ShootsManyBullets

Well-known member

All the areas where oil money was flowing into housing are going to get hit hard. I also think we'll see more growth of the medium sized markets with reliable internet grow as people get out of the big cities and work remotely. Already happening but it'll accelerate.

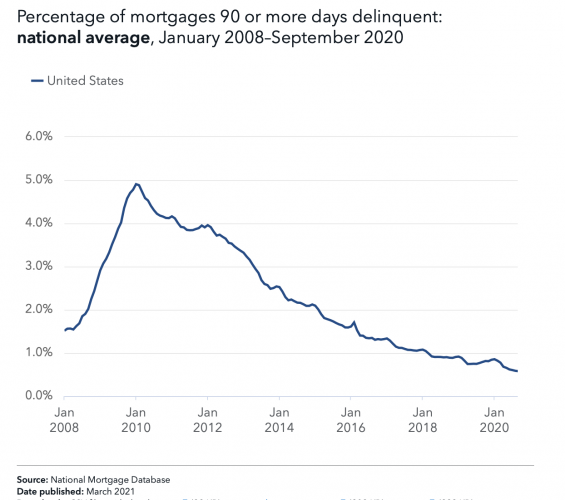

Expect the banks and servicers to try to keep prices up by limiting the supply of foreclosures even though there's going to be millions of zombie homes out there where the owners are hopelessly behind and unable to pay due to unemployment. Instead of letting the market clean itself out and have prices reset to where they should be, they'll keep the bubble inflated as much as they can. Same game the Fed plays with stocks and bonds.

Forbearance is no deal for the homeowners who are going to have to make the payments eventually plus they're going to be disqualified from all sorts of other credit. Anyone who needs help needs to get the terms in writing and not accept any kind of vague terms about what will happen in a few months. If you need longer term help, look at modifying as it should not hurt your credit or access to credit.

Expect the banks and servicers to try to keep prices up by limiting the supply of foreclosures even though there's going to be millions of zombie homes out there where the owners are hopelessly behind and unable to pay due to unemployment. Instead of letting the market clean itself out and have prices reset to where they should be, they'll keep the bubble inflated as much as they can. Same game the Fed plays with stocks and bonds.

Forbearance is no deal for the homeowners who are going to have to make the payments eventually plus they're going to be disqualified from all sorts of other credit. Anyone who needs help needs to get the terms in writing and not accept any kind of vague terms about what will happen in a few months. If you need longer term help, look at modifying as it should not hurt your credit or access to credit.