SilentBirdHunter

Well-known member

- Joined

- Feb 5, 2024

- Messages

- 416

Core CPI rose in January to 3.3%.

Energy prices with 1.8% MoM rise in gasoline prices

The food index increased with the greatest rise in two years. A large component of that rise was driven by a 15.2% MoM increase in egg prices. This marked the largest jump since 2015, in part due to the ongoing Avian flu.

Not shocking news to anyone who pumped gas or bought groceries in January.

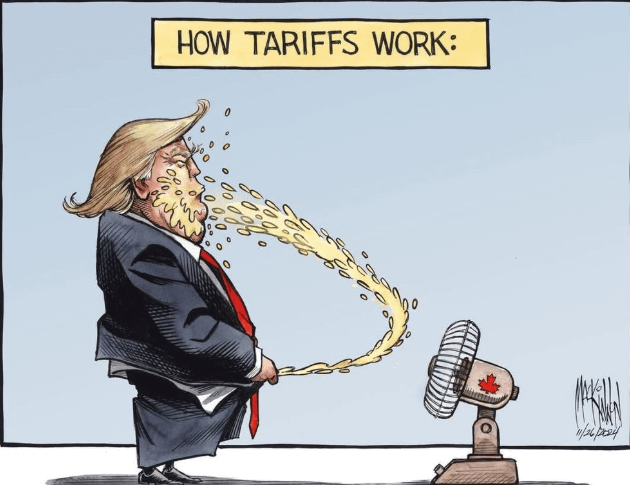

My fear is inflation is sticky and with tariffs likely to increase.

What goes up, rarely comes down.

The fed may not reduce interest rates anytime soon.

Energy prices with 1.8% MoM rise in gasoline prices

The food index increased with the greatest rise in two years. A large component of that rise was driven by a 15.2% MoM increase in egg prices. This marked the largest jump since 2015, in part due to the ongoing Avian flu.

Not shocking news to anyone who pumped gas or bought groceries in January.

My fear is inflation is sticky and with tariffs likely to increase.

What goes up, rarely comes down.

The fed may not reduce interest rates anytime soon.