BuzzH

Well-known member

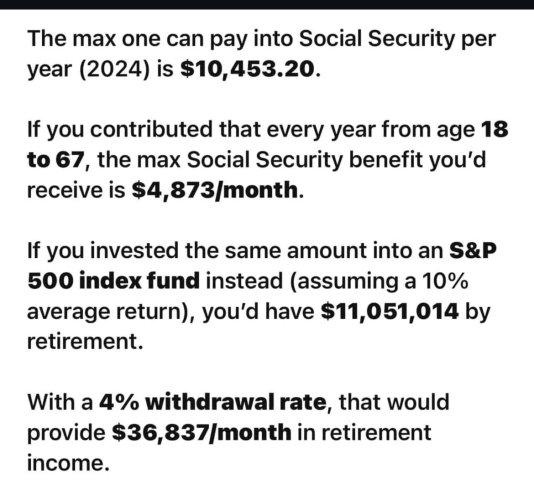

Today 40% of retirees have no defined benefit OR defined contribution income, and rely solely on social security to survive. Social security is the only thing keeping tens of millions of older Americans out of severe poverty.

It is significantly inadequate in that function though, as the age to attain needed benefits is far beyond how long people are actually capable of working. The average retirement age in the US is 62, whereas the highest SS payment is achieved by waiting to draw SS at age 70. People working physically demanding jobs overwhelmingly get stiffed because they often don’t have extra $ to set aside for retirement during their working years, and when they are forced out of work due to health, they are stuck settling for a greatly reduced benefit by pulling the benefit early.

It is also an enormously wasteful, inefficient, and convoluted program. SS is a regressive tax, so the poorest workers pay the most into the program proportionate to their income. The benefits, however, are highly progressive. Retired white collar workers collect much higher monthly checks because their incomes were higher during their working years, and they can also delay the age to start collecting on account of their better health. Illegal workers, which our country relies on heavily to make our economy work, are left out entirely.

We’re robbing the young and poor to enrich the old and financially stable.

I am all for phasing out the program as it exists today and replacing it with a program funded by progressive payroll tax, and pays out regressive benefits. The career roofer should pay little to nothing in, and be able to collect when their body gives out. The six-figure desk jockey should pay a lot in and collect nothing unless their defined contribution IRA falls through.

Or, just bring back required pension plans with oversight to assure they follow workers through their careers and that the money is being invested properly.

I know, that's the "idea" behind 401's but the trouble is, many lower income earners don't have the money to contribute and if they hit a snag or "need" a new boat, the money is too accessible. Not to mention that many haven't been given any kind of guidance or sound advice how it all works.

Loss of DBP's was a huge hit to the blue collar working class, but a great deal for Corporate America.