SAJ-99

Well-known member

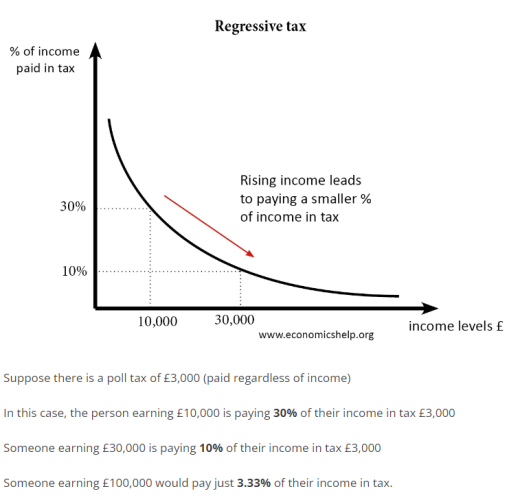

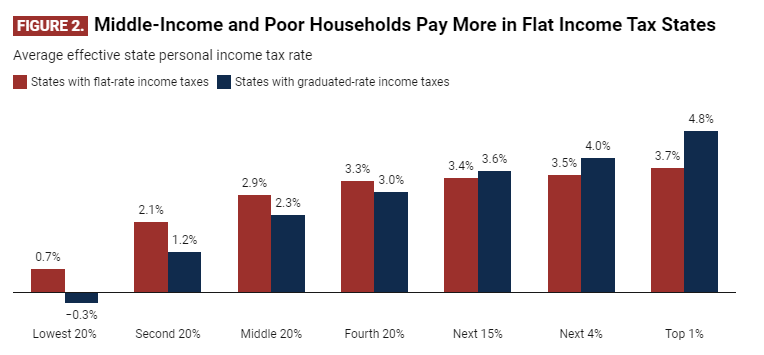

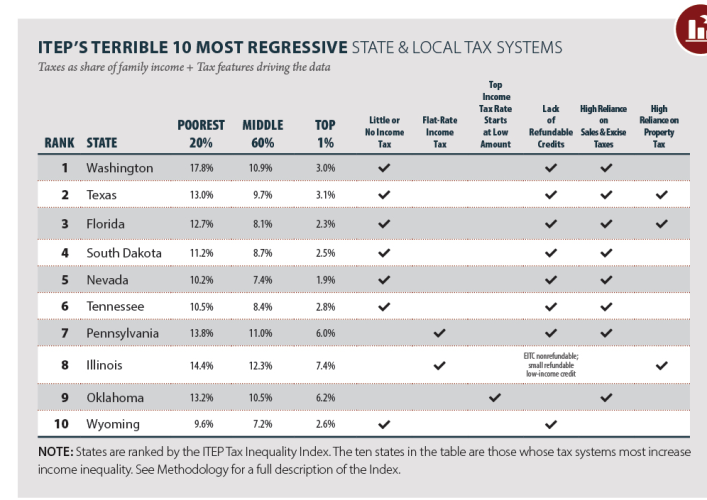

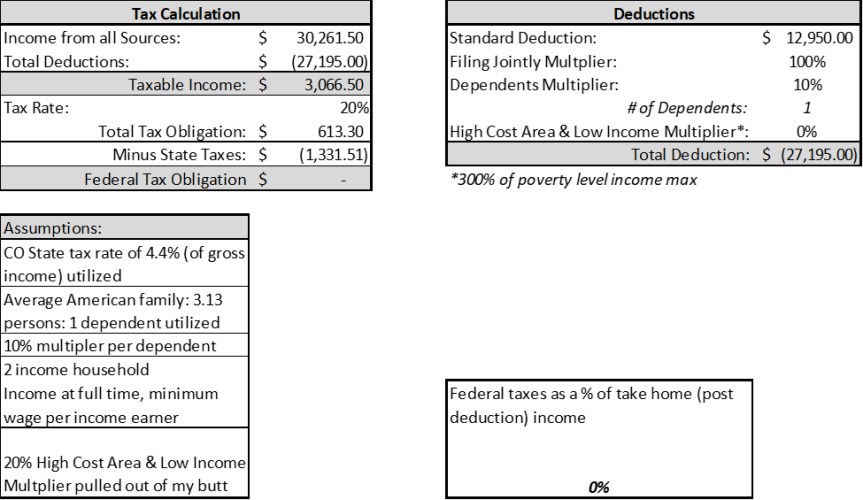

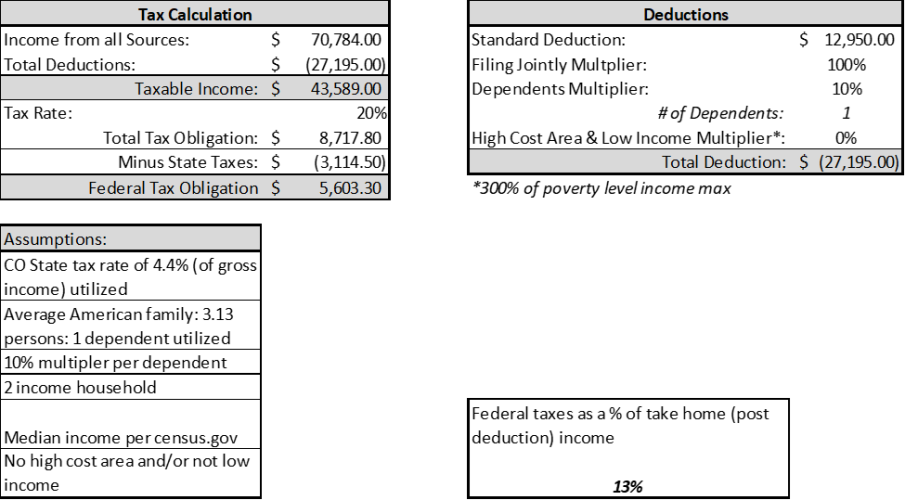

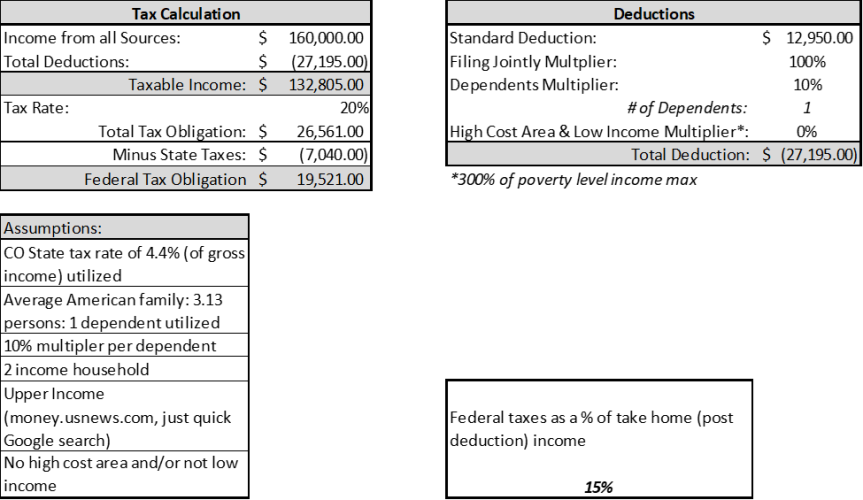

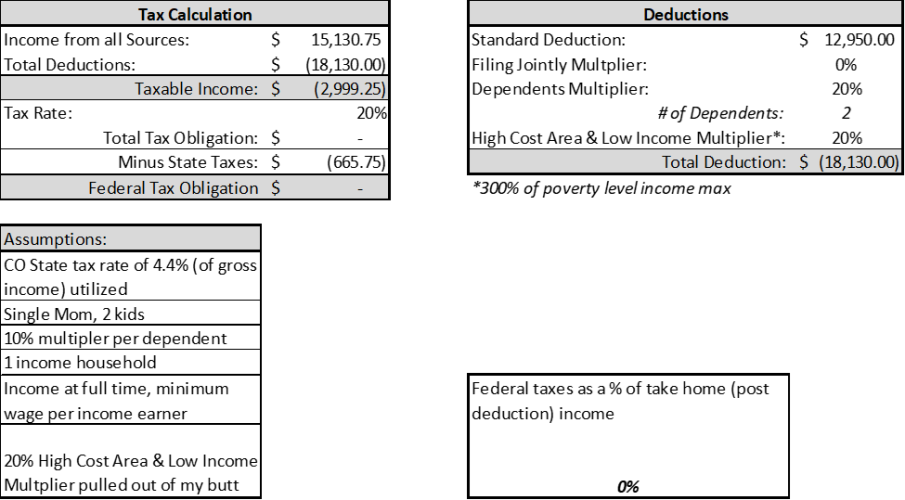

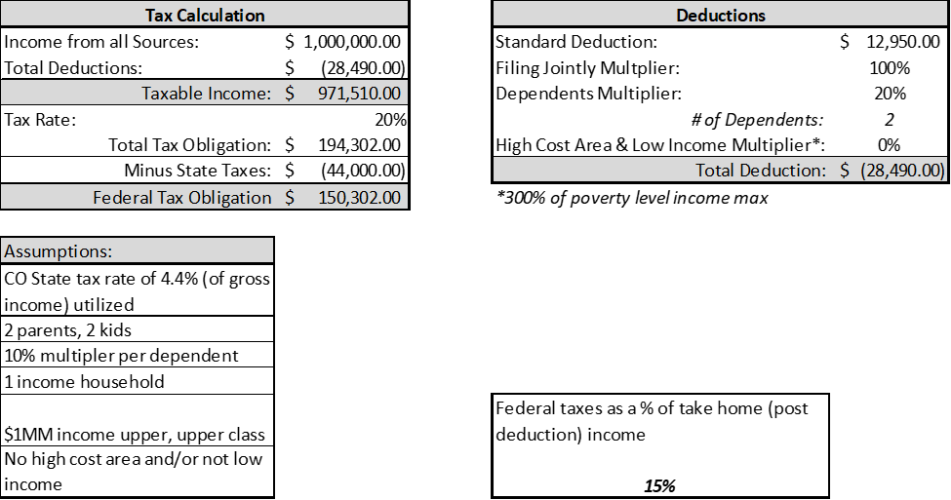

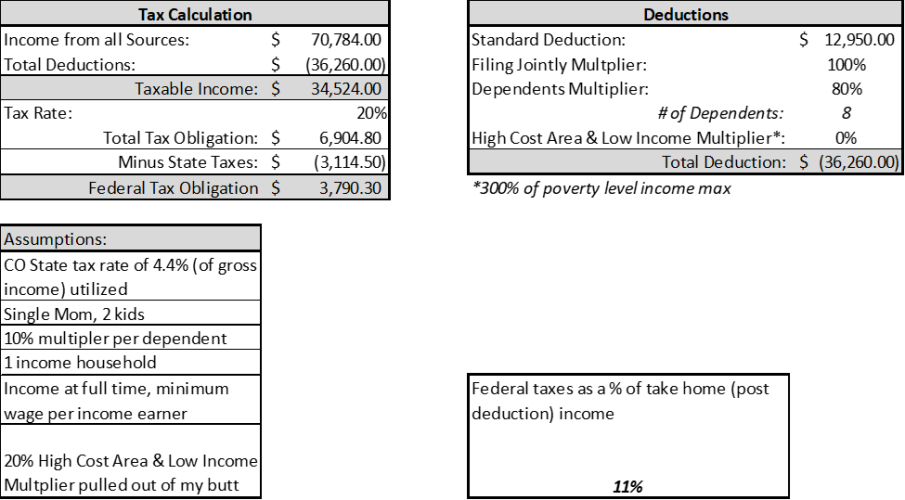

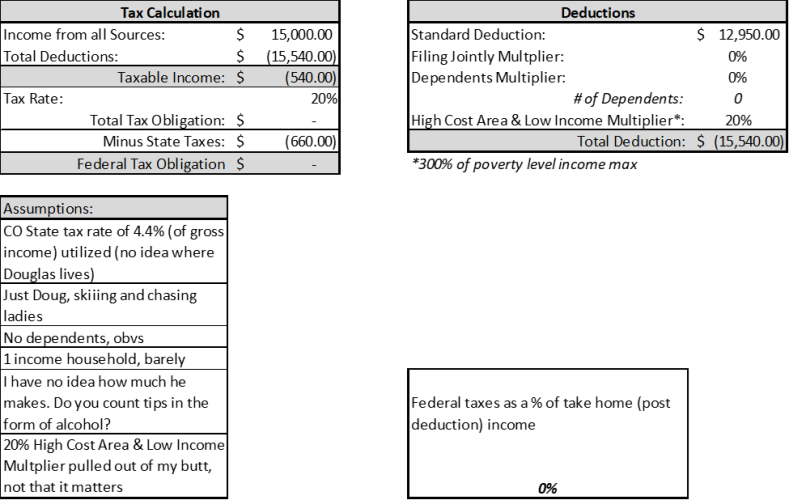

Remember my post about Ken Griffin, $22B in one year, and our inability to understand large numbers? $1billion is 1000 million $. So one person who makes $1B can spend $1000 per day for 1 million days before they ran out of money. That is over 2700 years. It is hard to comprehend. But Ken spends it on a bunch of houses that he is never in and buys the occasional politician when necessary, all the while complaining about taxes. I don't have the answers, but I know where to start. And remember I also said the standard deduction was too high, so spreading the pain.Bah! Poor become poorer is a farse used by opposition in the flat tax debate.

Poor don't drive Mercedes.

It maintains equality. The American dream.

Low income? Simple: F. Roosevelt's temp welfare intent turned socially long term accepted adapts. Low income, "reduced tax" for grocery/essentials.

Ziiing! Wish real fishing was this easy!