El Jason

Well-known member

Probably because there’s not enough customer base. The area I live in has four Costco’s within 120 mile radius. Every single one of them is boomingI wonder why they haven’t put a Costco in Cody or Sheridan?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Probably because there’s not enough customer base. The area I live in has four Costco’s within 120 mile radius. Every single one of them is boomingI wonder why they haven’t put a Costco in Cody or Sheridan?

Montana's gas tax revenue has barely increased in the last 20 years, but the price of building roads sure as hell has. The legislature has been super opposed to increasing the gas tax, probably at the behest of shipping and tourism (but also their constituents - gas prices increasing is a pretty universal way of pissing folks off), but increased fuel efficiency and now electric cars means less money coming in to somehow fix all the failing infrastructure at once.Don’t state and federal gas taxes compensate for this?

There was an agreement on funds to fix those roads last session. The governor shoved it in a drawer until the session officially ended before saying he vetoing it.Montana's gas tax revenue has barely increased in the last 20 years, but the price of building roads sure as hell has. The legislature has been super opposed to increasing the gas tax, probably at the behest of shipping and tourism (but also their constituents - gas prices increasing is a pretty universal way of pissing folks off), but increased fuel efficiency and now electric cars means less money coming in to somehow fix all the failing infrastructure at once.

There had been a legal county option on the books for ages. Missoula took the $0.02 increase it to voters who approved using the revenue to fund local infrastructure maintenance.A couple of sessions ago Missoula tried to institute a small gas local tax to go to road maintenance locally. The Legislature put the hammer down saying municipalities shall not dare do something to help themselves.

We voted a few years back to make itnso that local communities couldn't make their own laws that restrict something more than state law didn't we? Is this part of it? So Missoula don't ban conceal carry like they tried to. Or Helena can't have its own vapor ban.There had been a legal county option on the books for ages. Missoula took the $0.02 increase it to voters who approved using the revenue to fund local infrastructure maintenance.

This seems to me like a serious case of legislative overreach, punishing a locality for having politics that differ from their own.

Sorry to keep taking this thread off track taking taxes, but that was some serious BS.

Matt Reiger was quoted as saying “The gas tax might be no big deal for $100,000 a year earners, but for the low-income people it is a big deal.” Hopefully he maintains that way of thinking if the legislature debates a sales tax.

That wasn’t part of it. A gas tax isn’t a restriction. The 1979 legislature passed a law allowing counties to impart a gas tax to fund local transportation maintenance. Missoula County voters said “sure.” The legislature said “nope, not for you guys.”We voted a few years back to make itnso that local communities couldn't make their own laws that restrict something more than state law didn't we? Is this part of it? So Missoula don't ban conceal carry like they tried to. Or Helena can't have its own vapor ban.

The most "big brother" of them are usually the ones that say they are doing it for Freedom and Liberty.That wasn’t part of it. A gas tax isn’t a restriction. The 1979 legislature passed a law allowing counties to impart a gas tax to fund local transportation maintenance. Missoula County voters said “sure.” The legislature said “nope, not for you guys.”

Some more bills.

HB 353: Revise shed hunting requirements

(Require shed hunting license)

HB 283: Revise laws for hunting licenses lotteries

• Allows sheep and moose tags for a lottery

(Like BHA did with the mule deer raffle)

HB 328: Allow hunters over 75 years to use general elk license for cow elk

• 75 years of age or older may use a general elk license to harvest an antlerless elk during any season in a hunting district in which a youth under 15 years of age may harvest an antlerless elk and on privately owned land.

HB 330: Create auction or lottery licenses for antelope and swans

HB 356: Allow livestock loss reimbursement for black bear predation

I would have been in trouble.Rep Cohenour has an amendment to HB 353 (attached) that would change the bill after receiving some feedback from private land owners as well as public land advocates. The amendment would:

3.) eliminate the word possession from new section 1. This was confusing and could be interpreted that you needed a license to simply own sheds. That wasn't the intent, so it is deleted.

bills.legmt.gov

bills.legmt.gov

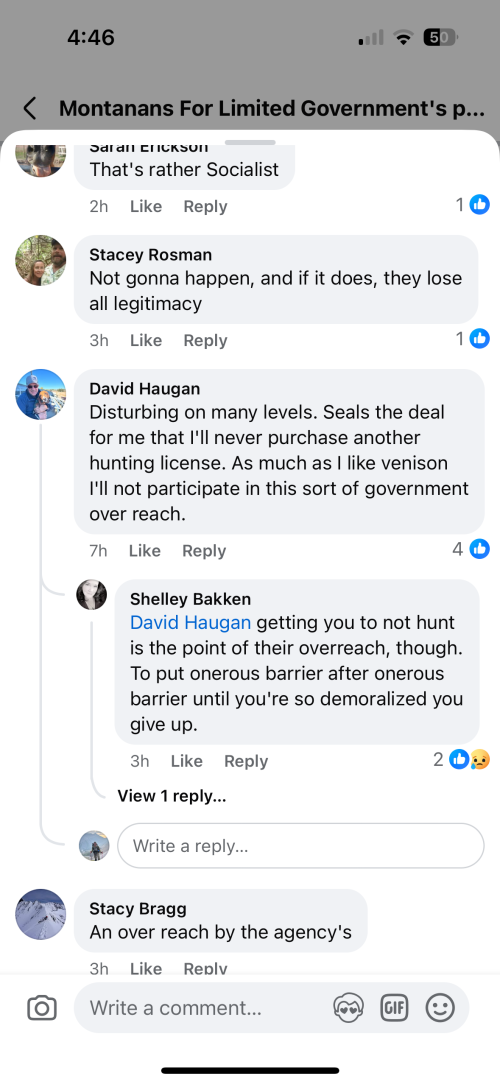

I've been surprised at the amount of ire a mandatory reporting bill (HB 417) can induce. Lots of folks making claims it's an affront to their liberty or some such thing. I don't see the ask as large nor invasive, but for the greater good.

Bill Explorer

Explore, track, and stay informed on legislative bills in Montana with the Montana Legislature Bill Explorer application. Access detailed information, monitor bill progress, and engage with the legislative process easily from your desktop or mobile device.bills.legmt.gov

I hadn’t heard the breakfast flakes since 2018. Then moved back to the Billings area and heard them. What happened to them in 6 years? It’s not even the same show.The breakfast flakes also talked about it Friday and said it’s a government over reach and it’s none of their business who is harvesting what.

Havent listened in years, as my commute has been much shorter... what do you mean?I hadn’t heard the breakfast flakes since 2018. Then moved back to the Billings area and heard them. What happened to them in 6 years? It’s not even the same show.

They almost got booted a few years back one of them went off the rails about not sending Billings kids down to the rez to play ball anymore. I don’t normally listen to them wife was out of town and I was driving kids around in her rigI hadn’t heard the breakfast flakes since 2018. Then moved back to the Billings area and heard them. What happened to them in 6 years? It’s not even the same show.

Lots of moronsI've been surprised at the amount of ire a mandatory reporting bill (HB 417) can induce. Lots of folks making claims it's an affront to their liberty or some such thing. I don't see the ask as large nor invasive, but for the greater good.

Bill Explorer

Explore, track, and stay informed on legislative bills in Montana with the Montana Legislature Bill Explorer application. Access detailed information, monitor bill progress, and engage with the legislative process easily from your desktop or mobile device.bills.legmt.gov

I watched a lady stuck in her brand new ford bronco today in town. I wanted to stop and explain to her how to put it in 4wd