NDGuy

Well-known member

- Joined

- Apr 26, 2018

- Messages

- 2,117

I’m glad bringing back fair and equal opportunity is including couch ****ers to live their dreams

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I’m glad bringing back fair and equal opportunity is including couch ****ers to live their dreams

Interesting choice of words.

JD's couch may pull out but he sure doesn'tI'm a dangerous sociopath who doesnt listen to music when I lift, but if I did it would be it would be a 1982 Michael Jackson hit right now.

I'm a dangerous sociopath who doesnt listen to music when I lift, but if I did it would be it would be a 1982 Michael Jackson hit right now.

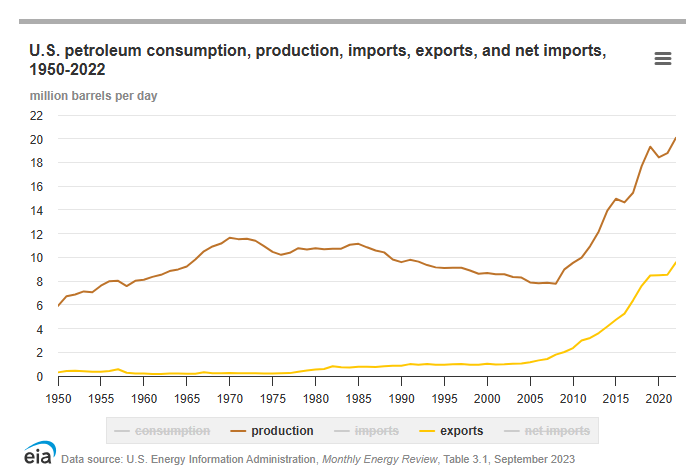

Where did it go and why were the strategic oil reserves depleting at the same time?Under Biden we already were producing more oil than ever before...producing more is going to be creating threads talking about hunting and fishing impacts on this board for the next 4 years....

Mostly Europe due to demand and sanctions on Russia.Where did it go and why were the strategic oil reserves depleting at the same time?

www.forbes.com

www.forbes.com

And how did that "dilution" get mainlined into the blood stream from April 2020 to April 2022?

Massie is a libertarian.Massie is a Tea Party guy. Must be something in the Kentucky water. That video was 30 minutes of circular logic from all participants. There were some good points but often leading to the nonsensical conclusion. Massie wants to get rid of the Fed, but he clearly blames Congress for issuing the debt (which he has voted on occasion for BTW). The Fed doesn't not print $ and buy $5 billion in bonds without Congress ok'ing the idea. Also, at the end of the day, you have to look at the broader economy to measure the effectiveness of any action. The economic strength today is just as real as the pain of inflation.

A distinction without a difference. Both are generally hated by the party trying to get anything voted on. If he was serious about the ideology he would put the L next to his name.Massie is a libertarian.

“There will be no curiosity, no enjoyment of the process of life. All competing pleasures will be destroyed. But always— do not forget this, Winston— always there will be the intoxication of power, constantly increasing and constantly growing subtler. Always, at every moment, there will be the thrill of victory, the sensation of trampling on an enemy who is helpless.A distinction without a difference. Both are generally hated by the party trying to get anything voted on. If he was serious about the ideology he would put the L next to his name.

The L stands for lonely.A distinction without a difference. Both are generally hated by the party trying to get anything voted on. If he was serious about the ideology he would put the L next to his name.