longbow51

Well-known member

- Joined

- Feb 17, 2023

- Messages

- 1,273

@ wllm When is NG going to go up? Pretty hot summer in some places. Too many rigs?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

When the rig counts in the Haynesville/Eagleford/Marcellus drop (a lot) is my guess, they ramped up hard and there is a ton of capacity coming out there right now.@ wllm When is NG going to go up? Pretty hot summer in some places. Too many rigs?

You can’t use a 6 month chart

Which one, his last, or next?You can’t use a 6 month chart

Move your chart to Biden’ Inauguration Day !

That’s when I went bullish on VDE and XLE.

XLE is about where it was in October 2018. You don't get to cherry-pick dates. You have been screaming buy at much higher levels than here.You can’t use a 6 month chart

That’s when I went in VDE and XLE just after Biden entered office all my dividends are reinvested. Recession has been pushed back to Fall.I have enjoyed selling puts on XLE on the declines. Much more reasonable to own in the 75-80 range than anything above that. Still waiting on the recession Red-Team. I guess you said it was supposed to start last week so we won't get to see any declaration until early 2024, but the real time data is still good.

XLE is about where it was in October 2018. You don't get to cherry-pick dates. You have been screaming buy at much higher levels than here.

I put it on the day you said buy VDE.You can’t use a 6 month chart

Move your chart to Biden’ Inauguration Day !

That’s when I went bullish on VDE and XLE….bet the farm ! When he closed the pipeline.

Not a great start for 2023 but was expected. I expect a good rebound for energy later this year into next. Especially if a change in Administration is Drill baby Drill is coming for 2025.

Currently suggest dollar cost average into VDE and XLE.

Chevron and Exxon CEO said late this fall into 2024 for rebound in Energy ……and China driving the demand not US. I expect hopefully that the Keystone pipeline construction will resume in 2025 with a new administration and the boarder wall completed and secured.

I'm sure you don't care, but I thought should share a little reality. Q2 earnings are coming up and these companies are going to have a difficult time with YOY comps. Q2 2022 average oil price was $110 and nat gas was $7ish (just eye-balled it). For 2023 we are setting at $75 and $2, respectively. Q3 will be an even harder comp. As the Q2 2022 numbers roll off, the PE will go up, making these companies look a lot less cheap than they seem now. Only positive is output is up over 10%, but still these numbers are not expected to be good. I might buy the dip, but I don't want to bet on the market's reaction to the numbers. I hope it works out for you.I am continuing to add to my position of XLE at every dividend date and very happy with returns and quarterly dividends .

So just gonna throw this out.You can’t use a 6 month chart

Move your chart to Biden’ Inauguration Day !

That’s when I went bullish on VDE and XLE….bet the farm ! When he closed the pipeline.

Not a great start for 2023 but was expected. I expect a good rebound for energy later this year into next. Especially if a change in Administration is Drill baby Drill is coming for 2025.

Currently suggest dollar cost average into VDE and XLE.

Chevron and Exxon CEO said late this fall into 2024 for rebound in Energy ……and China driving the demand not US. I expect hopefully that the Keystone pipeline construction will resume in 2025 with a new administration and the boarder wall completed and secured.

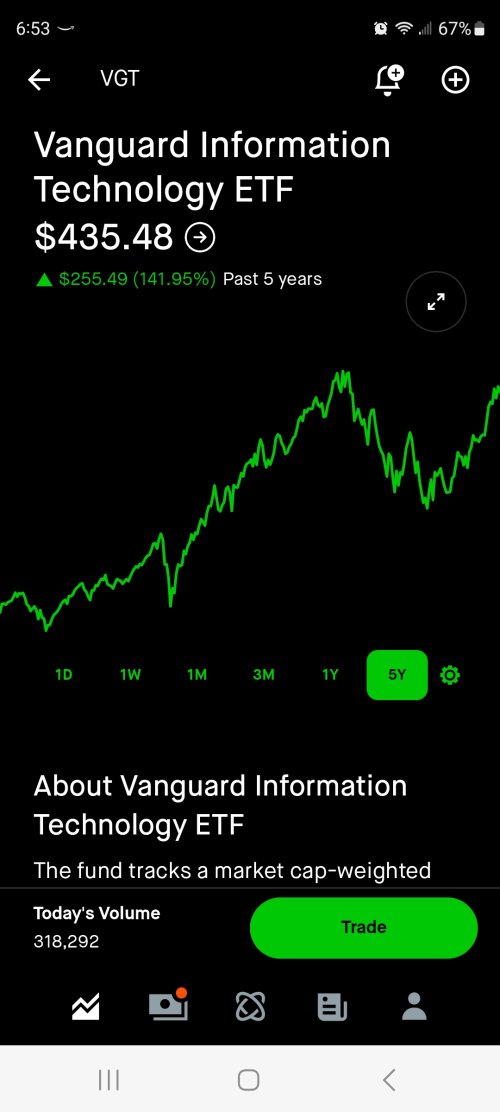

Just buy Microsoft for AI play .So just gonna throw this out.

View attachment 283104

You know, in case you were interested in making money...