SAJ-99

Well-known member

In theAll of Meta's new stuff is a failure...it has a lot further to fall

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

In theAll of Meta's new stuff is a failure...it has a lot further to fall

Montana fwp is knocking it out of the park on their deer management…on the metaverse. Thanks zuckIn thefuturepresent, the only way to hunt mature mule deer in Montana is using the VR headset. Opportunity...

Update from one week ago (S&P up a little less than 4% this week). Still not a lot of open interest in Nov options. Most positions seems to be in the Dec quarterly. Gains should harder from this level and the VIX at 26 doesn't make lot of sense given we have Nov 2 Fed, Nov 4 Jobs report, Nov 8 Election, and Nov 10 CPI. I have a trip to seek the last surviving mature mule deer in Montana in 10 days so I will miss some of the fun. Consequently, I'm taking a little exposure off here. I wouldn't be surprised about a continued run-up next week, but some of these will be sell-the-news events. Lately, every time the Fed talks the market sells off.People don't appear to be rolling to Nov monthly or Dec quarterly puts. We have more calls than puts in those. So the flow (Option market maker hedging) should be positive for the next few weeks (Until 31st maybe?). Lots of drivers that could change views the first week of November - Nov 2 Fed meeting, Nov 8 election day, Nov 10 CPI. VIX below 30 again. Lots of fun ahead.

My take is this is just another dead cat bounce or short term rally since I know you don’t like that term. I think the credit markets will lead this bear out of its cave. Good luck on your forkie expedition. Your going to need a lot of effort and some luck to pull it off. My investments always tank when I go on a hunt.Update from one week ago (S&P up a little less than 4% this week). Still not a lot of open interest in Nov options. Most positions seems to be in the Dec quarterly. Gains should harder from this level and the VIX at 26 doesn't make lot of sense given we have Nov 2 Fed, Nov 4 Jobs report, Nov 8 Election, and Nov 10 CPI. I have a trip to seek the last surviving mature mule deer in Montana in 10 days so I will miss some of the fun. Consequently, I'm taking a little exposure off here. I wouldn't be surprised about a continued run-up next week, but some of these will be sell-the-news events. Lately, every time the Fed talks the market sells off.

earth.org

earth.org

Yeah, for a stock that is down like 50%, the bar is set pretty low. Earnings have generally been ok. Interesting to see that they shot the generals this week and market still went higher. However, Forward estimates still look too high. General view seems to be we jump back to 8% earnings growth in 2023. That seems a bit aggressive. Investor sentiment seeing a push to neutral to positive, but I believe narrative follows price.Intel earnings was an enlightened boost of encouragement.

Seemed fine until the end, but it was a Fortune article sent through Yahoo. What did you expect. I think you just don't like the message.This God awful article came across my feed, so I thought it might be interesting to look up the authors background. No surprise when I did!

Exxon Mobil rides again as tech megacaps implode. Big Oil is going back to the future in the 2020s

Oil and gas companies have unseated tech as Wall Street’s stars. But will it last?finance.yahoo.com

Tristan Bove, Author at Earth.Org

earth.org

Comments after the article were accurate and entertaining as well.

The CLR take private is similarly interestingSeemed fine until the end, but it was a Fortune article sent through Yahoo. What did you expect. I think you just don't like the message.

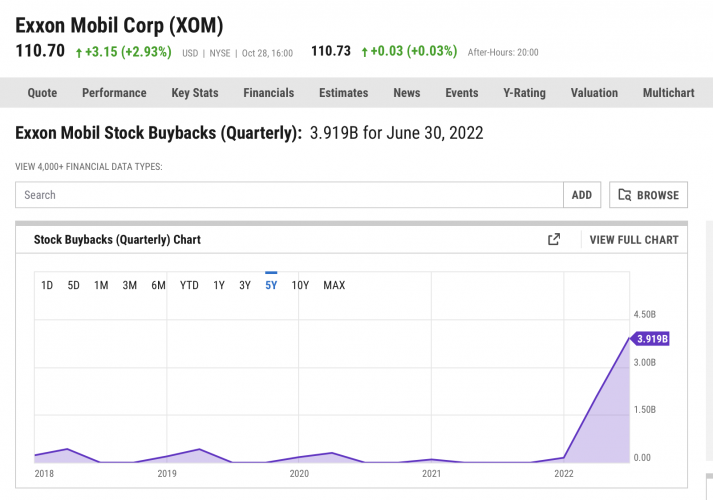

Interesting to see where those profits are going for some of the majors...

View attachment 247017

The message was a hoot! Did you read the comments? Exactly why investing in companies like XOM is only going get better in the years to come. Buying back stock is good for the investors. Those are the companies you want to invest in. Pissing their money away like META did is not a company you should invest in. It's not hard.Seemed fine until the end, but it was a Fortune article sent through Yahoo. What did you expect. I think you just don't like the message.

Interesting to see where those profits are going for some of the majors...

View attachment 247017

I didn't read the comments. I have learned to avoid that echo chamber dominated by who can "yell" the loudest. No honest objective analysis. Agree that as a stock holder you want buybacks. I also know it shows they can't invest in new projects with positive NPV. Maybe it's a labor issue, maybe the CEO just wants to boost the stock price so his options get in-the-money. Either way, we can't expect O&G to determine the future path of the worldwide energy infrastructure.The message was a hoot! Did you read the comments? Exactly why investing in companies like XOM is only going get better in the years to come. Buying back stock is good for the investors. Those are the companies you want to invest in. Pissing their money away like META did is not a company you should invest in. It's not hard.

Good luck with your forky quest. I'm heading out next week. I'll post a pic if I find a good one. They are around if you are willing to get out of the truck.

They are making money. Buying back stock with those massive profits and paving the way for more massive profits. Don't let your personal ideology get in the way making good investment choices. Your choice though.I didn't read the comments. I have learned to avoid that echo chamber dominated by who can "yell" the loudest. No honest objective analysis. Agree that as a stock holder you want buybacks. I also know it shows they can't invest in new projects with positive NPV. Maybe it's a labor issue, maybe the CEO just wants to boost the stock price so his options get in-the-money. Either way, we can't expect O&G to determine the future path of the worldwide energy infrastructure.

Wait, I will have to get out of the truck? Geez, Montana has really gone to sheet.

Hopefully you hunt better spots than I do. I have 22 days (21 days on archery elk to be accurate) in and over 200 miles on the boots I bet and I’m up to 37 deer including 2 small 3 points. Will put another 10 mile day in tomorrow in an area I’m sure has a good buck in if I’m good enough to find him before he finds me. October muleys is a fun challenge.Wait, I will have to get out of the truck? Geez, Montana has really gone to sheet.

Funny that you still think I have some ideology. I’m still overweight energy names, I just rarely bet on a single name. Lots of idiots in the energy industry (no offense @wllm). At some point you just bet on the price of the commodity. If I’m going to do that, I will just bet on the price of the commodity. I wish oil would stay between and 75 and 95 and these cos could print money. Problem for service cos is they are not growing so service cos don’t look as great. Market seems to price everything pretty fairly right now.They are making money. Buying back stock with those massive profits and paving the way for more massive profits. Don't let your personal ideology get in the way making good investment choices. Your choice though.

Exxon to invest $10 billion in massive Guyana offshore oil project

Exxon Mobil Corp on Monday decided to invest $10 billion in a fourth oil production project off the coast of Guyana, the largest in the South American country.www.reuters.com

Give you credit SAJ-99. You can shuck and jive with the best!Funny that you still think I have some ideology. I’m still overweight energy names, I just rarely bet on a single name. Lots of idiots in the energy industry (no offense @wllm). At some point you just bet on the price of the commodity. If I’m going to do that, I will just bet on the price of the commodity. I wish oil would stay between and 75 and 95 and these cos could print money. Problem for service cos is they are not growing so service cos don’t look as great. Market seems to price everything pretty fairly right now.

I like to keep you on your toes. Good luck on your hunt. If you see a Montana unicorn, shoot it.Give you credit SAJ-99. You can shuck and jive with the best!

Bro you have no idea… though it always cracks me up that stock price seems tied to the strip price, for a while it was exchange rate of the dollar. Folks have no idea how OG works.Funny that you still think I have some ideology. I’m still overweight energy names, I just rarely bet on a single name. Lots of idiots in the energy industry (no offense @wllm). At some point you just bet on the price of the commodity. If I’m going to do that, I will just bet on the price of the commodity. I wish oil would stay between and 75 and 95 and these cos could print money. Problem for service cos is they are not growing so service cos don’t look as great. Market seems to price everything pretty fairly right now.

Especially folks in Venezuela. The country with largest oil reserves on the planet went from the richest country in South America to one of the poorest countries on the planet in a little over a generation.Bro you have no idea… though it always cracks me up that stock price seems tied to the strip price, for a while it was exchange rate of the dollar. Folks have no idea how OG works.

I’ve worked several deals with CHK and a couple with APAEspecially folks in Venezuela. The country with largest oil reserves on the planet went from the richest country in South America to one of the poorest countries on the planet in a little over a generation.

Oil Companies Flee Venezuela, Leaving All Behind | OilPrice.com

In a move reminiscent of the Hugo Chavez years when Venezuela nationalized its oil industry, stripping by default many foreign oil companies of their assets, oil companies are once again preparing to abandon operations in the South American countryoilprice.com