Bonasababy

Well-known member

- Joined

- May 16, 2024

- Messages

- 915

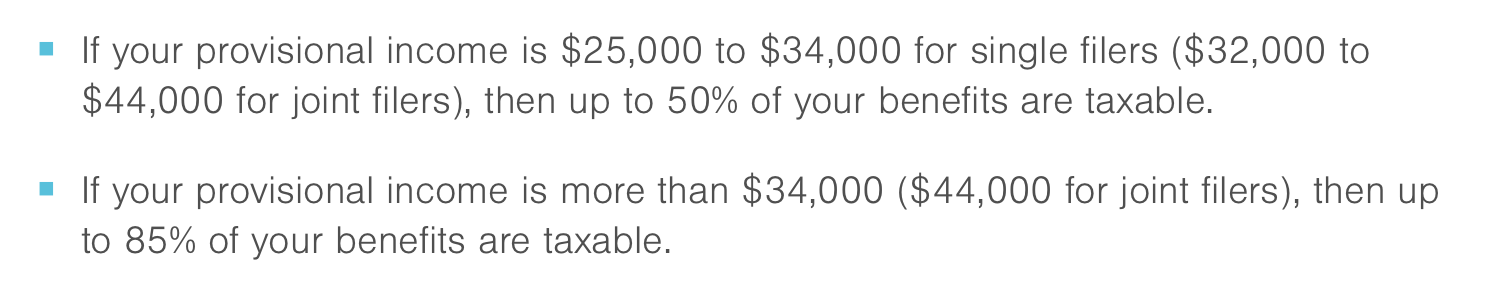

It's a little more complex I think. As I understand it eligibility and penalties are different before you turn 65 and are eligible for Medicare than after. Paying premiums before or after 65 with an HSA isn't illegal per se as I understand it, but there is a penalty and taxes will be due before 65..double whammy. I think after 65 the penalty goes away but taxes may still be due.HSA can be used for Medicare and Cobra premiums.