never invested in individual stocks before, but I've been studying to begin investing (I am an intelligence analyst by trade). I know that I'm only a "rookie", but I have still noticed some trends in the market that indicate that US stocks have further to slide, before they begin to recover. Every time that the FED has "pivoted" on the FED rates since the late 1960s, the stock market has actually declined for several more months- so, I know that whether the FED raises rates or pivots, we are likely to see US stocks slide some more. This, along with mass layoffs, historic yield curve inversions, recent congressional actions, ect... have all combined to convince me to hold off buying US stocks for the time being, so I am looking at getting started in foreign stocks first- the BRICS countries and some African countries that are suppliers for 1st world countries are particularly interesting to me. Does this answer your question?

He was an ex college football player, and a concrete donk. What did you expect.Yeah. Obviously.

Did you read this about the bill?@BigHornRam did you read this? I will reiterate @noharleyyet suggestion. It is always better to be informed.

Lower income people are already “audited” at a higher rate, BECAUSE IT’S EASIER! You need skilled, trained people to audit a tax return prepared by a team of CPAs. And a computer system a little better than the circa 1983 mainframe the IRS is using now. It’s takes nothing to audit the income of a W2 wage earner. Proper staffing would actually fix that and be revenue positive. I’m with @wllm in that what needs to be fixed is all the deductions. But that isn’t going to happen…ever.

The Tax Foundation disagrees. As does the CBO and anyone else that analyzed the bill. But I'm sure you know better, because they told you on TV.Did you read this about the bill?

"The legislation will roll back the billions of dollars of funding for the IRS approved in the Inflation Reduction Act last year but leaves in place funding for customer service and improvements to IT services.

The bill rescinds any funding that could be used to conduct new audits on Americans and funding that would double the agency's current size."

If you are naive enough to think the 70 billion will allow the IRS to hire qualified agents bright enough to squeeze more than 70 billion out of the Jeff Bezos types that already hire the best and brightest accountants, you are mistaken.

If they go after the crypto fraud and under the table drug dealers, good. Hire a few more agents, but 70 billion aditional funding is a farce.