I'd say a majority of the country is confused with that.You are confusing nominal prices with the rate of inflation.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs and Potential Inflation

- Thread starter SilentBirdHunter

- Start date

- Status

- Not open for further replies.

VikingsGuy

Well-known member

tldr; c-suite - fun to flog, but not the problemFair enough. But I still find it hard to worry about those big businesses still making a profit on top of increased costs. They aren't guaranteed or have a right to a certain profit margin.

When they stop giving C-suite executives raises I'll starting believing their profits have been pinched

Just a little moody and sarcastic this morning.

OK - we have wander far away from the OP, but by page 9 I suppose that is par from the course.

C-suite comp is an easy horse to flog. Fun for one and all. But an actual discussion of its real impact breaks down into three discussions.

Economic impact, social impact (envy) and unintended consequences.

Since this is a tariff/inflation thread and your remarks seem connected to company profits vs consumer prices, let’s go to economic impact first. I hope we can all agree that no human is worth $40 million for one year’s work. Not a CEO, not an athlete, not an entertainer. But what is the actual economic impact of this? Does it drive inflation? Does it force down general wages? The simple answer to both of those is not really. I will use a S&P500 company I know well as an example. So, if the total comp of the entire c-suite of this entity was paid the entry level salary instead, the company would have those funds to do one of two things folks would hope to see improved — reduce prices or increase wages. In this case the company could reduce prices in a manner that would save the average American household less than 10 cents per year. Or it could use those funds to increase average wages of its other employees by less than $200 per year per employee. Neither of these choices do anything to enrich the lives of Americans. It does not drive a shared prosperity, it does not reduce the cost of goods, it does not raise the standard of living, it does not help a family buy a home, pay for college or even take a cheap vacation. So - there is no material effective economic impact of most S&P500 c-suite comp to the broader economy or workforce. Also, when you take into account the progressive tax rates and limited deductibility of c-suite comp, well over 50% of this comp is returned to the public coffers via taxes.

Now what I feel is really behind comments such as yours is the politics of envy (social impact). Why should any one have that much . . . . I think this is a very unproductive and subtractive view of the world. We should not be worried about knocking these folks down a peg - we should be asking how we can actually raise the stakes of working families (which per above is barely effected by c-suit comp). I don’t care how much bill gates has, I care about paying for my kids college and there is no actual connection between the two at the scale of 350 million Americans.

As for the third, unintended consequences is an area that is hard to really dial in, but I do wonder if prior attempts at limiting c-suite comp via income tax policy drove us to a more equity based comp model that may skew descision making in the long run. Hard to know/establish, but an interest area to consider. But the solution would likely result in paying higher salaries and bonuses and removing equity so while the form would change, the envy would still be there.

Last edited:

VikingsGuy

Well-known member

Fixed it for youI'd say a majority of the country is confusedwith that.

Agree and disagree. The wage thing is one thing but total compensation is another. Companies are pulling benefits and hiking healthcare benefit cost constantly. And it's BS news that everyone's wages went up in the last 3 years, not that you said it but most people I know got little to no increase during huge inflation. Media and current administration saying inflation not so bad because wages increased is more fake news.tldr; c-suite - fun to flog, but not the problem

OK - we have wander far away from the OP, but by page 9 I suppose that is par from the course.

C-suite comp is an easy horse to flog. Fun for one and all. But an actual discussion of its real impact breaks down into three discussions.

Economic impact, social impact (envy) and unintended consequences.

Since this is a tariff/inflation thread and your remarks seem connected to company profits vs consumer prices, let’s go to economic impact first. I hope we can all agree that no human is worth $40 million for one year’s work. Not a CEO, not an athlete, not an entertainer. But what is the actual economic impact of this? Does it drive inflation? Does it force down general wages? The simple answer to both of those is not really. I will use a S&P500 company I know well as an example. So, if the total comp of the entire c-suite of this entity was paid the entry level salary instead, the company would have those funds to do one of two things folks would hope to see improved — reduce prices or increase wages. In this case the company could reduce prices in a manner that would save the average American household less than 10 cents per year. Or it could use those funds to increase average wages of its other employees by less than $200 per year per employee. Neither of these choices do anything to enrich the lives of Americans. It does not drive a shared prosperity, it does not reduce the cost of goods, it does not raise the standard of living, it does not help a family buy a home, pay for college or even take a cheap vacation. So - there is no material effective economic impact of most S&P500 c-suite comp to the broader economy or workforce. Also, when you take into account the progressive tax rates and limited deductibility of c-suite comp, well over 50% of this comp is returned to the public coffers via taxes.

Now what I feel is really behind comments such as yours is the politics of envy (social impact). Why should any one have that much . . . . I think this is a very unproductive and subtractive view of the world. We should not be worried about knocking these folks down a peg - we should be asking how we can actually raise the stakes of working families (which per above is barely effected by c-suit comp). I don’t care how much bill gates has, I care about paying for my kids college and there is no actual connection between the two at the scale of 350 million Americans.

As for the third, unintended consequences is an area that is hard to really dial in, but I do wonder if prior attempts at limiting c-suite comp via income tax policy drove us to a more equity based comp model that may skew descision making in the long run. Hard to know/establish, but an interest area to consider. But the solution would likely result in paying higher salaries and bonuses and removing equity so while the form would change, the envy would still be there.

VikingsGuy

Well-known member

I agree inflation in wages was hugely uneven in spread. Most folks took a real hit and those pretending “it is over” are either fools or liars for reasons already discussed above. Very very few ended up “net postive” when looking at their own wages and their own bills.Agree and disagree. The wage thing is one thing but total compensation is another. Companies are pulling benefits and hiking healthcare benefit cost constantly. And it's BS news that everyone's wages went up in the last 3 years, not that you said it but most people I know got little to no increase during huge inflation. Media and current administration saying inflation not so bad because wages increased is more fake news.

As for the benefits area - I agree they are getting squeezed too, but again c-suite total comp isn’t enough to drive that and that was the issue I was addressing.

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,315

tldr; c-suite - fun to flog, but not the problem

OK - we have wander far away from the OP, but by page 9 I suppose that is par from the course.

C-suite comp is an easy horse to flog. Fun for one and all. But an actual discussion of its real impact breaks down into three discussions.

. . .

I'm afraid you missed my entire point. I couldn't care less about C-suite pay generally. But as a small business owner it's easy to say something like, "If I'm able to keep giving myself a raise every year, profits are more than sufficient." That's true even if the profit margin is less than before. Not all things scale, but I feel like that one does. Again, maybe I'm wrong and maybe I'm just a little snarky.

My point is more that C-suite compensation is an indicator that the companies lack financial distress. Don't tell me that things are getting tighter, in any real meaningful way, if the big bosses are making more money every year.

Last edited:

jryoung

Well-known member

Agree and disagree. The wage thing is one thing but total compensation is another. Companies are pulling benefits and hiking healthcare benefit cost constantly.

As a data point, we just went through open enrollment. For my company we provide HMO (Kaiser) and PPO (Blue Cross/Blue Shield) options for staff to choose from. I pay 100% of employee medical/dental/vision. Kaisers increased 7% this year (historically 3-5%) and BC/BS increased 25% (historically 7-9%). There's nothing I can do as as an employer to avoid those health care cost increases delivered to me by the providers.

You can't control the cost of it but a company can stop paying a CEO 45 million and cover the increase with a pay reduction in one person's salary to keep the employees cost from m going up. They just choose not toAs a data point, we just went through open enrollment. For my company we provide HMO (Kaiser) and PPO (Blue Cross/Blue Shield) options for staff to choose from. I pay 100% of employee medical/dental/vision. Kaisers increased 7% this year (historically 3-5%) and BC/BS increased 25% (historically 7-9%). There's nothing I can do as as an employer to avoid those health care cost increases delivered to me by the providers.

VikingsGuy

Well-known member

Wow - does @jryoung make $45 million? I would have been much nicer to him if I had known thatYou can't control the cost of it but a company can stop paying a CEO 45 million and cover the increase with a pay reduction in one person's salary to keep the employees cost from m going up. They just choose not to

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,315

Genuinely honest question: Can you shop a PPO plan from someone else? Or is BC/BS still competitive in the market?As a data point, we just went through open enrollment. For my company we provide HMO (Kaiser) and PPO (Blue Cross/Blue Shield) options for staff to choose from. I pay 100% of employee medical/dental/vision. Kaisers increased 7% this year (historically 3-5%) and BC/BS increased 25% (historically 7-9%). There's nothing I can do as as an employer to avoid those health care cost increases delivered to me by the providers.

jryoung

Well-known member

Genuinely honest question: Can you shop a PPO plan from someone else? Or is BC/BS still competitive in the market?

Wasn't a ton of difference between Aetna and United, just need to buy more lube. While I cover 100% for my employees, dependents are their responsibility, I did have one staff move to Kaiser as a result.

Bonasababy

Well-known member

- Joined

- May 16, 2024

- Messages

- 915

Nope--inflation is a constant. Unless some of us are old enough to remember the conditions before or into the late 1930's the last US long term average I saw was 3.7 percent. Right before the election the rate of inflation was around 2.5 percent for the previous year--roughly the same as the last year under Trump before Covid--the outlier neither president should be blamed for.I understand it is politically inconvenient, but actually it is.

Inflation is Almost Always present. Some act like they want negative inflation--a rare event and the conditions that precede it usually are accompanied by other economic pain and aren't something anyone should wish for.

What matters is why the prices have gone up and ability to pay.

That varies, but wages rose dramatically over the last 5 years--and were passed on to consumers in the form of higher prices. That's a big cause of much of the inflation.

All discussed in the Reuters article and by every economist.

If the price of a car rose 5k in recent years but your wages have increased by 10K a year---see the point?

So no, actually the expressed view overly simplifies the situation.

What matters is income adjustments together with inflation. Certainly for some incomes have not kept up with inflation--but for many that's not the case--but many focus only on cost, not ability to pay.

VikingsGuy

Well-known member

Nominal inflation rate and purchase power adjusted for income & price inflation are two concepts you mix together. The later being the thing we have the least good data for but is probably the most useful. Meanwhile most people are talking about inflated prices. As for "every economist says", this is an obvious overstatement, as my best friend is a top 5 economist at the Fed and he constantly rails against the misleading notion that "inflation is only 4% everyone should be happy now" drivel.Nope--inflation is a constant. Unless some of us are old enough to remember the conditions before or into the late 1930's the last US long term average I saw was 3.7 percent. Right before the election the rate of inflation was around 2.5 percent for the previous year--roughly the same as the last year under Trump before Covid--the outlier neither president should be blamed for.

Inflation is Almost Always present. Some act like they want negative inflation--a rare event and the conditions that precede it usually are accompanied by other economic pain and aren't something anyone should wish for.

What matters is why the prices have gone up and ability to pay.

That varies, but wages rose dramatically over the last 5 years--and were passed on to consumers in the form of higher prices. That's a big cause of much of the inflation.

All discussed in the Reuters article and by every economist.

If the price of a car rose 5k in recent years but your wages have increased by 10K a year---see the point?

So no, actually the expressed view overly simplifies the situation.

What matters is income adjustments together with inflation. Certainly for some incomes have not kept up with inflation--but for many that's not the case--but many focus only on cost, not ability to pay.

Last edited:

SAJ-99

Well-known member

It’s a good point, but it was viewed as election year noise mostly just to match Trump's tariff rhetoric. Much like the not taxing tips. Most of the list is to protect American car manufacturers (sound familiar?), and I think GM is pulling out of China. I could argue that is narrow, small list of items, but either way, those were a bad idea too. It probably raised prices on my Anker power bank, so I'm outraged. I'm not sure why you are so upset at people not paying attention to announcements of changes in the 301 list and not reacting equally? Do you realize how many items are on that list? Here is one line item. The doc is hundreds of pages of these.Interesting content shared by John F. Kennedy when he signed Congress' Trade Expansion Act that gave Presidential powers to set tariffs:

Since, I bet he's rolled in his grave too many times to count.

Biden's Statement regarding his administration's tariffs (May 14, 2024);

"American workers and businesses can outcompete anyone—as long as they have fair competition. But for too long, China’s government has used unfair, non-market practices. China’s forced technology transfers and intellectual property theft have contributed to its control of 70, 80, and even 90 percent of global production for the critical inputs necessary for our technologies, infrastructure, energy, and health care—creating unacceptable risks to America’s supply chains and economic security. Furthermore, these same non-market policies and practices contribute to China’s growing overcapacity and export surges that threaten to significantly harm American workers, businesses, and communities."

Crickets then...

- The tariff rate on certain steel and aluminum products under Section 301 will increase from 0–7.5% to 25% in 2024.

- The tariff rate on semiconductors will increase from 25% to 50% by 2025.

- The tariff rate on electric vehicles under Section 301 will increase from 25% to 100% in 2024.

- The tariff rate on lithium-ion EV batteries will increase from 7.5%% to 25% in 2024, while the tariff rate on lithium-ion non-EV batteries will increase from 7.5% to 25% in 2026. The tariff rate on battery parts will increase from 7.5% to 25% in 2024.

- The tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026. The tariff rate for certain other critical minerals will increase from zero to 25% in 2024.

- The tariff rate on solar cells (whether or not assembled into modules) will increase from 25% to 50% in 2024.

- The tariff rate on ship-to-shore cranes will increase from 0% to 25% in 2024.

- The tariff rates on syringes and needles will increase from 0% to 50% in 2024. For certain personal protective equipment (PPE), including certain respirators and face masks, the tariff rates will increase from 0–7.5% to 25% in 2024. Tariffs on rubber medical and surgical gloves will increase from 7.5% to 25% in 2026.

View attachment 349894

Since,

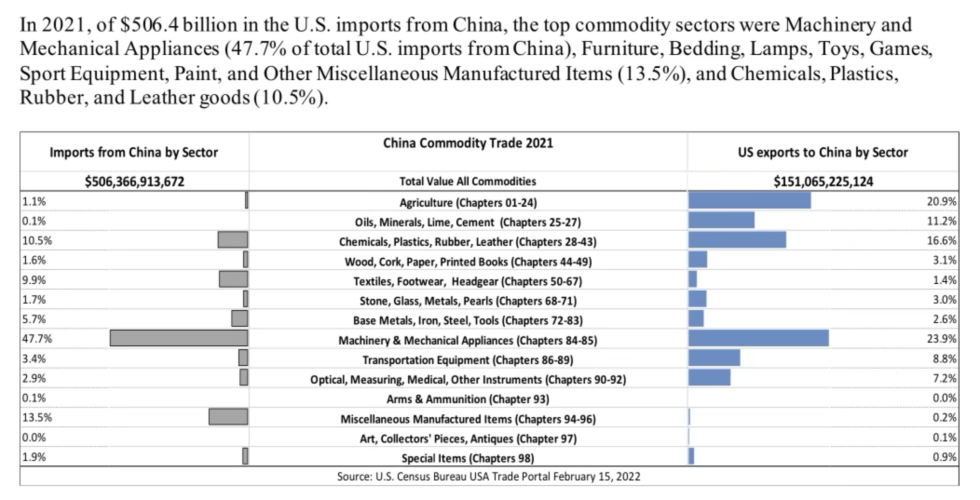

I agree a lot of important, core products should be moved back to America, or at least to a partner. Covid did teach a lot of these lessons. It doesn't matter if it is Trump, Biden or JFK, tariffs are bad idea because they raise prices and are inefficient from an economic perspective. In the interest of education, here is a snapshot of just China trade from a few years ago. It gives a good idea of where retaliatory tariffs will go. Now slapping tariffs on EVERY trading partner, which was the selling claim, and you have problems.

who said he did? It was a reference to many companies with CEO's making more and more and the rest of the employees making less.Wow - does @jryoung make $45 million? I would have been much nicer to him if I had known that

VikingsGuy

Well-known member

please take judicial note of the smiley emojiwho said he did? It was a reference to many companies with CEO's making more and more and the rest of the employees making less.

ismith

Well-known member

Imagine paying that kind of dough, then promptly being sunk by a Russian submarine on day two of WWIII.It's going to be a long 4 years for some of you guys. Here's an idea that you may find appealing while locking into a 4 year, inflation free piece of mind!

noharleyyet

Well-known member

That's it then, I'm paying by the week...Imagine paying that kind of dough, then promptly being sunk by a Russian submarine on day two of WWIII.

Forkyfinder

Well-known member

- Joined

- Dec 13, 2023

- Messages

- 3,817

Anti trumpers going down because of russiaImagine paying that kind of dough, then promptly being sunk by a Russian submarine on day two of WWIII.

- Status

- Not open for further replies.

Similar threads

- Replies

- 6

- Views

- 2K