VikingsGuy

Well-known member

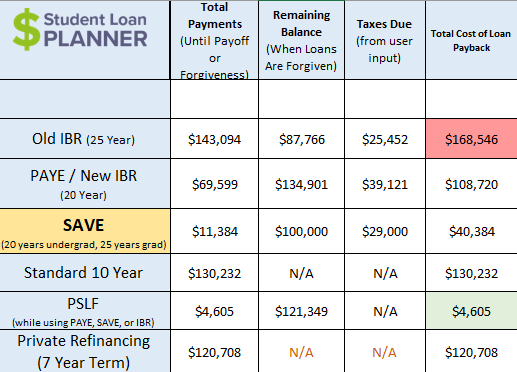

On your points 1 & 2 - The best answer is always take the lowest rate with the best terms regardless of govt involvement. This may take a little thinking given ones circumstances, but avoiding govt backing on principle is a very expense principle. Many of us (including me) would like to think we can still live in a bright line govt/private world, but the reality is that we live in a hybrid ecosystem where public and private intermingle and to make choices otherswise just doesn't make sense.Sounds like I’m going to learn something today!

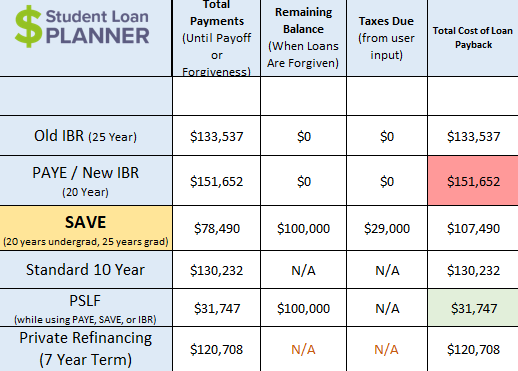

On the final point - For some folks pursuing some fields of study some of the govt repayment plans are 5-digit (even 6-digit) gifts. Gift a student's parents and grandparents paid into support and the student will pay in many times over (in taxes) so no reason not to use the system the way it is designed. We can't always write the rules, but we can benefit from some.