D

Deleted member 28227

Guest

It was consumed, there was a delay in price increase as demand increased.I understand the demand spike, but what happened to all the excess from when demand was so low that oil was trading in negative numbers.

Lots of wells were shut in, but often you have contracts that have to be honored. So it's not so much turning off the well as drilling. So again a lag on the way down. A company might still produce 100,000 BOE/d but would go from 6 rigs to 1 rig during the pandemic.Were the oil companies smart enough to curtail production before the demand fell off

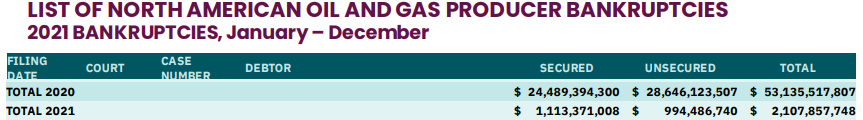

Also a lot of companies just went out of business whatever you hear about profits, you have to remember the industry lost 55 Billion dollars over the course of the pandemic.

but didn’t have the same foresight to ramp up production as demand was coming back,

To increase production you have to add rigs and drill or complete new wells, this requires capital. A lot of drilling is financed, banks wouldn't lend at low levels. I just got a report this week from a couple of the big name banks saying they were finally upping there strip numbers.

The biggest effect this has is on borrowing base. So essentially banks use your current production and assets as collateral for a loan. At a $55 basis your production and well locations might be worth 5 Billion but at $70 oil they are worth 8 Billion.

This difference is what funds 'new' drilling. The exciting news was for the first time banks had $70 in their analysis, everything is long term so $100 oil today isn't relevant it's the outlook for 12-24 months out. So point being is just this week bankers are starting to get comfortable with the idea that oil won't just dive back down to the 50s.

Wells decline so because companies weren't running rigs a lot had production declines, their Q1 2022 budgets provide capital for 1. Maintaining current levels of production and 2. Some increases in production, say 10-20%. But they need new financing to add an additional 20% which is what I'm calling "New Drilling".

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

So things are changing but it's a lot of moving parts and doesn't happen fast. I think the part that people don't quite get is how many folks are involved. It's not one guy 'pulling the trigger'

It's getting 50+ banks and investment firms to be on the same page with over 100 different EP companies, and then for them to actually drill wells.

Public Oil Companies

US oil isn't nationalized, we aren't like the Saudis who can just say yep tomorrow we turn it on.

The other component is the alignment of the banks, if you loan someone 100k and they made zero payments for 3 years in year 4 would you want to loan them another 100k with the promise of a great return or would you want them to pay back the first 100k.

Last edited by a moderator: