SAJ-99

Well-known member

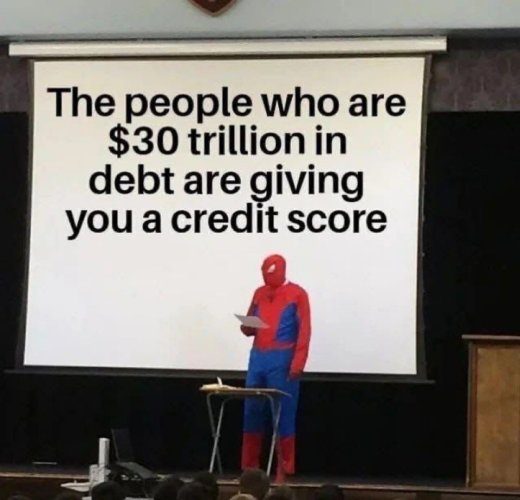

Already had the conversation. It’s the Boomers. I’m not blaming them, but it’s them. We have seen this coming for years. They are living longer, healthier lives (with the assistance of medical advancements) than was ever anticipated. I guess we can blame some government actuaries in the 1950’s and 60’s.The amazing thing to me is in 2021 we collected $4 trillion for the US Treasury but spent $6.8 trillion. How can we as a society have a real conversation about what services we want or expect from the government when we start with spending that is so unsustainable?

Boomers are about 20% of US population.

They hold over 50% of the household wealth.

They accounted for 33% of the 2022 US government spending (SS and Medicare).