peterk1234

Well-known member

- Joined

- Oct 9, 2019

- Messages

- 755

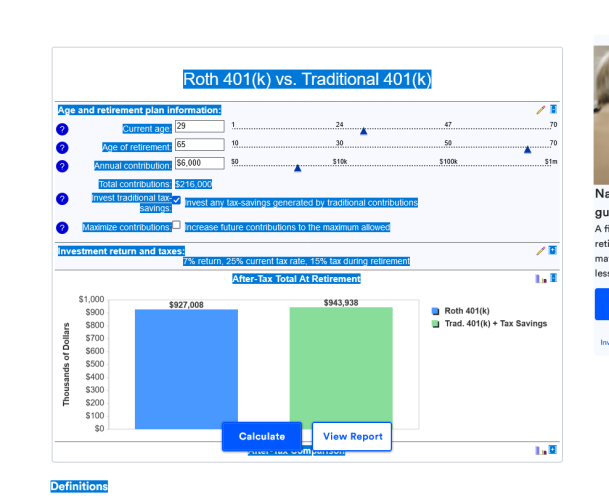

I have two girls. Made them get jobs the minute they hit 16. Started funding their Roths the day they started to work. One is now 27 the other is 25. We continue to fully fund those things. And plan to do it until the day I'm dead.

Time in the market is a huge thing. It cannot be overstated how important that is. I'm not worried about them needing money prior to 59 1/2. That's their problem. It's called life. I want to help them get to the point that they can retire at a reasonable age.

Kudos for your willingness to do this!

Time in the market is a huge thing. It cannot be overstated how important that is. I'm not worried about them needing money prior to 59 1/2. That's their problem. It's called life. I want to help them get to the point that they can retire at a reasonable age.

Kudos for your willingness to do this!

Last edited: