Rob96

Active member

Unleaded= $4.47

Diesel= $5.99

Diesel= $5.99

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

The problem with that argument is that even with the increased consumption there is no shortage of crude or lack of availability of the refined product so there is no reason for the continual increase in prices. Given the already record profits of the petro companies.Either way, this is my point.

View attachment 221111

Renewables have increased and are a far larger percentage of the US energy mix than they have ever been before, yet oil consumption has also dramatically increased.

The political narrative is to rail against producers without having the consumption conversation. Reducing our carbon foot print is a goal at odds with reducing wealth inequality, just is what it is.

I think if you actually wanted to reduce our dependence on fossil fuels you'd have to do something like impose a $300 a barrel oil tax and then pour every cent of that into nuclear/grid infrastructure/EV vehicles. Essentially make gas $10+ a gallon, EV cars like $10,000 and virtually free to charge (fleet wide long term).

Hundred dollar oil encourages development in challenging oil fields. Meanwhile Brent, WTI, and nat gas are all up over 5% today. The "value" of the dollar certainly wouldn't have anything to do with continual price increases, would it?The problem with that argument is that even with the increased consumption there is no shortage of crude or lack of availability of the refined product so there is no reason for the continual increase in prices. Given the already record profits of the petro companies.

Same in western PA. RobberyDiesel went up again yesterday in the Allentown, PA area, $6.29 per gallon

The problem with that argument is that even with the increased consumption there is no shortage of crude or lack of availability of the refined product so there is no reason for the continual increase in prices. Given the already record profits of the petro companies.

There absolutely is a lack of availability that is exactly what's happening. This is why Biden released oil from the SPR.there is no shortage of crude or lack of availability of the refined product so there is no reason for the continual increase in prices.

So the simple answer is not Broseph's conscripted sloganeering, 'Cornpop's Fault'?You are confusing a product and a commodity

Commodities Versus Differentiated Products | Ag Decision Maker

www.extension.iastate.edu

This is a great article on the topic.

Is It Fair To Blame Oil Companies For High Prices? | OilPrice.com

Oil companies are catching a lot of flack as prices remain firmly above $100 per barrel, but there’s a few details some finger-pointers may be overlookingoilprice.com

This is further complicated because many companies aren't actually getting all the profit from prices. A lot of companies hedge their volumes. Many hedge books are currently at $65 and below so oil companies are writing huge checks.

Shale Producers Face $42 Billion In Hedging Losses | OilPrice.com

Upstream companies are reporting blockbuster earnings for Q1 2022, but hedging losses are dimming otherwise stellar earnings reportsoilprice.com

Bottom line, companies to make a lot of money at $100 and $7 natural gas. Companies don't set prices demand does. The entire reason that OPEC exists is to try and fix prices by controlling supply. US and western European companies are not part of a cartel they operate on the free market and therefore don't try and "fix" prices.

The us has has attempted to do this before but it never really worked.

There absolutely is a lack of availability that is exactly what's happening. This is why Biden released oil from the SPR.

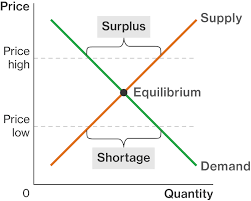

The reason you aren't seeing rationing/ our stations being out of gas is because of the price. At $100 oil and $4 demand is eroded and therefore less oil is used. If say the president mandated that oil be sold for $65 a barrel, folks would increase their usage and we would quickly run out of gas.

View attachment 221501

You are confusing a product and a commodity

Commodities Versus Differentiated Products | Ag Decision Maker

www.extension.iastate.edu

This is a great article on the topic.

Is It Fair To Blame Oil Companies For High Prices? | OilPrice.com

Oil companies are catching a lot of flack as prices remain firmly above $100 per barrel, but there’s a few details some finger-pointers may be overlookingoilprice.com

This is further complicated because many companies aren't actually getting all the profit from prices. A lot of companies hedge their volumes. Many hedge books are currently at $65 and below so oil companies are writing huge checks.

Shale Producers Face $42 Billion In Hedging Losses | OilPrice.com

Upstream companies are reporting blockbuster earnings for Q1 2022, but hedging losses are dimming otherwise stellar earnings reportsoilprice.com

Bottom line, companies to make a lot of money at $100 and $7 natural gas. Companies don't set prices demand does. The entire reason that OPEC exists is to try and fix prices by controlling supply. US and western European companies are not part of a cartel they operate on the free market and therefore don't try and "fix" prices.

The us has has attempted to do this before but it never really worked.

There absolutely is a lack of availability that is exactly what's happening. This is why Biden released oil from the SPR.

The reason you aren't seeing rationing/ our stations being out of gas is because of the price. At $100 oil and $4 demand is eroded and therefore less oil is used. If say the president mandated that oil be sold for $65 a barrel, folks would increase their usage and we would quickly run out of gas.

View attachment 221501

Yes we know.

Already happening.What happens when the OTR guys park their rigs because it is diminishing returns for them to continue hauling?