NEWHunter

Well-known member

Individually or jointly?I'm 100% sure you have no idea if I'm loaded or up to my eyeballs in debt... or both. And it doesn't matter anyway. However, there are lots of discussions on HT about retirement and investing advice, so I know people think about it.

As to why I asked, plenty of financial articles have statistics on average worth/savings by age group, I merely wondered if the million mark was more often reached at an early age or slowly and later in life. It's a fair question and nobody is required to answer.

I find people's success stories aspirational and like to see people do well, for all you know I'm just trying to be inspired. I didn't mean to offend anybody and apologize if I did.

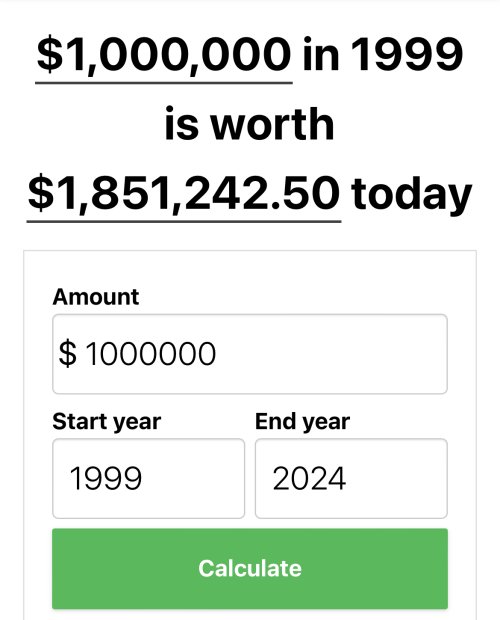

Geez, take it easy on the OP. A million dollars is nice, but it’s not the huge sum it used to be. And for the folks that don’t do it, keeping track of your net worth is a good idea. Knowing what goes in to that number helps greatly with financial planning and budgeting.

I used to keep a monthly budget but tracking it was a pain in the rear. I gave up. Now I just put together a PFS at the end of every year and call it good. It works just as well as a weekly/monthly budget and takes a lot less time. It shows us where we’ve been and where we’re going. It helps a lot in making spending and saving decisions.